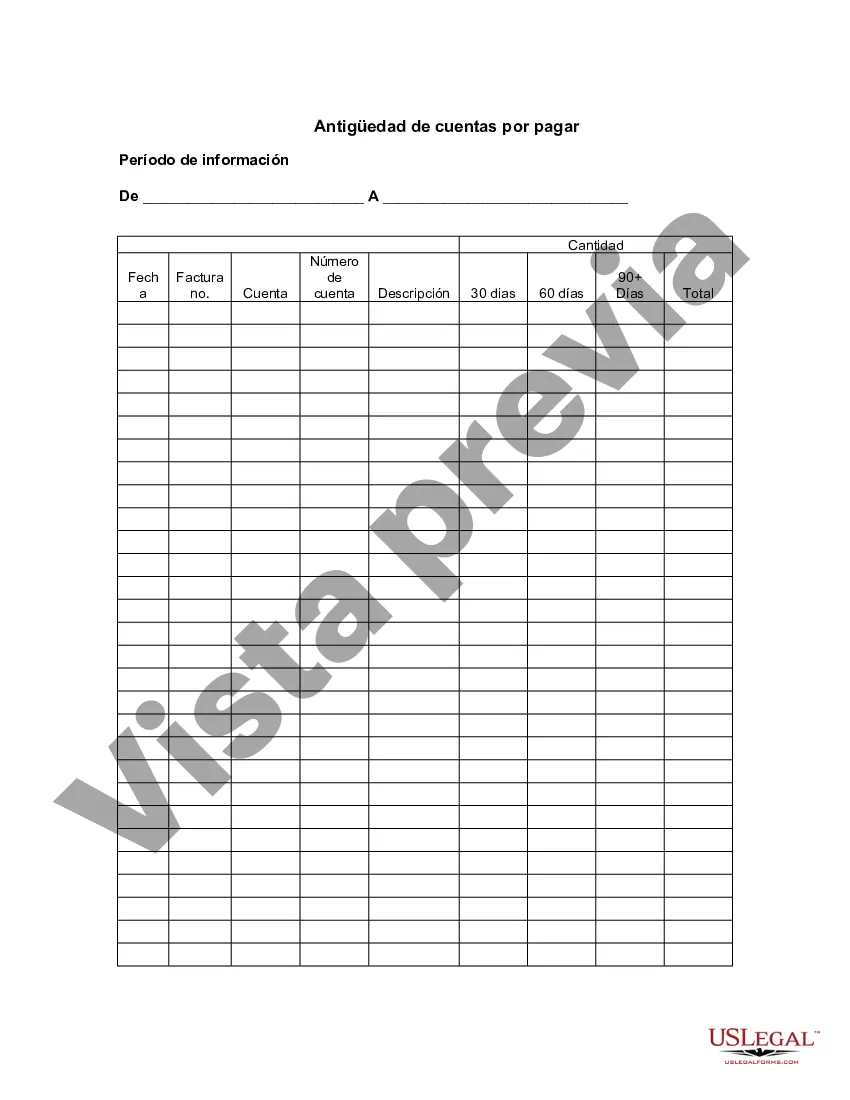

Middlesex Massachusetts Aging of Accounts Payable refers to a financial process used by businesses in Middlesex County, Massachusetts, to track and analyze the aging status of their outstanding accounts payable. This process involves categorizing and evaluating unpaid invoices according to their due dates and calculating the average time it takes for payments to be made. By analyzing the aging of accounts payable, businesses gain insights into their financial health, cash flow management, and vendor relationships. Different types of Middlesex Massachusetts Aging of Accounts Payable can be classified based on time intervals, such as: 1. Current Accounts Payable: This category includes invoices that are due and payable within the current payment period, typically 30 days. These invoices represent the shortest-term liabilities of a business. 2. 30 – 60 Days Aging: This category comprises invoices that have remained unpaid beyond the current payment period and fall between 30 and 60 days past due. It indicates a slight delay in payment but may not be considered high risk yet. 3. 60 – 90 Days Aging: Invoices falling under this category have remained unpaid for a period ranging from 60 to 90 days past their due date. This aging of accounts payable suggests a moderate delay in payment, requiring attention from the business to ensure timely settlement. 4. 90+ Days Aging: This category encompasses invoices that have not been paid for more than 90 days past their due date. These accounts payable represent high-risk and potentially problematic payments, which may require escalated actions such as collections or negotiations. Analyzing Middlesex Massachusetts Aging of Accounts Payable helps businesses manage their cash flow effectively. By identifying trends and patterns within each aging category, businesses can prioritize their payment schedules, negotiate better terms with vendors, and implement strategies to minimize late payments. Moreover, it enables companies to assess their financial obligations, improve internal processes, and optimize working capital management. In conclusion, Middlesex Massachusetts Aging of Accounts Payable is crucial for businesses in Middlesex County, Massachusetts, as it provides a comprehensive overview of their outstanding invoices. By organizing and analyzing accounts payable based on the aging period, businesses can enhance their financial decision-making, mitigate potential risks, and maintain positive relationships with vendors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Middlesex Massachusetts Antigüedad De Cuentas Por Pagar?

If you need to find a trustworthy legal paperwork supplier to find the Middlesex Aging of Accounts Payable, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can search from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support make it easy to get and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Middlesex Aging of Accounts Payable, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Middlesex Aging of Accounts Payable template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less expensive and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Middlesex Aging of Accounts Payable - all from the comfort of your sofa.

Sign up for US Legal Forms now!