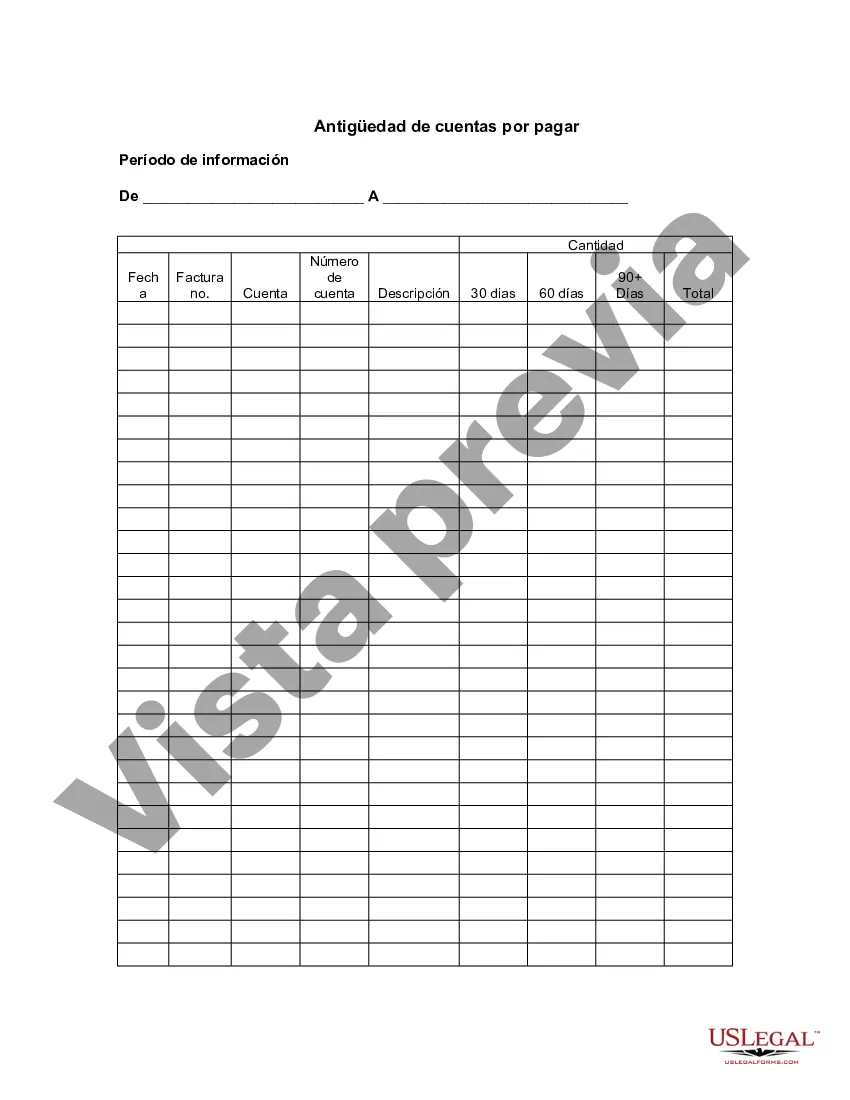

Philadelphia Pennsylvania Aging of Accounts Payable refers to the process of tracking and analyzing outstanding payments owed by a company in Philadelphia, Pennsylvania. It provides an insight into the payment patterns of a business, indicating how long invoices have been outstanding and the overall financial health of the organization. The Philadelphia Pennsylvania Aging of Accounts Payable helps businesses in managing cash flow, forecasting financial obligations, and identifying potential liquidity issues. By categorizing outstanding payments based on their due dates, businesses can prioritize their collection efforts and take necessary steps to ensure timely payment from customers. This analysis is crucial for maintaining healthy vendor relationships, preventing late fees, and ensuring smooth operations. There are different types of Philadelphia Pennsylvania Aging of Accounts Payable reports, including: 1. Current Accounts Payable: This category includes invoices that are due for payment within the current billing cycle or have already been paid. Such invoices typically have a due date within 30 days. 2. 30 Days Aging: This category includes invoices that are 30 to 60 days past their due dates. It signifies a moderate delay in payment. 3. 60 Days Aging: This category includes invoices that are 60 to 90 days past due. It highlights a significant delay in payment and may require a more stringent collection approach. 4. 90+ Days Aging: This category includes invoices that are more than 90 days past due. It indicates a severe delay in payment, requiring immediate attention and potentially involving collection agencies or legal actions. By analyzing these different categories within the Philadelphia Pennsylvania Aging of Accounts Payable reports, businesses can identify which customers or clients consistently delay payments and take appropriate actions to rectify the situation. It also helps in establishing credit policies, negotiating favorable terms with vendors, and making informed decisions regarding product pricing and financial strategy. Overall, Philadelphia Pennsylvania Aging of Accounts Payable is an essential financial tool that allows businesses to assess their cash flow, maintain financial stability, and optimize working capital. By closely monitoring outstanding payments and addressing overdue invoices, organizations can protect their financial health and sustain long-term growth in the competitive business landscape of Philadelphia, Pennsylvania.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Philadelphia Pennsylvania Antigüedad De Cuentas Por Pagar?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life situation, finding a Philadelphia Aging of Accounts Payable suiting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. In addition to the Philadelphia Aging of Accounts Payable, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Philadelphia Aging of Accounts Payable:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Philadelphia Aging of Accounts Payable.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!