Dallas Texas Cash Receipts Control Log is a crucial tool used by businesses and organizations in Dallas, Texas, to effectively manage and track all cash inflows. This comprehensive log ensures proper financial record-keeping, transparency, and effective control over cash receipts. By utilizing relevant keywords, we can create valuable content that highlights the significance and types of Dallas Texas Cash Receipts Control Log. 1. Definition: Dallas Texas Cash Receipts Control Log is a systematic record-keeping mechanism used to document and monitor all cash transactions received by a business or organization based in Dallas, Texas. 2. Importance: Implementing a Dallas Texas Cash Receipts Control Log is of paramount importance for businesses and organizations to maintain accurate financial records, prevent fraud, detect errors, and ensure compliance with financial regulations in the region. 3. Key Features: The Dallas Texas Cash Receipts Control Log typically includes fields for recording relevant information, including date, customer name, payment method (cash, check, credit card), amount received, purpose of payment, receipt number, and initials of the individual responsible for handling the transaction. 4. Types of Dallas Texas Cash Receipts Control Log: a. Manual Log: This type involves maintaining a physical register or ledger to manually record all cash receipts. It can be customized based on the specific requirements of the business. b. Electronic Log: An electronic version of the Cash Receipts Control Log that can be accessed and maintained digitally. This type offers convenience, easy searchability, and backup options. c. Integrated Software: Certain accounting software in Dallas, Texas, offer built-in Cash Receipts Control Log functionality, simplifying the process by automating data entry and generating reports. 5. Benefits: Dallas Texas Cash Receipts Control Log serves several benefits, such as: a. Enhanced Security: By keeping track of all cash receipts, this log reduces the risk of theft or unauthorized access to financial resources. b. Simplified Reconciliation: The log enables easy cross-referencing with financial statements, bank deposits, and sales records, ensuring accurate reconciliation and financial reporting. c. Fraud Prevention: Effective control measures and monitoring provided by the Dallas Texas Cash Receipts Control Log help identify discrepancies and potential fraudulent activities. 6. Best Practices: To ensure optimal utilization of the Dallas Texas Cash Receipts Control Log, businesses should establish internal controls, segregate duties, conduct regular audits, and provide training to relevant staff. In conclusion, a Dallas Texas Cash Receipts Control Log is an essential tool for businesses and organizations in the region to keep track of cash received, maintain accurate financial records, and prevent financial irregularities. Implementing this log, whether through a manual, electronic, or integrated software approach, offers numerous benefits to ensure financial transparency and accountability.

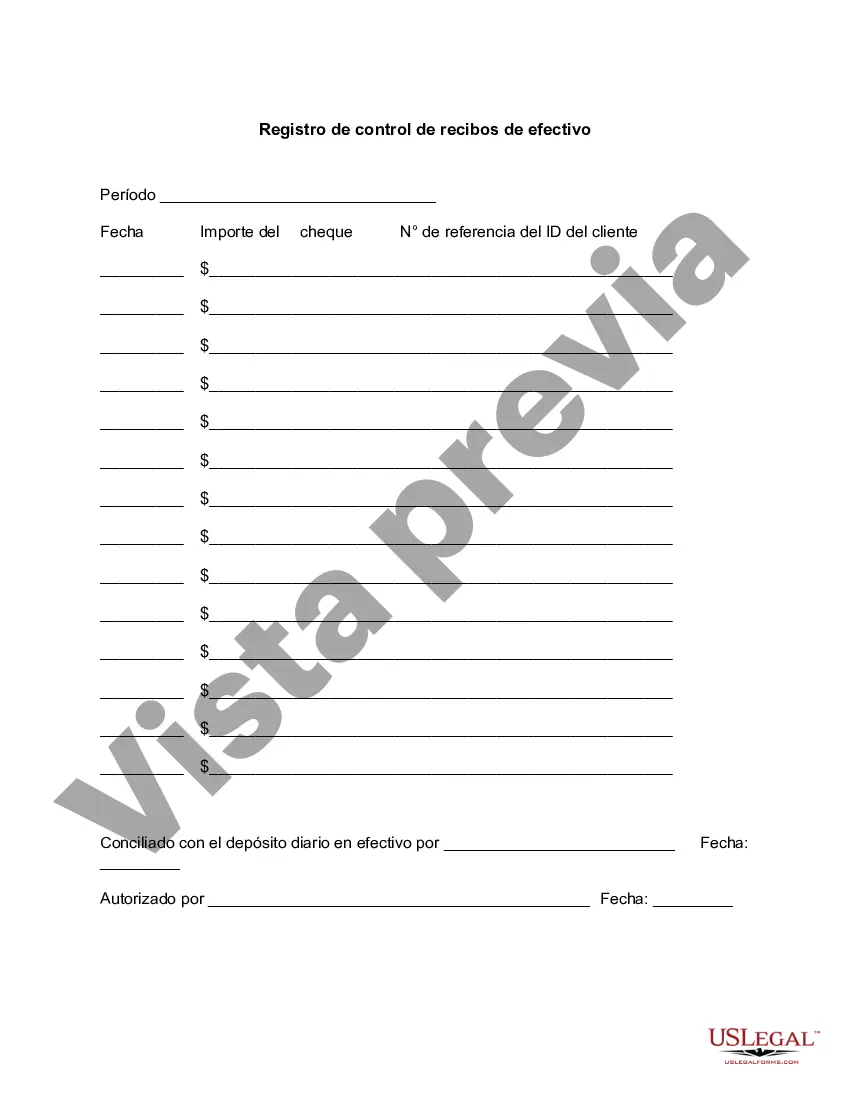

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Dallas Texas Registro De Control De Recibos De Efectivo?

How much time does it typically take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, finding a Dallas Cash Receipts Control Log meeting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. In addition to the Dallas Cash Receipts Control Log, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Dallas Cash Receipts Control Log:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Dallas Cash Receipts Control Log.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!