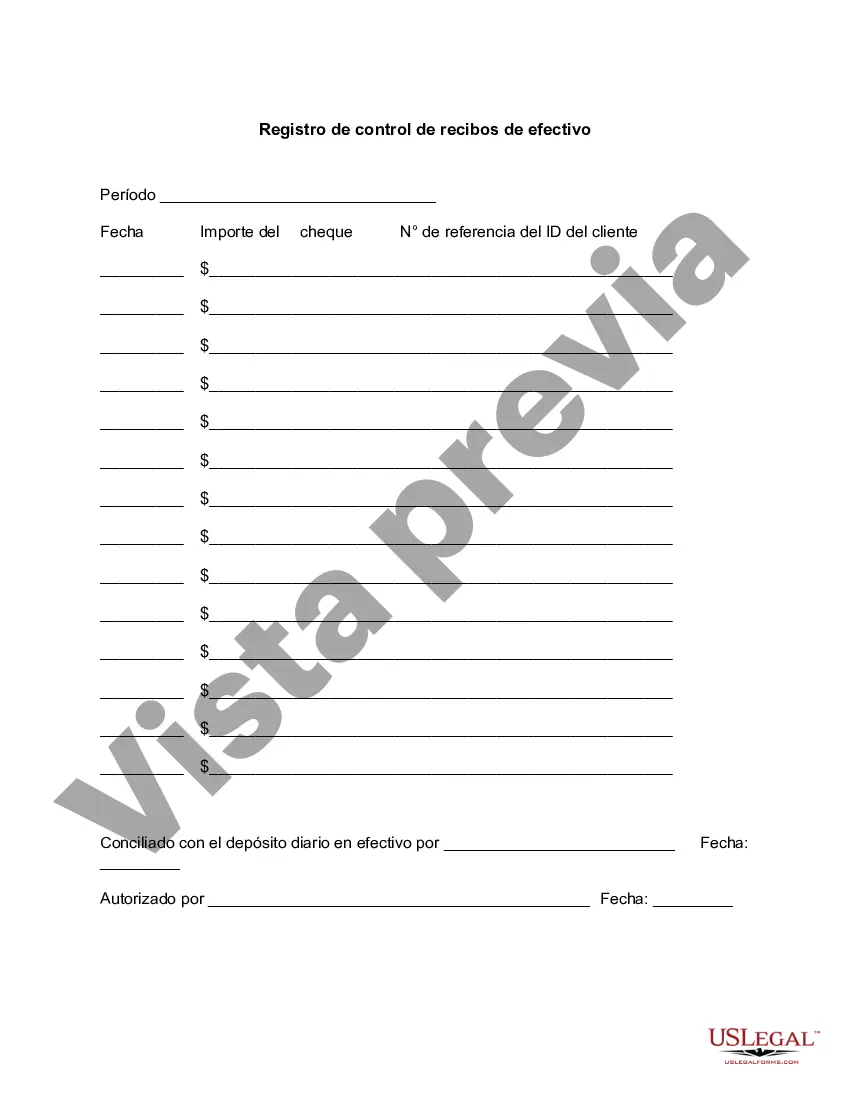

Riverside California Cash Receipts Control Log is a document used by the Riverside County government to keep track of cash transactions and ensure proper financial management. This log helps to prevent mismanagement, fraud, and errors in recording cash receipts. It is a crucial tool for maintaining transparency, accountability, and accuracy of financial records. Keywords: Riverside California, cash receipts, control log, financial management, mismanagement, fraud, errors, recording, transparency, accountability, accuracy, financial records. Different types of Riverside California Cash Receipts Control Logs: 1. Daily Cash Receipts Log: This type of log is used to record cash transactions on a daily basis. It includes detailed information such as the date, amount, source, purpose, and the responsible person or department for each cash receipt. Daily logs enable close monitoring of cash flow and provide a comprehensive record for auditing purposes. 2. Department-specific Cash Receipts Log: In larger organizations, different departments may have their own cash receipts control logs. This allows for better departmental accountability and tracking of cash receipts within specific areas of operations. These logs contain similar information as the daily log but are focused on a particular department's cash handling activities. 3. Petty Cash Receipts Log: Petty cash is a small amount of cash reserved for minor expenses or emergencies. Petty cash controls ensure that the funds are properly spent and accounted for. The petty cash receipts log outlines the reimbursement or expenditure details, date, amount, purpose, and the recipient's name for each transaction. 4. Special Events Cash Receipts Log: For events organized by the Riverside County, such as fundraisers, fairs, or community gatherings, a special events cash receipts control log is utilized. This log records cash received from ticket sales, concessions, donations, or any other revenue sources related to the event. Detailed information about each transaction is recorded, including the date, amount, source, and purpose. By having various types of cash receipts control logs, the Riverside County can ensure comprehensive financial oversight and maintain accurate records across its operations. These logs play a vital role in preventing financial irregularities and promoting sound financial management practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Riverside California Registro De Control De Recibos De Efectivo?

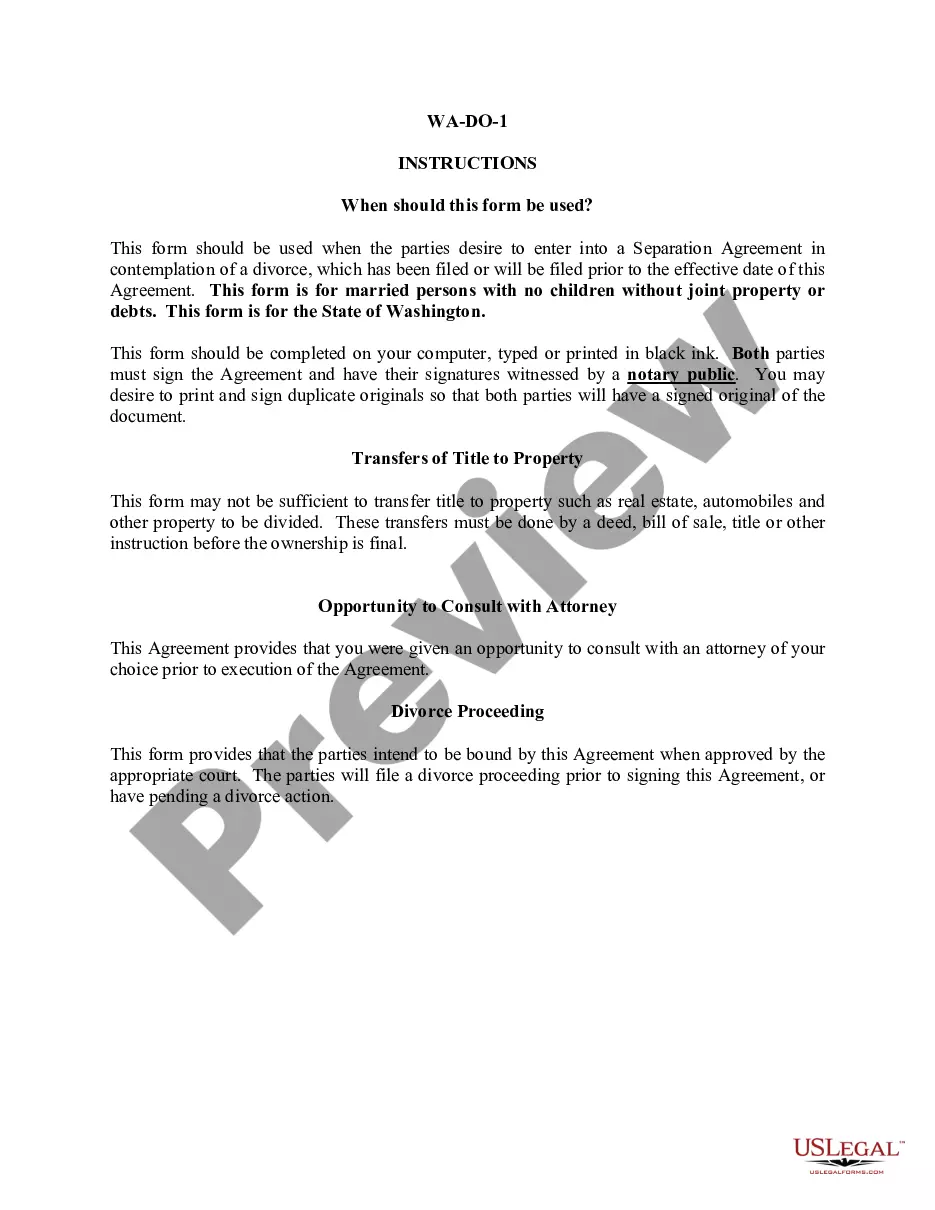

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Riverside Cash Receipts Control Log meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the Riverside Cash Receipts Control Log, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Riverside Cash Receipts Control Log:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Riverside Cash Receipts Control Log.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!