Queens New York Cash Receipts Control Log is a comprehensive system designed to track and monitor cash inflow and record keeping processes in Queens, a borough in New York City. It plays a crucial role in maintaining financial transparency and ensuring accurate records of cash transactions. The Cash Receipts Control Log serves as a central repository for recording every cash receipt received by various departments or businesses operating within Queens, New York. By employing this control log, organizations can maintain a streamlined cash management system and facilitate efficient cash handling procedures. Key features of the Queens New York Cash Receipts Control Log usually include: 1. Identification and Recording: The control log requires the date, time, source, and amount received for each cash transaction. This information helps in effectively tracking and organizing cash receipts. 2. Sequential Log Numbers: Each cash receipt is assigned a unique sequential log number, providing a systematic way of identification. This ensures that no receipt goes missing or gets duplicated. 3. Staff Accountability: The log maintains a record of every staff member involved in cash handling processes, helping to establish accountability and prevent any misappropriation. 4. Reconciliation Process: The control log allows for comparing the entries in the log with the actual cash balance, thus ensuring a smooth reconciliation process. Any discrepancies can be promptly identified and investigated. 5. Audit and Compliance: The Cash Receipts Control Log aids in maintaining compliance with accounting standards and regulatory requirements. It provides auditors with an easy reference to verify cash handling practices and validate financial records. Different types of Queens New York Cash Receipts Control Logs can include: 1. Governmental Cash Receipts Control Log: This log is specifically tailored to meet the requirements set by government agencies operating in Queens, New York. It may have additional fields to record specific information, such as funding sources or departmental allocations. 2. Business Cash Receipts Control Log: Designed for businesses operating within Queens, this log helps organizations maintain control over their cash inflow, ensuring accurate recording of sales, revenue, and customer payments. 3. Non-profit Organization Cash Receipts Control Log: Non-profit organizations in Queens, New York can utilize this log to track donations, grants, and other forms of cash contributions. It may include features specific to the non-profit sector, such as donor information and tax-deductible status. In conclusion, the Queens New York Cash Receipts Control Log is an essential tool for managing cash receipts effectively. It promotes accountability, assists in financial reconciliation, and ensures compliance with regulatory standards. Different variants of the control log cater to specific needs of governmental agencies, businesses, and non-profit organizations in Queens, New York.

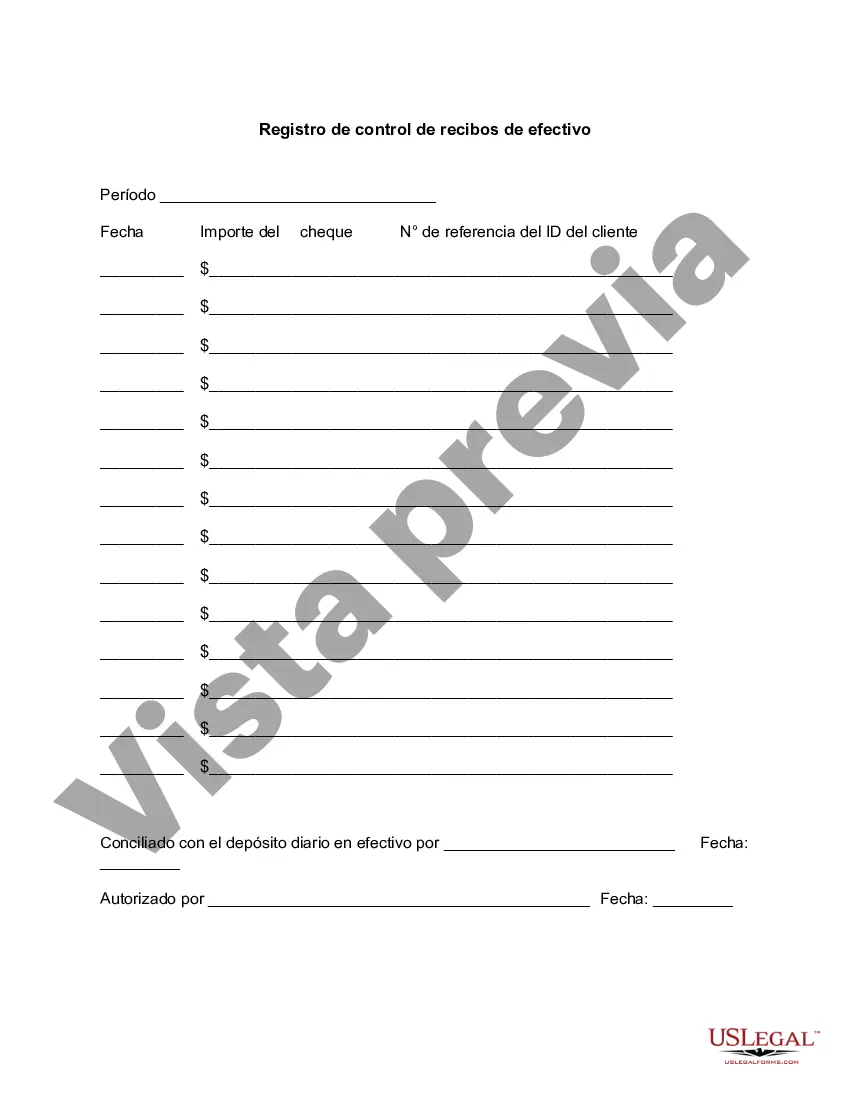

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Queens New York Registro De Control De Recibos De Efectivo?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Queens Cash Receipts Control Log, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Queens Cash Receipts Control Log, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Queens Cash Receipts Control Log:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Queens Cash Receipts Control Log and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!