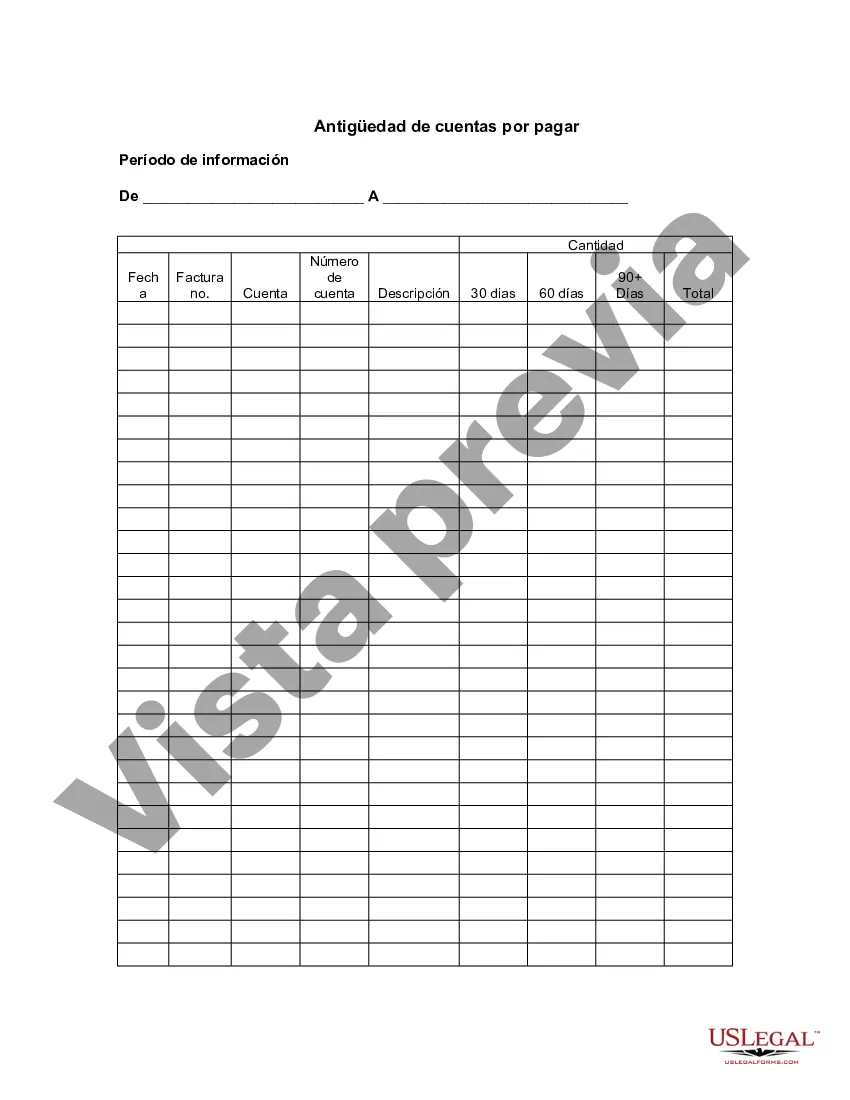

San Jose California Aging of Accounts Payable refers to the process of analyzing and categorizing outstanding liabilities owed by a business or organization in San Jose, California. This financial analysis tool helps to determine the time duration for which the accounts payable have been outstanding, ultimately providing crucial insights into a company's financial health. It enables businesses in San Jose, California, to effectively manage and monitor their outstanding payments and ensure timely settlement of debts. The Aging of Accounts Payable method categorizes the accounts payable into various time periods, usually by 30-day increments, to assess the aging of outstanding debts. This practice allows businesses to prioritize payments based on urgency, subsequently improving their cash flow management and overall financial performance. The different types of San Jose California Aging of Accounts Payable include: 1. Current Accounts Payable: Refers to debts that are due for payment within the current billing cycle or within a span of 30 days. 2. 30-60 Days: Represents accounts payable that have remained outstanding for 30 to 60 days since the due date. These debts require immediate attention to avoid potential penalties or strained vendor relationships. 3. 60-90 Days: Pertains to unpaid bills or invoices that have been due for payment for 60 to 90 days. Businesses need to address these liabilities promptly to avoid any negative consequences, such as damage to credit ratings or loss of trust from suppliers. 4. 90-120 Days: Represents accounts payable that have aged between 90 and 120 days. These liabilities often indicate a prolonged delay in payment and may require additional communication with vendors to avoid escalation. 5. Over 120 Days: Refers to debts that have remained unpaid for more than 120 days. Overdue accounts payable beyond this time frame require immediate action, such as negotiating payment plans or considering collections. The San Jose California Aging of Accounts Payable process is imperative for businesses and organizations to maintain healthy financial operations. By regularly reviewing and assessing their accounts payable, businesses in San Jose can identify any potential bottlenecks, streamline their payment processes, and ultimately sustain positive business relationships with their vendors. Additionally, this analysis allows companies to promptly resolve any discrepancies or errors in billing, ensuring accurate financial record-keeping and reporting. Keywords: San Jose California, Aging of Accounts Payable, outstanding liabilities, financial analysis, business, organization, debts, financial health, manage, monitor, timely settlement, payments, cash flow management, Current Accounts Payable, 30-60 Days, 60-90 Days, 90-120 Days, Over 120 Days, billing cycle, invoices, due date, vendor relationships, penalties, credit ratings, trust, suppliers, prolonged delay, communication, negotiation, payment plans, collections, financial operations, bottlenecks, streamlining, payment process, business relationships, vendors, discrepancies, errors, billing, accurate financial record-keeping, reporting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out San Jose California Antigüedad De Cuentas Por Pagar?

If you need to find a reliable legal document provider to obtain the San Jose Aging of Accounts Payable, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to find and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to search or browse San Jose Aging of Accounts Payable, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the San Jose Aging of Accounts Payable template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate agreement, or execute the San Jose Aging of Accounts Payable - all from the comfort of your sofa.

Sign up for US Legal Forms now!