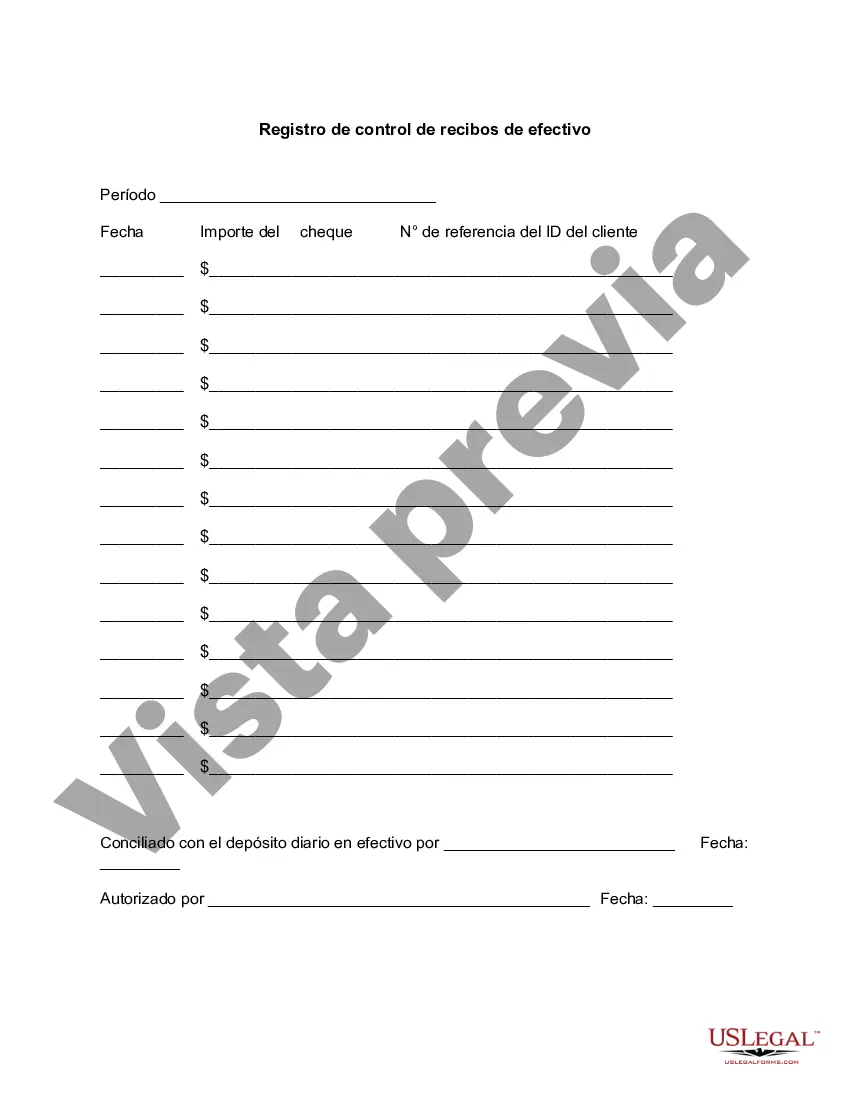

Miami-Dade Florida Cash Receipts Control Log is a crucial document designed to maintain a comprehensive record of all cash transactions within the county. This log plays a vital role in ensuring transparency, accuracy, and accountability in cash management. The primary purpose of the Miami-Dade Florida Cash Receipts Control Log is to track and monitor incoming cash received from various sources, such as tax payments, fees, fines, permits, and other revenue-generating activities. By keeping meticulous records in this log, county officials can effectively manage and reconcile cash inflows, ensuring that all funds are accounted for and properly deposited. The Cash Receipts Control Log includes relevant fields to capture essential details of each transaction, including the date, amount, payment method, purpose, source, and the responsible department or individual involved. These records aid in identifying discrepancies, investigating any potential irregularities, and facilitating accurate financial reporting. This control log ensures that proper internal control measures are in place regarding cash handling, preventing misappropriation or theft. It serves as a critical reference for audits and helps maintain compliance with regulatory requirements, financial policies, and accounting standards. It is worth mentioning that there may be different types of Cash Receipts Control Logs customized for specific departments or revenue streams within Miami-Dade County. Examples of these variations include: 1. Tax Receipts Control Log: Focuses on cash receipts related to property taxes, sales taxes, or any other tax-related payments made to the county. 2. Permit Fee Receipts Control Log: Tracks cash received for various permits, licenses, and related fees, allowing for accurate monitoring of revenue generated from these activities. 3. Fine Collection Receipts Control Log: Specifically designed to document fines and penalties received by law enforcement agencies and the judiciary system, ensuring proper recording and handling of these payments. 4. Parking Fee Receipts Control Log: Dedicated to tracking cash collected from parking fees, this log assists parking authorities in managing funds received and monitoring revenue generated from parking facilities. In conclusion, the Miami-Dade Florida Cash Receipts Control Log is a fundamental tool for maintaining financial integrity within the county. It provides a systematic approach to documenting cash transactions and serves as a reference for internal control, auditing, and financial reporting purposes. The log can be customized to suit various revenue streams, such as taxes, permits, fines, and parking fees, ensuring accurate tracking and management of funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Registro de control de recibos de efectivo - Cash Receipts Control Log

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02879BG

Format:

Word

Instant download

Description

This for can be an effective tracking mechanism for cash-based businesses and also may serve to prevent employee theft and loss.

Miami-Dade Florida Cash Receipts Control Log is a crucial document designed to maintain a comprehensive record of all cash transactions within the county. This log plays a vital role in ensuring transparency, accuracy, and accountability in cash management. The primary purpose of the Miami-Dade Florida Cash Receipts Control Log is to track and monitor incoming cash received from various sources, such as tax payments, fees, fines, permits, and other revenue-generating activities. By keeping meticulous records in this log, county officials can effectively manage and reconcile cash inflows, ensuring that all funds are accounted for and properly deposited. The Cash Receipts Control Log includes relevant fields to capture essential details of each transaction, including the date, amount, payment method, purpose, source, and the responsible department or individual involved. These records aid in identifying discrepancies, investigating any potential irregularities, and facilitating accurate financial reporting. This control log ensures that proper internal control measures are in place regarding cash handling, preventing misappropriation or theft. It serves as a critical reference for audits and helps maintain compliance with regulatory requirements, financial policies, and accounting standards. It is worth mentioning that there may be different types of Cash Receipts Control Logs customized for specific departments or revenue streams within Miami-Dade County. Examples of these variations include: 1. Tax Receipts Control Log: Focuses on cash receipts related to property taxes, sales taxes, or any other tax-related payments made to the county. 2. Permit Fee Receipts Control Log: Tracks cash received for various permits, licenses, and related fees, allowing for accurate monitoring of revenue generated from these activities. 3. Fine Collection Receipts Control Log: Specifically designed to document fines and penalties received by law enforcement agencies and the judiciary system, ensuring proper recording and handling of these payments. 4. Parking Fee Receipts Control Log: Dedicated to tracking cash collected from parking fees, this log assists parking authorities in managing funds received and monitoring revenue generated from parking facilities. In conclusion, the Miami-Dade Florida Cash Receipts Control Log is a fundamental tool for maintaining financial integrity within the county. It provides a systematic approach to documenting cash transactions and serves as a reference for internal control, auditing, and financial reporting purposes. The log can be customized to suit various revenue streams, such as taxes, permits, fines, and parking fees, ensuring accurate tracking and management of funds.