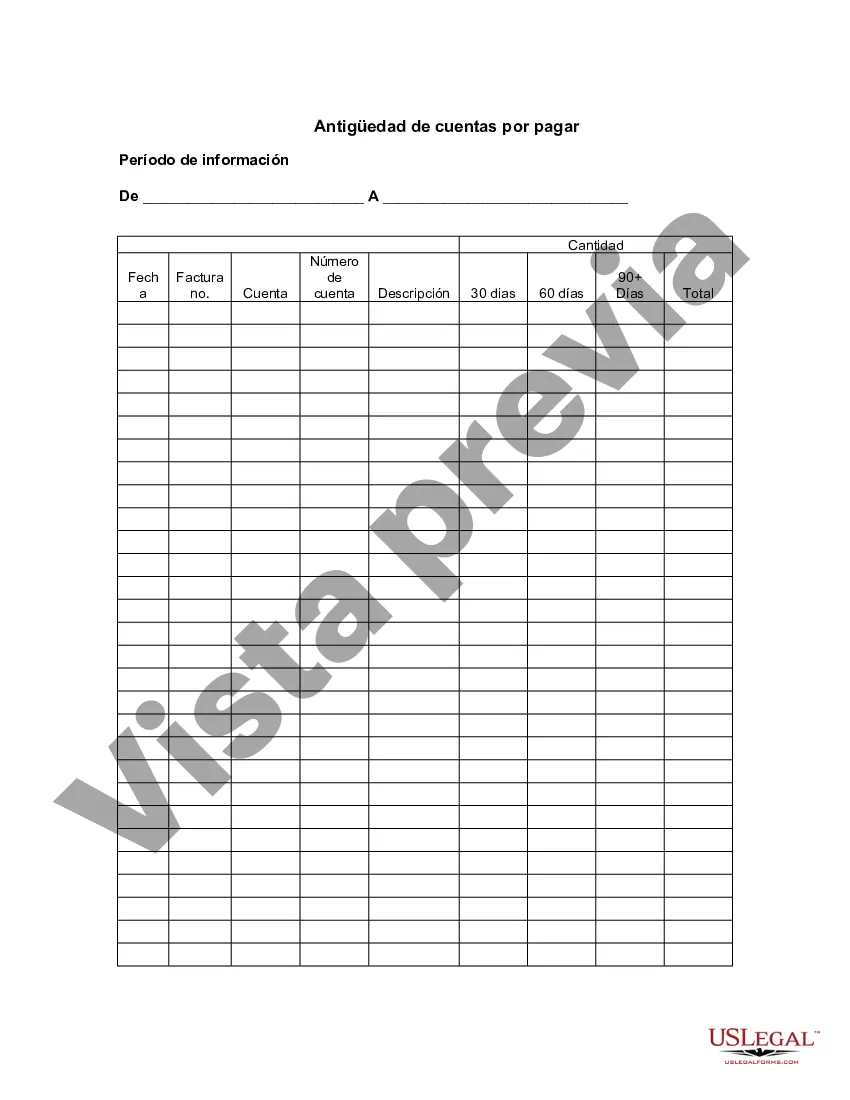

Wake North Carolina Aging of Accounts Payable refers to the process and analysis of determining the length of time it takes for a company in Wake North Carolina to pay its outstanding bills to vendors and suppliers. This practice helps businesses in Wake North Carolina to manage their cash flow, maintain good relationships with their creditors, and monitor their financial obligations. The Aging of Accounts Payable process categorizes outstanding bills into different time periods, usually 30, 60, 90 days, and beyond. By analyzing these categories, businesses in Wake North Carolina can gauge their financial health and develop plans to effectively manage their payables. In Wake North Carolina, there are various types of Aging of Accounts Payable reports utilized by businesses: 1. Wake North Carolina Aging of Accounts Payable by Vendor: This report categorizes outstanding bills by each vendor or supplier. It provides a comprehensive view of the company's payment performance to each vendor, allowing businesses to identify vendors who consistently receive late payments and take corrective actions to maintain healthy vendor relationships. 2. Wake North Carolina Aging of Accounts Payable by Due Date: This report arranges outstanding bills based on their due dates. It helps Wake North Carolina businesses to prioritize payments and avoid late fees or penalties. By closely monitoring due dates, businesses can ensure timely payments and prevent any disruption in the supply chain. 3. Wake North Carolina Aging of Accounts Payable by Invoice Aging: This report categorizes outstanding bills based on the number of days outstanding. It provides a snapshot of how long each invoice has been unpaid, helping businesses in Wake North Carolina to identify any problematic patterns, like consistent delays or overlooked invoices. This analysis assists in making informed decisions on managing cash flow and optimizing resources. 4. Wake North Carolina Aging of Accounts Payable by Department: This report classifies outstanding bills by department within a company. It helps Wake North Carolina businesses with multiple departments to identify which departments are falling behind in payments and address any internal inefficiencies. The Wake North Carolina Aging of Accounts Payable analysis is crucial for businesses in Wake North Carolina to maintain healthy financial relationships, avoid unnecessary costs, and ensure the smooth operation of their cash flow. By utilizing these reports, Wake North Carolina businesses can identify areas where improvement is required, implement effective payment strategies, and maintain strong financial health in the long run.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Wake North Carolina Antigüedad De Cuentas Por Pagar?

Preparing documents for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Wake Aging of Accounts Payable without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Wake Aging of Accounts Payable on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Wake Aging of Accounts Payable:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!