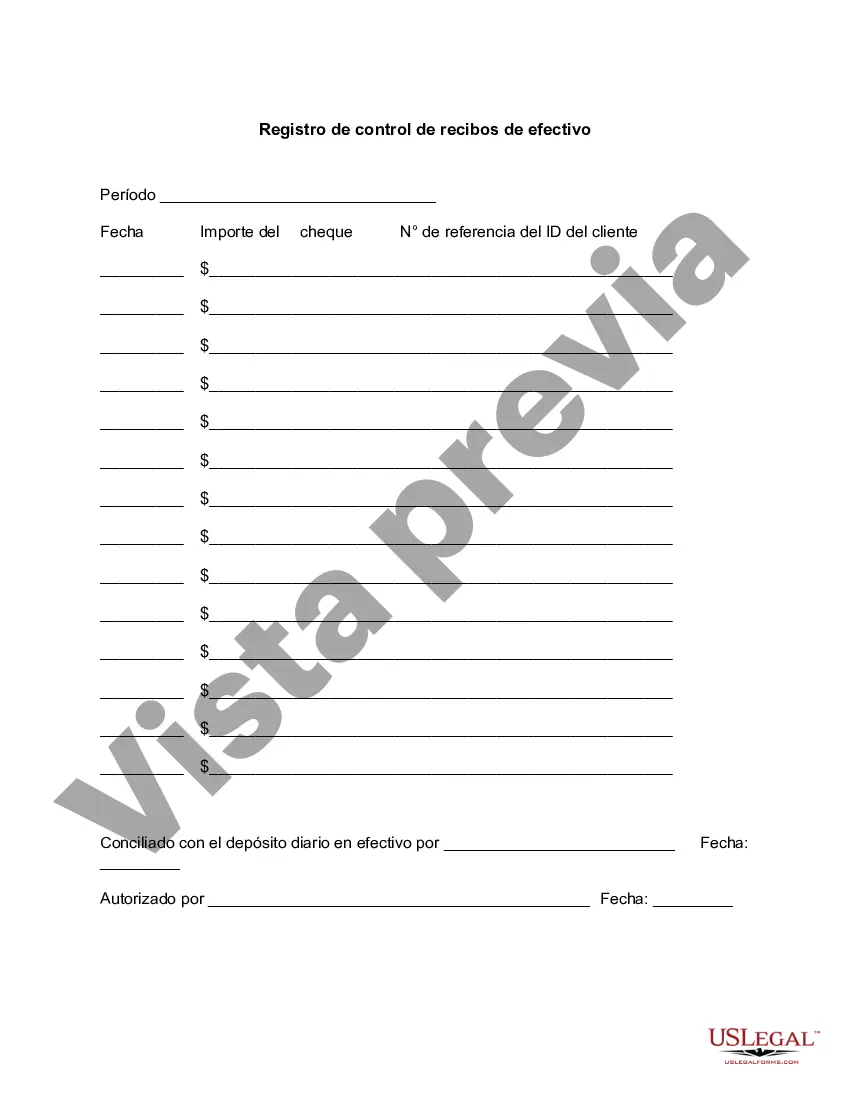

Chicago Illinois Cash Receipts Control Log is a crucial tool used by businesses and organizations in the city to monitor and manage their cash inflows effectively. This comprehensive log helps companies maintain a detailed record of all cash transactions, ensuring transparency and accountability in their financial operations. It plays a vital role in preventing fraudulent activities, minimizing errors, and ensuring timely and accurate reporting. The Chicago Illinois Cash Receipts Control Log typically consists of various sections, allowing businesses to capture essential information related to cash receipts. These sections may include: 1. Date: The date on which the cash receipt is generated is recorded to establish a chronological order of transactions. 2. Receipt Number: Each cash receipt is assigned a unique identification number, enabling quick identification and retrieval of specific transactions. 3. Amount: The amount of cash received is recorded in this section, ensuring accurate tracking of financial inflows. 4. Description: A brief description of the nature or purpose of the cash receipt is included to provide additional context and clarity. 5. Source/Payer: The name or details of the individual or entity responsible for the payment are documented, helping identify the source of cash inflows. 6. Payment Method: The mode of payment used, such as cash, check, credit card, or electronic transfer, is noted to track different types of payment methods accurately. 7. Department/Account: This section records the department or account to which the cash receipt is attributed, facilitating proper allocation and classification of funds. 8. Prepared By: The name or initials of the person responsible for preparing the cash receipt log entry are documented for accountability purposes. 9. Approved By: The name or initials of the individual who reviews and approves the cash receipt log entry are recorded, ensuring a second layer of authorization and accuracy. 10. Remarks/Notes: Any relevant additional information or comments regarding the cash receipt can be included in this section for future reference or clarification. In Chicago, Illinois, several variations of the Cash Receipts Control Log may exist, tailored to specific industries or organizational requirements. These variations may include: 1. Retail Cash Receipts Control Log: Designed for businesses operating in the retail sector, this log may incorporate additional fields to capture customer details, product information, and salesperson identifiers. 2. Non-profit Cash Receipts Control Log: Specialized for non-profit organizations, this log may focus on recording donations, grants, and fundraising proceeds, catering to their unique financial management needs. 3. Government Cash Receipts Control Log: Customized for government entities and agencies, this log may include sections to document revenue from taxes, fines, licenses, or permit fees, reflecting their specific sources of income. Overall, the Chicago Illinois Cash Receipts Control Log helps organizations maintain impeccable financial records, adhere to regulatory requirements, and identify any discrepancies or irregularities promptly. It serves as an essential control mechanism, streamlining cash management processes and ensuring financial integrity in the vibrant city of Chicago, Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Chicago Illinois Registro De Control De Recibos De Efectivo?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Chicago Cash Receipts Control Log.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Chicago Cash Receipts Control Log will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Chicago Cash Receipts Control Log:

- Ensure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Chicago Cash Receipts Control Log on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!