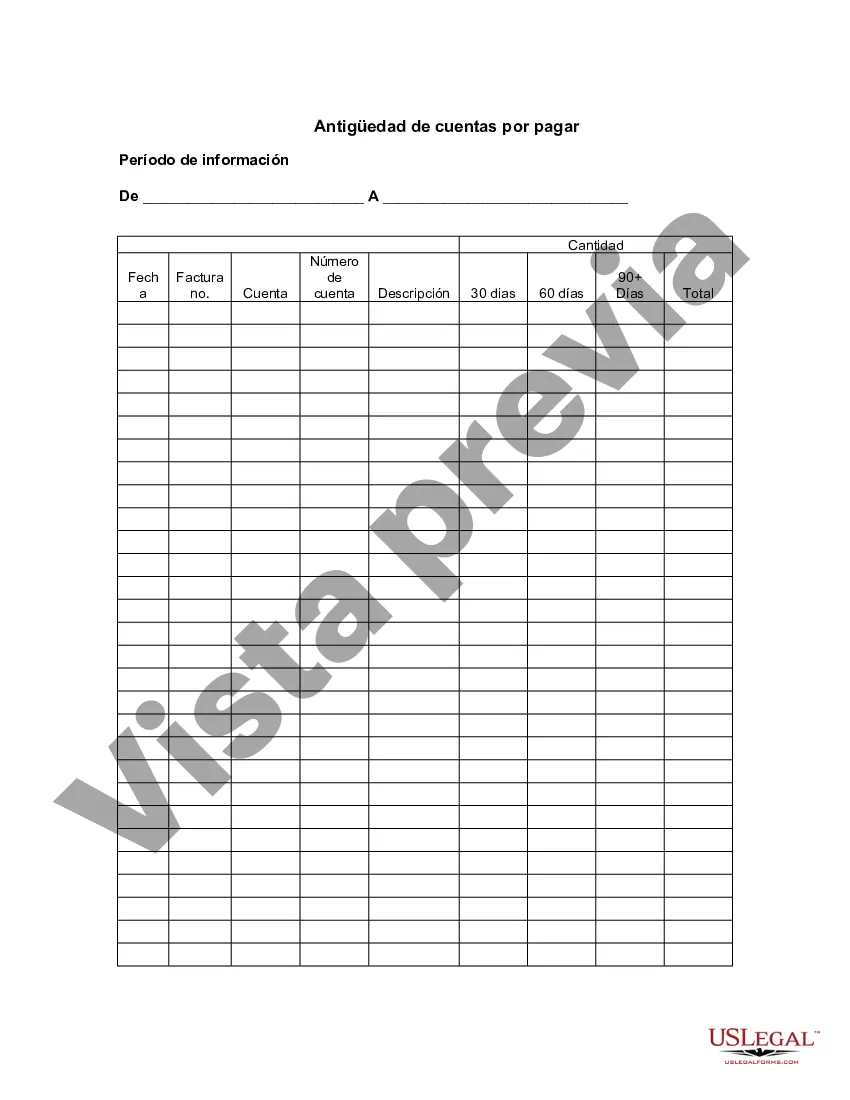

Orange California Aging of Accounts Payable is a financial process used by businesses to track and manage the amount of time it takes for their outstanding invoices to be paid by their customers in Orange, California. It helps a company evaluate the effectiveness of its credit and collections policies and strategies, as well as monitor cash flow and overall financial health. The Aging of Accounts Payable in Orange California categorizes outstanding invoices into different time periods or "buckets" based on their due dates. This categorization allows businesses to identify invoices that are overdue and potentially in need of more assertive collection efforts. It also helps to pinpoint areas where credit terms can be renegotiated or modified to improve cash flow management. There are typically four types of Orange California Aging of Accounts Payable buckets: 1. Current: This category includes invoices that are still within the agreed-upon payment terms, typically payable within 30 days. These invoices are considered current and do not pose an immediate collection risk. 2. 30 Days: Invoices that are past their due dates by 1-30 days fall into this category. Although not severely overdue, businesses may start monitoring and following up with customers who have not made timely payments. 3. 60 Days: Invoices that are 31-60 days overdue are placed in this bracket. The aging of accounts payable at this point suggests potential cash flow issues or unwillingness to pay. Companies may initiate more rigorous collection efforts, such as sending reminders or making phone calls to the customers. 4. 90+ Days: Invoices that remain unpaid beyond 60 days in the Orange California Aging of Accounts Payable system are considered severely overdue. These long-outstanding invoices often require intensified collection actions, such as involving third-party collection agencies, initiating legal proceedings, or even considering bad debt write-offs. Effectively managing the Orange California Aging of Accounts Payable ensures companies maintain a healthy cash flow by promptly collecting outstanding payments. It helps to identify potential risks, improve forecasting accuracy, and address any issues that may hinder a timely inflow of cash. By regularly reviewing the aging report, businesses can take proactive measures to reduce credit risks and optimize financial performance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Orange California Antigüedad De Cuentas Por Pagar?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Orange Aging of Accounts Payable is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Orange Aging of Accounts Payable. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Orange Aging of Accounts Payable in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!