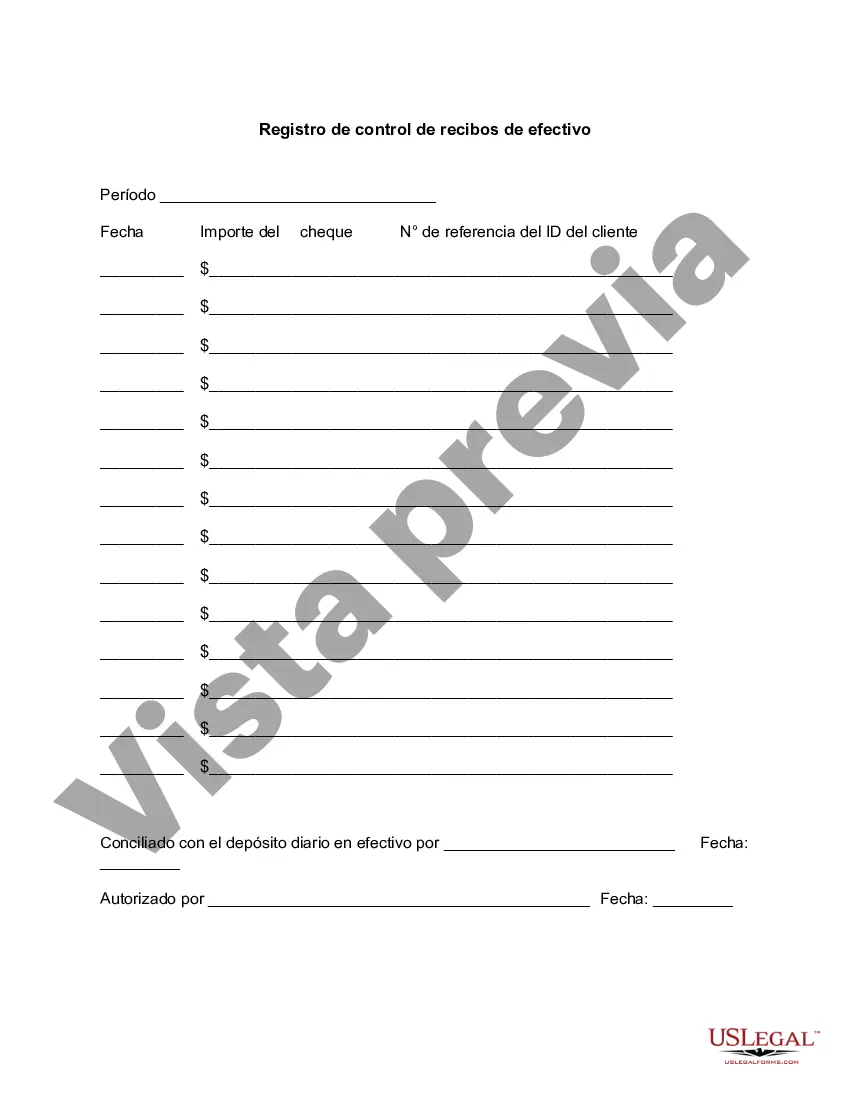

The Lima Arizona Cash Receipts Control Log is a significant financial document utilized by businesses and organizations in Lima, Arizona, to track and manage cash received. It serves as a comprehensive record of all cash transactions and helps ensure proper control and accountability over funds. The Cash Receipts Control Log contains various columns and sections to capture relevant information. These may include: 1. Date: The date when the cash was received. 2. Transaction Description: A brief description of the transaction or reason for the cash receipt. 3. Received From: The name of the individual, company, or entity from which the cash was received. 4. Amount: The specific amount of cash received. 5. Check No./Invoice No.: If applicable, this column records the check number or invoice number associated with the cash receipt. 6. Account Number: The relevant account number where the cash is being deposited or assigned. 7. Department: In case of multiple departments within an organization, this column denotes the specific department to which the cash receipt is allocated. 8. Receipt Number: An assigned receipt number for easy identification and reference purposes. 9. Authorized By: The name or initials of the authorized personnel responsible for reviewing and approving the cash receipt. 10. Remarks: Additional notes or comments regarding the cash transaction. Different types of Lima Arizona Cash Receipts Control Logs may be based on the specific needs and preferences of the organization using them. Some variations may include: 1. Daily Cash Receipts Log: This type of log focuses on capturing cash receipts on a daily basis, providing a detailed record of each day's transactions. 2. Monthly Cash Receipts Summary Log: A consolidated summary log that captures the total cash receipts for each month, providing a comprehensive overview of the organization's financial performance. 3. Department-specific Cash Receipts Control Log: For organizations with multiple departments, separate logs may be maintained to allocate cash receipts accurately and track department-specific financial information. 4. Online Cash Receipts Control Log: In today's digital era, an online version of the cash receipts log may be utilized, allowing for real-time data entry, storage, and analysis. Utilizing the Lima Arizona Cash Receipts Control Log provides businesses and organizations with a structured and organized approach to tracking cash inflows, ensuring accuracy, transparency, and effective financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Pima Arizona Registro De Control De Recibos De Efectivo?

Draftwing paperwork, like Pima Cash Receipts Control Log, to manage your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for various scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Pima Cash Receipts Control Log template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before downloading Pima Cash Receipts Control Log:

- Make sure that your template is compliant with your state/county since the regulations for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Pima Cash Receipts Control Log isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our website and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!