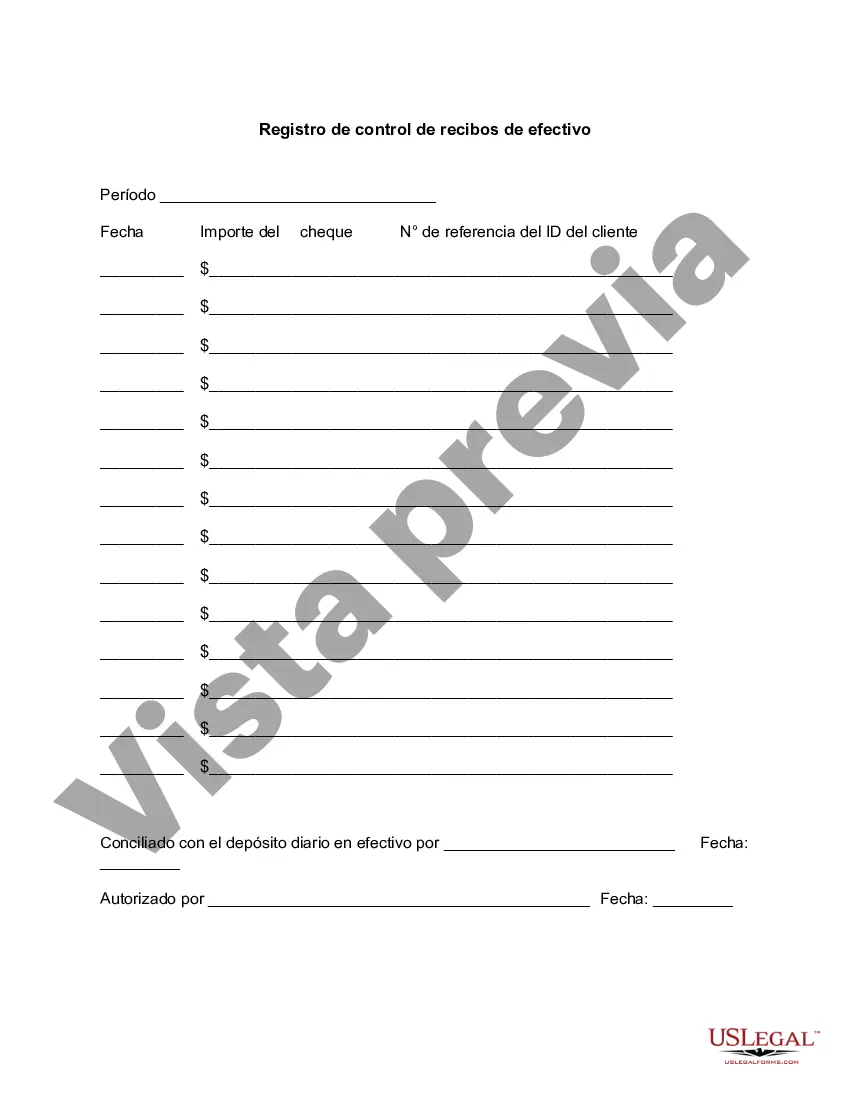

Phoenix Arizona Cash Receipts Control Log is a crucial document that helps ensure proper management and tracking of cash transactions within an organization in Phoenix, Arizona. This log is designed to maintain strict control and accounting of all cash receipts received by the organization, including cash, checks, and credit card payments. The Cash Receipts Control Log serves multiple purposes, including: 1. Accountability: It provides a detailed record of each cash receipt received, ensuring that all funds are properly accounted for and reducing the risk of theft or misappropriation. 2. Tracking: The log allows for easy tracking and reconciliation of cash receipts, enabling businesses to identify any discrepancies and resolve them promptly. 3. Audit trail: By maintaining a comprehensive log of cash receipts, organizations can establish a clear audit trail for financial reporting, compliance, and internal or external audits. The Cash Receipts Control Log typically includes the following information: 1. Date: The date on which the cash receipt was received. 2. Receipt Number: A unique identifier for each receipt, facilitating easy reference and retrieval. 3. Payer Information: The name, address, and contact details of the individual or entity making the payment. 4. Payment Method: This indicates whether the payment was made in cash, by check, or through a credit card. 5. Amount: The total amount of funds received, including any applicable taxes or fees. 6. Purpose: A description of what the payment is for, such as product sales, services rendered, or donations. 7. Received By: The name or initials of the employee responsible for receiving the cash receipt. 8. Deposited By: The name or initials of the employee responsible for depositing the cash into the organization's bank account. Different types of Cash Receipts Control Logs may exist depending on the specific needs and preferences of each organization. These variations may include: 1. Electronic Cash Receipts Control Log: Some organizations prefer to maintain their records digitally, using specialized software or Excel spreadsheets to track and manage cash receipts. 2. Manual Cash Receipts Control Log: In smaller or less technologically advanced organizations, a manual logbook or ledger may be used to record cash receipts. 3. Department-Specific Cash Receipts Control Log: In larger organizations with multiple departments or divisions, separate logs may be maintained for each unit to ensure accountability and control. In conclusion, the Phoenix Arizona Cash Receipts Control Log is an essential tool for managing and tracking cash transactions within an organization. By maintaining accurate and detailed records of cash receipts, organizations can enhance financial control, minimize risks, and facilitate smooth financial operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Phoenix Arizona Registro De Control De Recibos De Efectivo?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Phoenix Cash Receipts Control Log.

Locating forms on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Phoenix Cash Receipts Control Log will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Phoenix Cash Receipts Control Log:

- Make sure you have opened the right page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Phoenix Cash Receipts Control Log on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!