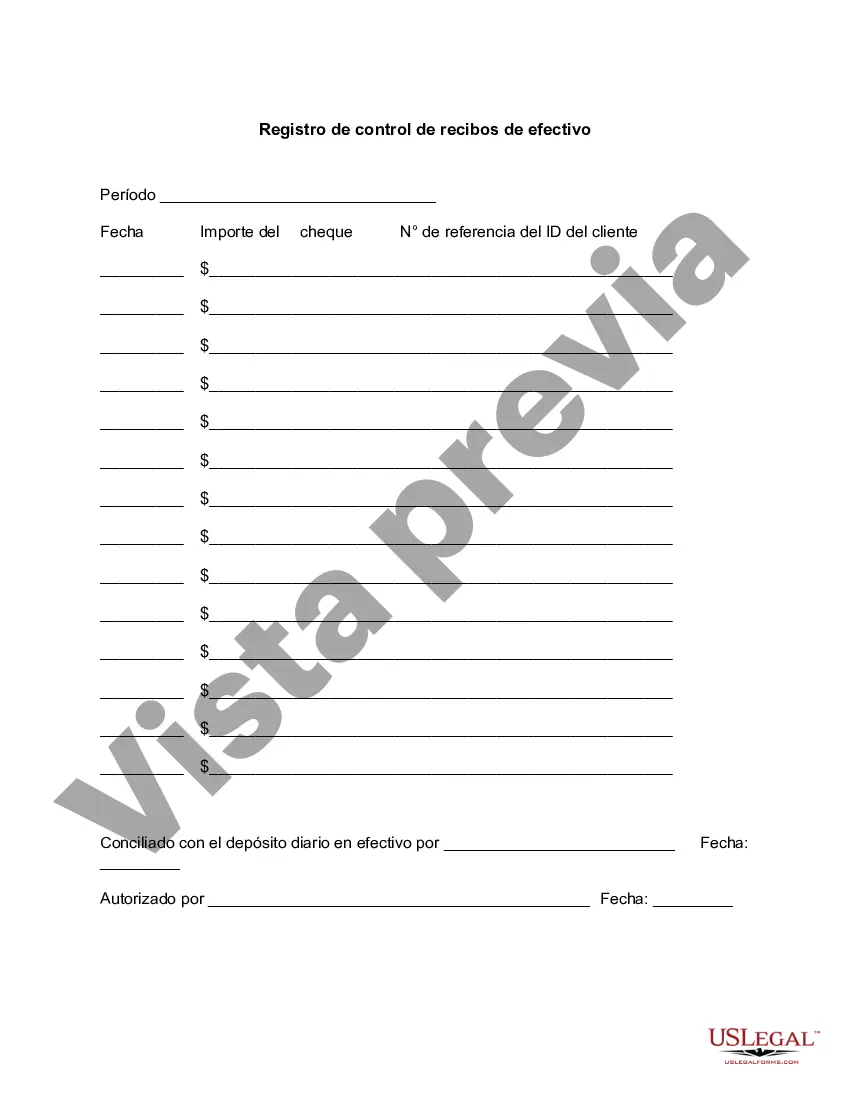

Philadelphia Pennsylvania Cash Receipts Control Log is a crucial record-keeping tool used by businesses and organizations in Philadelphia, Pennsylvania, to effectively manage their cash flow. This log helps businesses maintain accurate and reliable financial records, ensuring transparency, accountability, and preventing any potential financial discrepancies or fraud. The Philadelphia Pennsylvania Cash Receipts Control Log is designed to document all incoming cash transactions, including both cash received and cash refunds. It serves as a comprehensive ledger, tracking the source, amount, and purpose of each cash transaction, thus providing an overview of the organization's financial activities, and facilitating easy reconciliation at the end of each accounting period. Different types of Philadelphia Pennsylvania Cash Receipts Control Logs may vary depending on the nature and scale of the business. Here are some common variations: 1. General Cash Receipts Control Log: This type of log is commonly used by businesses in various industries, including retail, restaurants, and service providers, to record all cash receipts from sales, revenue, and other sources. It includes fields to capture important details such as date, customer name, payment method, amount, and reason for payment. 2. Donations and Fundraising Cash Receipts Control Log: Non-profit organizations, charities, and community groups often use this log to track and manage cash donations and funds received during fundraising events. It helps maintain transparency and serves as an essential tool for financial reporting and accountability. 3. Petty Cash Receipts Control Log: Some businesses and organizations maintain a separate log specifically for petty cash transactions, used for small daily expenses or urgent purchases. This log helps track the disbursement of petty cash funds and ensures proper documentation for every expenditure. 4. Cash Refunds Control Log: This log is employed to record all cash refunds issued by a business or organization. It captures details such as the customer's name, date of refund, reference number, amount, and reason for the refund. This log assists in reconciling refund transactions and minimizing potential errors or mismanagement. Philadelphia Pennsylvania Cash Receipts Control Log is essential for complying with local tax regulations, preparing accurate financial statements, and ensuring proper internal controls. It plays a crucial role in financial audits, providing auditors with the necessary documentation and evidence to verify the accuracy and validity of cash transactions. In conclusion, the Philadelphia Pennsylvania Cash Receipts Control Log is an indispensable tool for businesses and organizations operating in Philadelphia, Pennsylvania, aiding in financial management, accountability, and maintaining transparency in cash transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Philadelphia Pennsylvania Registro De Control De Recibos De Efectivo?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Philadelphia Cash Receipts Control Log is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Philadelphia Cash Receipts Control Log. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Cash Receipts Control Log in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!