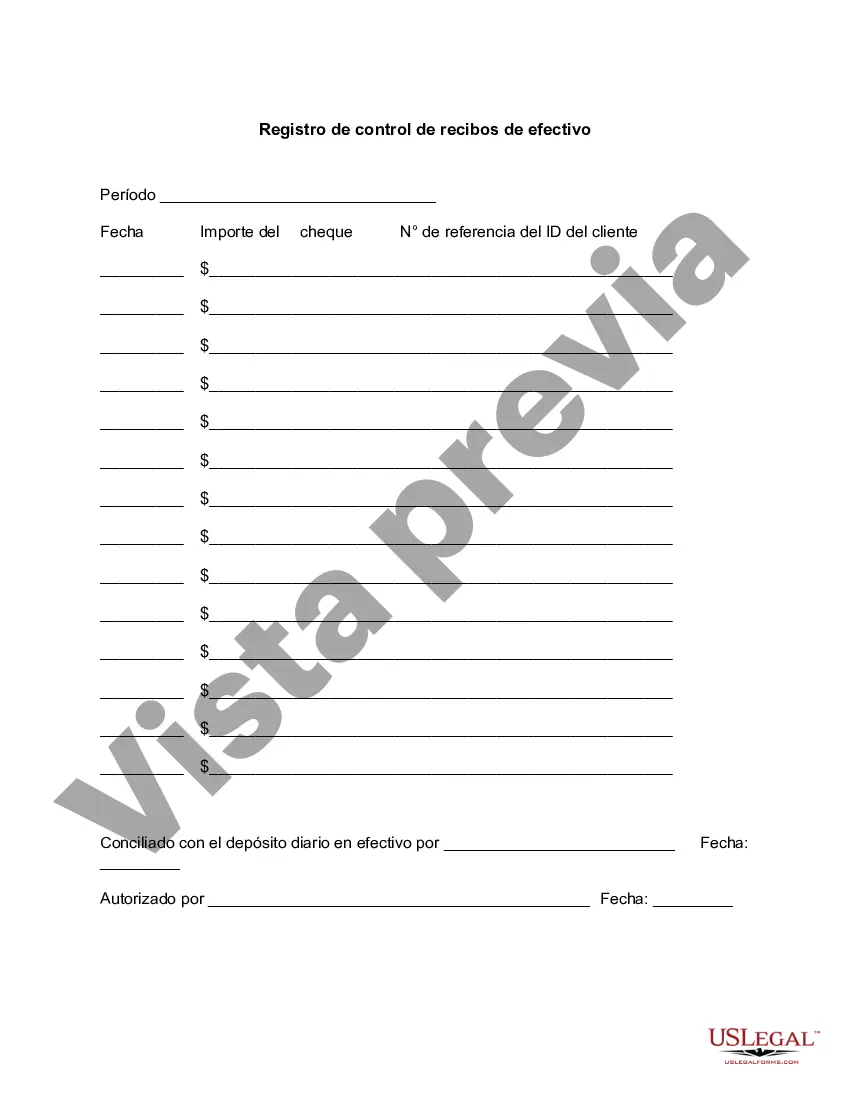

Hennepin Minnesota Cash Receipts Control Log serves as a crucial tool for effective financial management and oversight. This log is designed to track and monitor all cash receipts received by the Hennepin County government or any other organizations based in Hennepin County, Minnesota. The primary purpose of the Cash Receipts Control Log is to ensure transparency, accuracy, and proper documentation of all cash inflows. This log enables organizations to maintain a comprehensive record of their financial transactions, minimizing the risk of errors, fraud, or other discrepancies. The Hennepin Minnesota Cash Receipts Control Log includes relevant fields to capture essential information such as the date of receipt, source of income, transaction description, amount received, mode of payment, and responsible personnel involved. This log establishes a standardized process to validate and verify each transaction, promoting financial accountability within the organization. By using the Cash Receipts Control Log, Hennepin County or any other entity can keep track of numerous types of cash receipts, including but not limited to: 1. Government Revenue: Tracking all payments made to Hennepin County government agencies, such as taxes, fines, fees, or licenses. 2. Public Services: Recording cash received for services provided by Hennepin County, such as parking fees, facility rentals, or utility payments. 3. Donations and Grants: Documenting all cash contributions, philanthropic donations, or grants received by Hennepin County or affiliated organizations. 4. Miscellaneous: Including any other miscellaneous cash receipts that are not covered by the above categories but are still relevant to Hennepin County's financial operations. Each type of cash receipt is categorized and segregated within the Cash Receipts Control Log, making it easier to analyze and reconcile financial data. Additionally, this log ensures that all financial records are up-to-date and well-maintained, facilitating internal and external audits, as well as compliance with legal and regulatory requirements. In summary, the Hennepin Minnesota Cash Receipts Control Log is a vital tool for maintaining financial integrity and accountability. It assists in tracking various types of cash receipts, enabling accurate record-keeping, reducing the risk of errors or fraud, and ensuring compliance with financial policies and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Hennepin Minnesota Registro De Control De Recibos De Efectivo?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Hennepin Cash Receipts Control Log, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork completion straightforward.

Here's how you can purchase and download Hennepin Cash Receipts Control Log.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Examine the related document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Hennepin Cash Receipts Control Log.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Hennepin Cash Receipts Control Log, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an extremely difficult case, we advise getting a lawyer to examine your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!