Riverside California Aging of Accounts Payable is a critical financial process that assesses the length of time it takes for a company to pay off its outstanding debts to suppliers and vendors in the Riverside area. It provides valuable insights into a company's cash flow management, financial health, and overall creditworthiness. By calculating the average time it takes to settle invoices, businesses can gauge their payment efficiency and identify potential issues or areas for improvement. There are two main types of Riverside California Aging of Accounts Payable methods commonly used: 1. Time-Based Aging: This method categorizes outstanding invoices based on predetermined time periods, such as 30 days, 60 days, 90 days, and so on. Each invoice is assigned to a specific aging bracket based on the number of days it has been outstanding. Time-based aging enables businesses to identify and track payment tendencies, such as the number of invoices past their due date, the average time taken to clear invoices, and the overall payment trend. 2. Category-Based Aging: This approach groups outstanding invoices into specific categories based on their characteristics, such as the vendor, invoice amounts, or payment terms. By categorizing invoices, businesses can analyze the aging of accounts payable based on different criteria, providing insights into variables that may impact payment timelines. For example, a company may identify a pattern of delayed payments for invoices from certain vendors, indicating a need for improved communication or renegotiation of terms. Both types of Riverside California Aging of Accounts Payable methods are essential tools in financial reporting, allowing businesses to assess their liabilities and manage their cash flow effectively. By regularly monitoring and analyzing these aging reports, businesses can spot potential cash flow bottlenecks, identify opportunities for early payment discounts, and maintain robust relationships with suppliers. In conclusion, the Riverside California Aging of Accounts Payable is a critical financial analysis process that enables businesses to track and manage their outstanding debts efficiently. Time-based and category-based aging methods both provide valuable insights into payment patterns, helping companies make informed decisions to optimize their cash flow management and maintain healthy financial relationships with vendors and suppliers in the Riverside area.

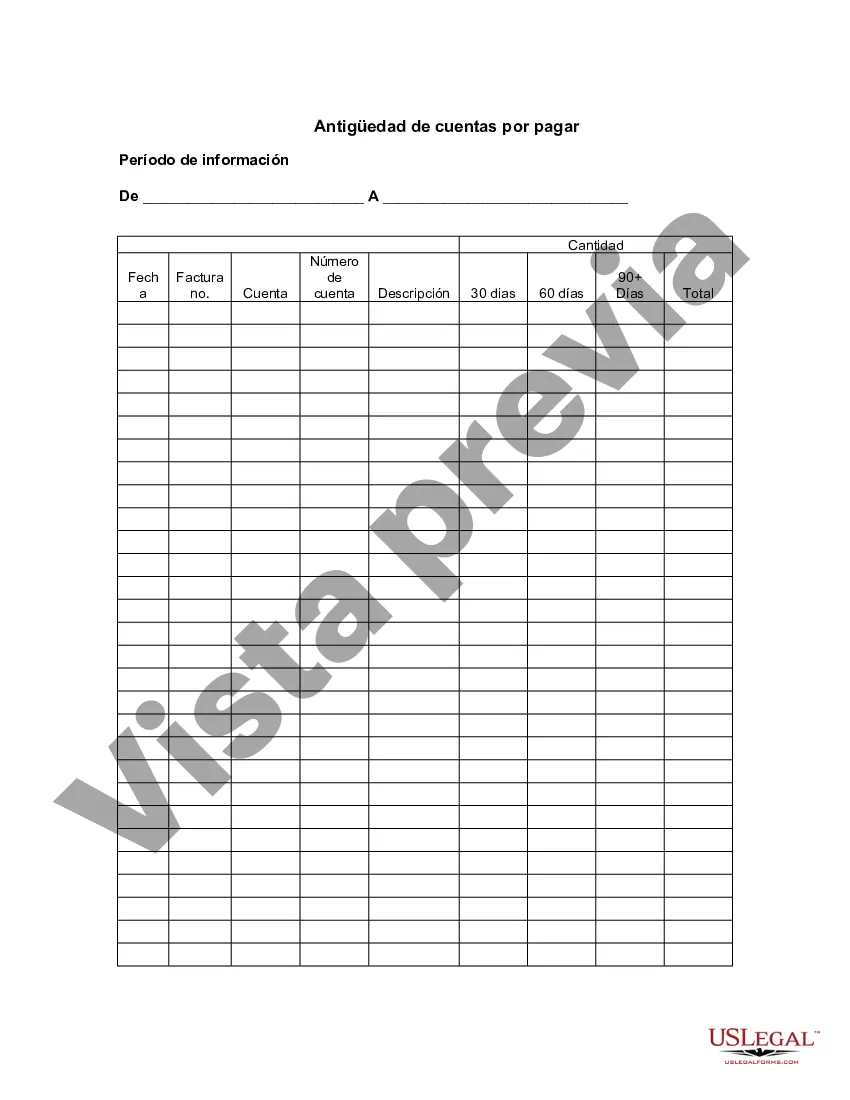

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Riverside California Antigüedad De Cuentas Por Pagar?

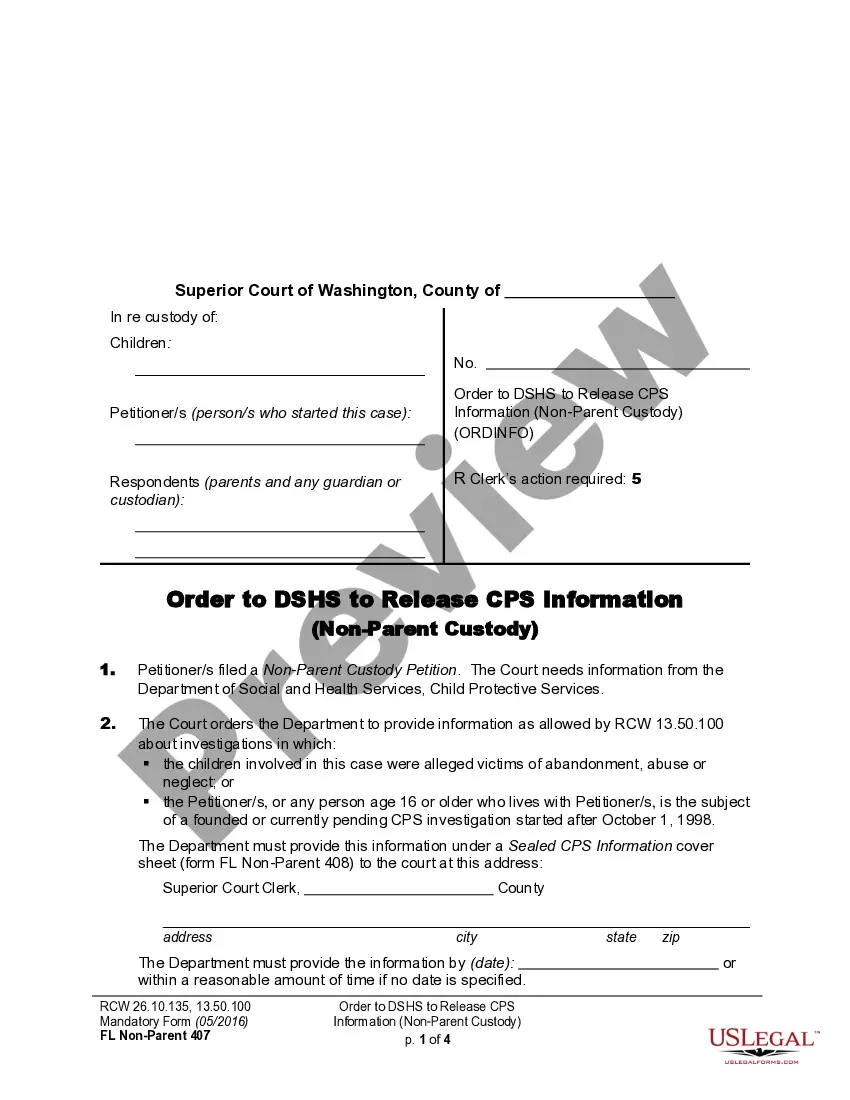

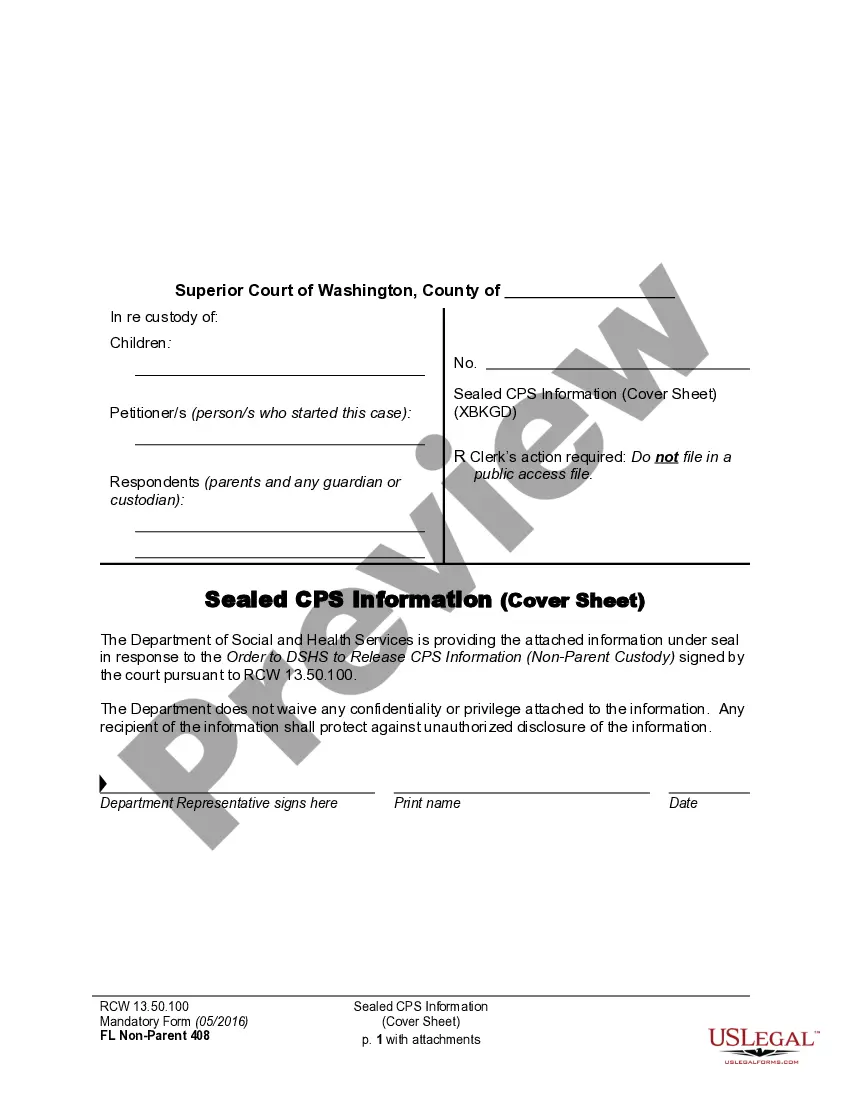

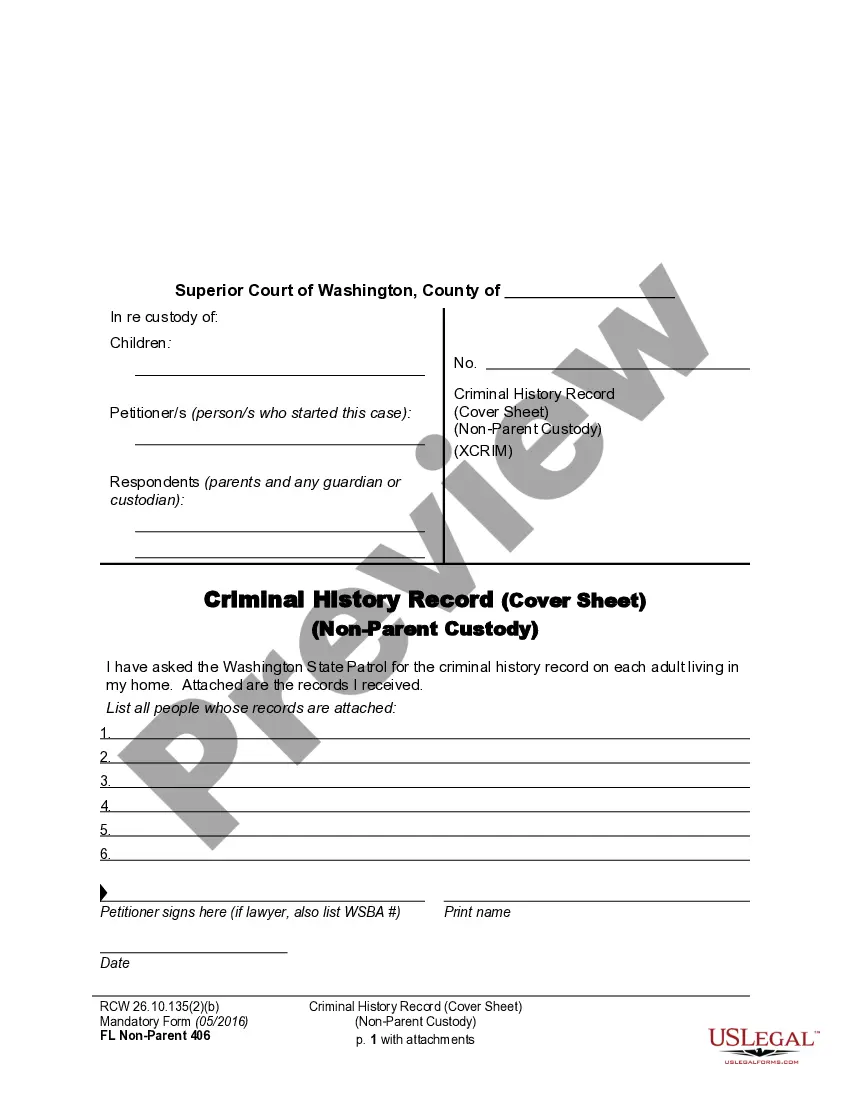

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Riverside Aging of Accounts Payable is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Riverside Aging of Accounts Payable. Adhere to the guidelines below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Aging of Accounts Payable in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!