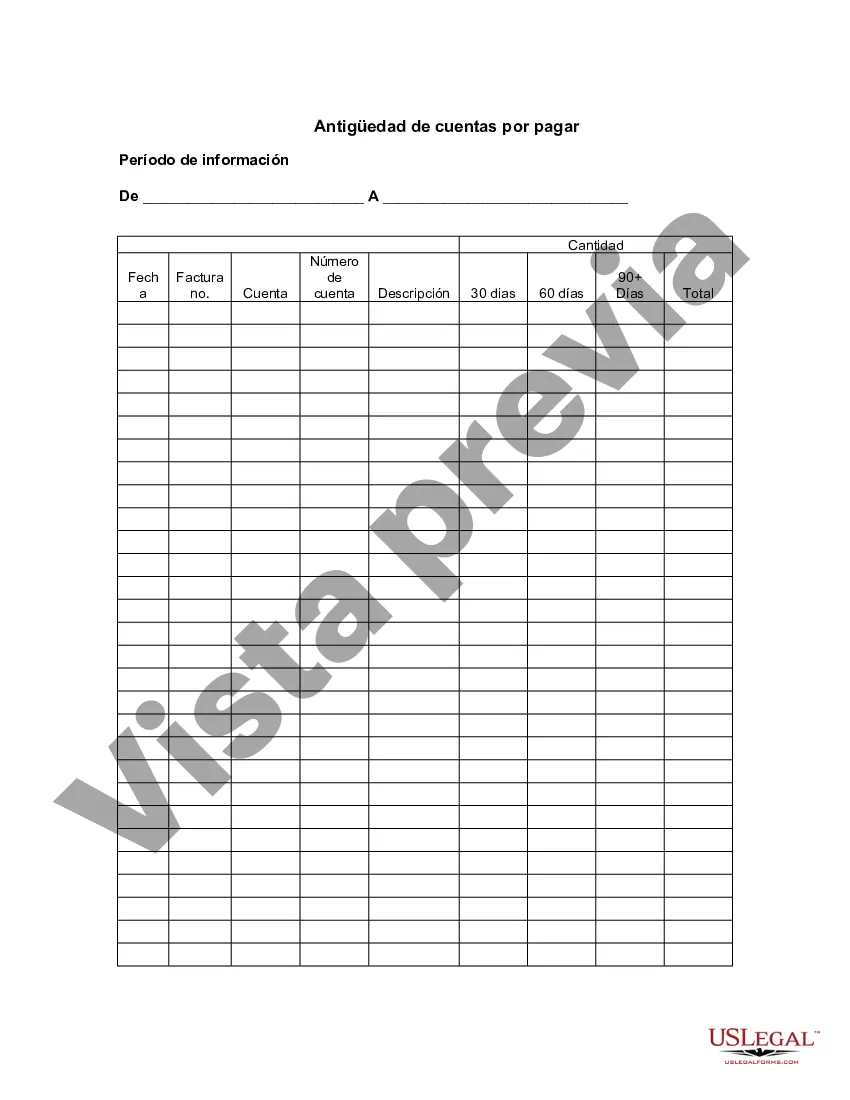

Sacramento California Aging of Accounts Payable is a financial management process used by businesses in Sacramento, California to track and analyze the outstanding balances owed to suppliers or vendors. It involves categorizing and monitoring the aging of these payments to gain insights into cash flow management, identify potential bottlenecks, and make strategic decisions. In Sacramento, California, there are typically two types of Aging of Accounts Payable methods employed by businesses: 1) Time Buckets Aging Analysis, and 2) Vendor Aging Analysis. 1) Time Buckets Aging Analysis: Time Buckets Aging Analysis is a widely used method in Sacramento, California, where accounts payable balances are classified based on the age of the invoices. Businesses often divide their outstanding balances into predefined time periods, typically 30-day increments, such as 0-30 days, 31-60 days, 61-90 days, and so on. By categorizing invoices into these "buckets," companies can easily identify the aging patterns of their payables and determine which invoices require immediate attention. For example, a Sacramento-based business may notice a significant number of invoices overdue in the 61-90 days bucket. This could indicate potential collection issues or financial hardships faced by specific vendors, prompting the business to take necessary actions, such as renegotiating terms or contacting vendors to resolve outstanding payments. 2) Vendor Aging Analysis: Vendor Aging Analysis involves analyzing the aging of accounts payable balances based on individual vendors or suppliers. In this approach, businesses in Sacramento, California, compile a list of their vendors and categorize their outstanding balances by each vendor. By doing so, companies can identify vendors with higher outstanding balances and assess their payment trends over time. For instance, a business in Sacramento may observe that Vendor X has consistently delayed payments and has a higher average days payable outstanding (DPO) compared to other vendors. This insight can initiate conversations with Vendor X to improve their payment process or explore opportunities for discounts in exchange for quicker payment, ultimately enhancing the financial relationship with that vendor. Overall, Sacramento California Aging of Accounts Payable offers businesses valuable insights into their financial obligations. Whether using the Time Buckets Aging Analysis or Vendor Aging Analysis method, companies gain a clear understanding of their payables' aging patterns, helping them make informed decisions to improve cash flow management, strengthen relationships with vendors, and maintain financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Sacramento California Antigüedad De Cuentas Por Pagar?

Preparing paperwork for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Sacramento Aging of Accounts Payable without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Sacramento Aging of Accounts Payable by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Sacramento Aging of Accounts Payable:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!