Oakland Michigan Aging of Accounts Payable is a crucial financial management tool used by businesses to monitor and analyze their outstanding payables. It helps in understanding the payment patterns and identifying any potential issues or discrepancies in the accounts payable process. The process of aging accounts payable involves categorizing and classifying outstanding invoices based on their due dates. This classification is typically done in time brackets such as current, 30 days past due, 60 days past due, 90 days past due, and so on. These brackets provide a clear snapshot of how long invoices have been outstanding and help businesses prioritize their payments accordingly. In Oakland Michigan, like in any other place, understanding the aging of accounts payable is vital for maintaining a healthy cash flow and building strong vendor relationships. By analyzing the aging reports, businesses can identify the average time it takes for invoices to get paid and identify any trends or delays in the payment process. Different types of Oakland Michigan Aging of Accounts Payable may include: 1. Current Accounts Payable: This category includes invoices that are due within the current billing cycle. They are typically accounts payable that are up to date and within their agreed-upon payment terms. Proper management of current accounts payable ensures a smooth cash flow and fosters good relationships with suppliers. 2. Past Due Accounts Payable: This category comprises invoices that have exceeded their agreed-upon payment terms. Past due accounts payable can be further segmented into subcategories based on the number of days past due, such as 30 days past due, 60 days past due, etc. Identifying and addressing past due accounts payable is crucial to avoid late fees, penalties, and strained relationships with vendors. 3. Overdue Accounts Payable: This category includes invoices that have gone significantly beyond their payment terms. Overdue accounts payable pose a more severe concern for businesses, as they may indicate financial instability or strained cash flow. Promptly addressing overdue accounts payable is essential to avoid potential legal actions and damage to the business's reputation. By regularly monitoring and analyzing the aging of accounts payable, businesses in Oakland Michigan can proactively identify bottlenecks or inefficiencies in their payables process. This allows them to take appropriate actions such as negotiating extended payment terms, establishing payment plans, or resolving any disputes that may arise. Furthermore, it enables businesses to maintain healthy financial relationships with vendors, improve cash flow management, and ensure compliance with financial obligations. In conclusion, Oakland Michigan Aging of Accounts Payable is a critical financial management process that helps businesses monitor, analyze, and manage their outstanding payables. By categorizing invoices based on their due dates, businesses gain valuable insights into their cash flow and can take proactive steps to ensure timely payments, maintain strong vendor relationships, and foster overall financial stability.

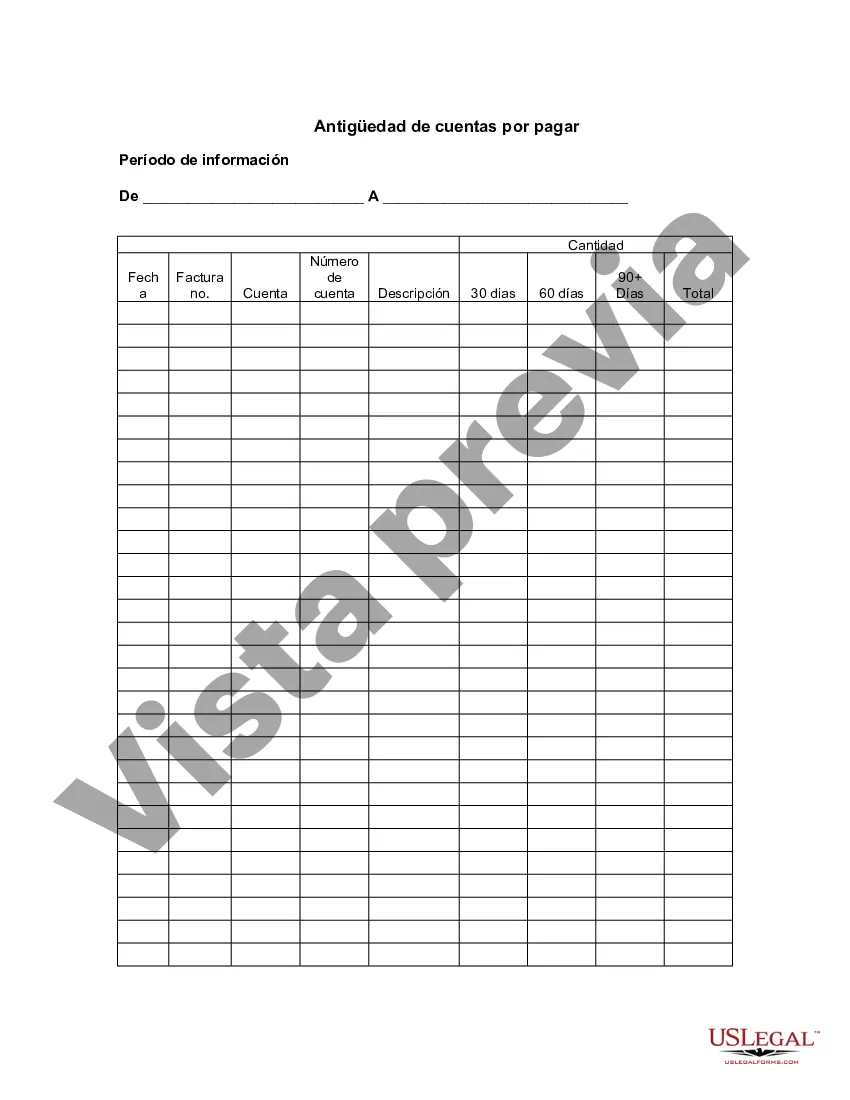

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Oakland Michigan Antigüedad De Cuentas Por Pagar?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your county, including the Oakland Aging of Accounts Payable.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Oakland Aging of Accounts Payable will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Oakland Aging of Accounts Payable:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Oakland Aging of Accounts Payable on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!