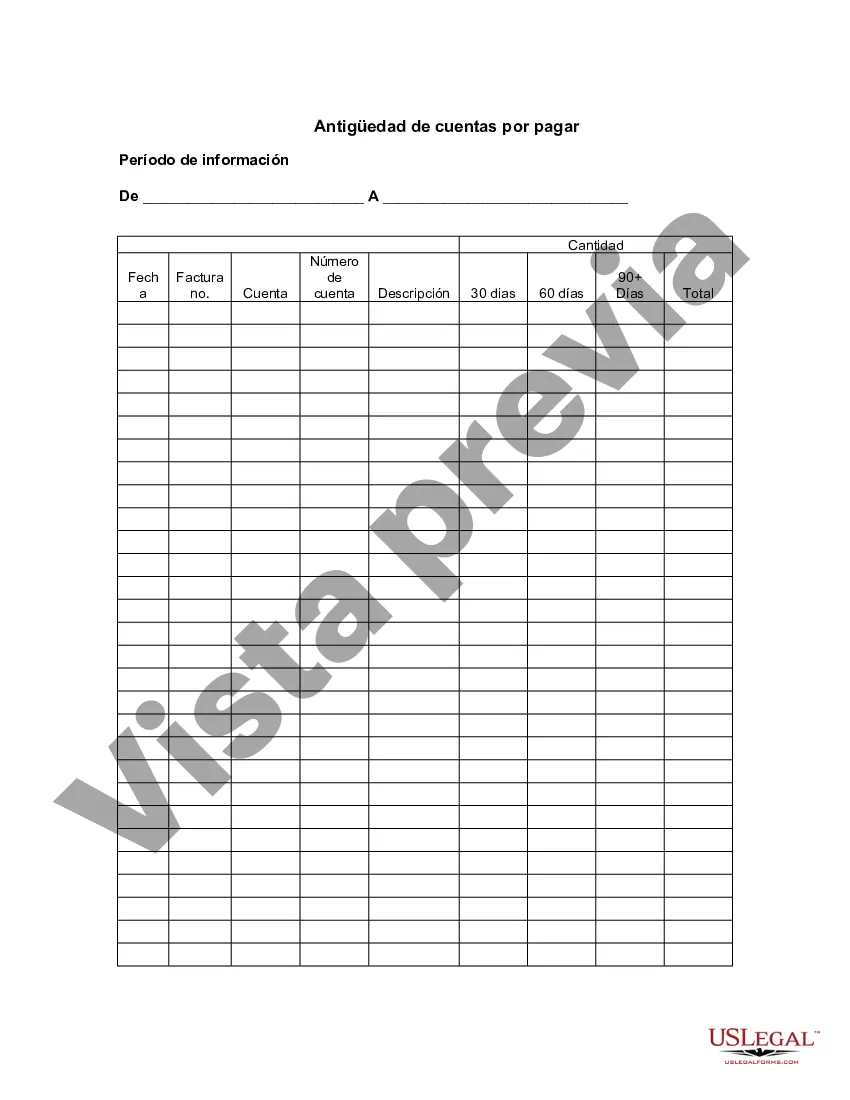

Suffolk New York Aging of Accounts Payable helps businesses in the Suffolk County area manage and monitor their outstanding payment obligations. This financial tool assists companies in analyzing and tracking their accounts payable process, ensuring timely payment of debts owed to vendors, suppliers, and other creditors. With the ability to identify aging accounts, businesses can assess their cash flow, negotiate favorable payment terms, and avoid potential penalties or risks associated with late payments. There are two main types of Suffolk New York Aging of Accounts Payable: 1. Summary Aging of Accounts Payable: This type provides a consolidated overview of all outstanding payables. It categorizes unpaid invoices into specific time buckets, such as 30, 60, 90, or more days past the due date. This summary allows businesses to promptly identify which accounts are overdue and plan their payment priorities accordingly. 2. Detailed Aging of Accounts Payable: In contrast to the summary aging, this type provides a more comprehensive breakdown of individual unpaid invoices. Each outstanding payment is listed along with its due date, invoice number, vendor information, and aging bracket. This detailed aging report offers a granular view, enabling businesses to pinpoint specific overdue accounts, communicate with vendors more effectively, and allocate resources accordingly. Keywords: Suffolk New York, aging of accounts payable, payment obligations, outstanding payables, cash flow management, late payment penalties, risk management, vendors, suppliers, creditors, summary aging, detailed aging, unpaid invoices, due date, invoice number, vendor information, aging bracket, granular view, resource allocation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Suffolk New York Antigüedad De Cuentas Por Pagar?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Suffolk Aging of Accounts Payable, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Suffolk Aging of Accounts Payable from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Suffolk Aging of Accounts Payable:

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!