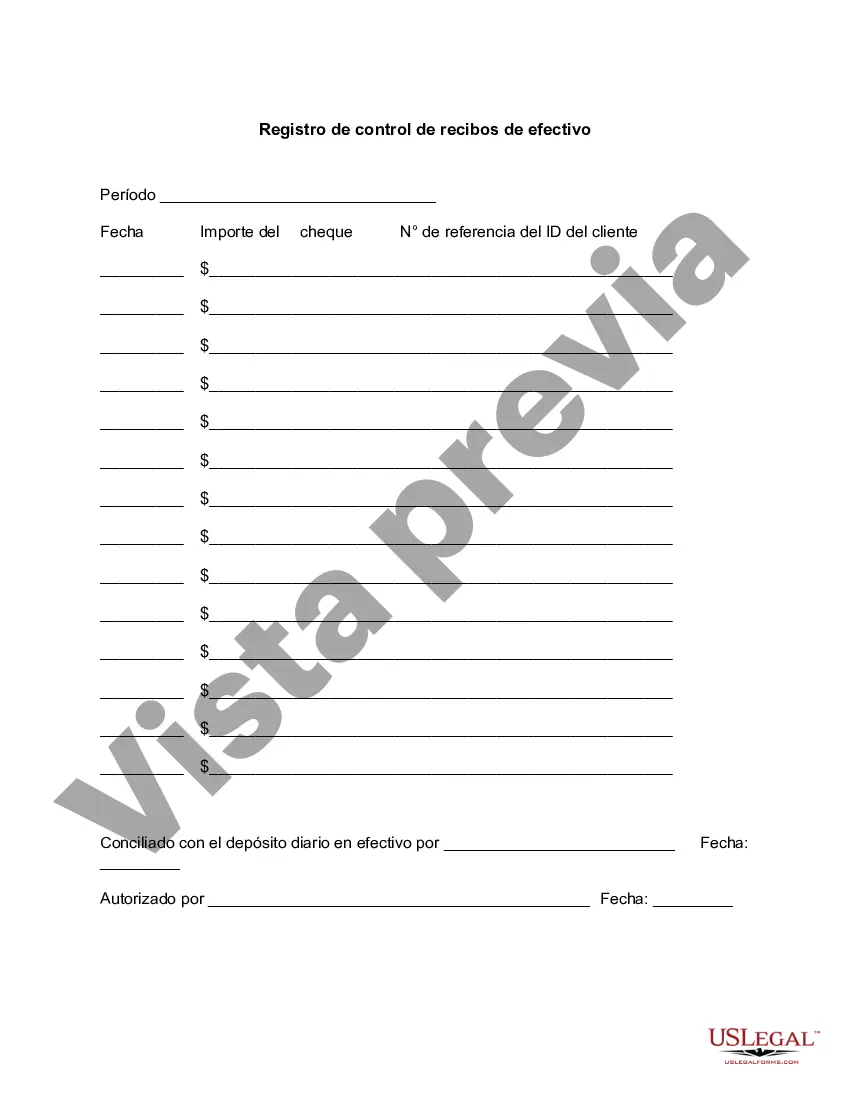

The Tarrant Texas Cash Receipts Control Log is a crucial document used to track and manage cash transactions in the Tarrant County of Texas, ensuring financial accountability and control. It serves as a record-keeping tool for documenting the inflow of cash within various organizations, entities, or governmental bodies located in Tarrant County. This control log is designed to accurately record all cash receipts, including cash received from sales, services, fees, and other revenue sources. It helps maintain transparency and prevents any potential discrepancies or fraudulent activities related to cash handling. The log provides a detailed description of the cash received, the date and time of receipt, the purpose or source of the cash, and the amount received. The Tarrant Texas Cash Receipts Control Log plays a critical role in financial management, allowing organizations to maintain a comprehensive and systematic approach to cash handling. It assists in tracking the origin of the funds and ensures that all cash received is properly documented and deposited in the appropriate accounts. Additionally, it helps organizations reconcile their cash receipts with bank statements and internal accounting records. Different types or variations of the Tarrant Texas Cash Receipts Control Log may exist depending on the specific needs or requirements of different organizations or entities within Tarrant County. Some variations may include: 1. Governmental Cash Receipts Control Log: This log is typically utilized by various local government bodies, departments, or agencies within Tarrant County. It tracks cash inflows from taxes, permits, fines, licenses, and other government-related revenues. 2. Nonprofit Cash Receipts Control Log: Nonprofit organizations operating within Tarrant County may adopt a specialized control log to manage cash received from donations, fundraisers, grants, and other charitable contributions. 3. Retail Cash Receipts Control Log: Retail businesses in Tarrant County may implement a cash receipts control log tailored to their specific needs. This log would typically record cash received from sales transactions, refunds, and other revenue sources related to their business operations. Implementing a Tarrant Texas Cash Receipts Control Log is integral to maintaining a well-organized and transparent system for handling cash transactions. It ensures that an accurate and reliable record of all cash inflows is documented, promoting financial integrity and helping organizations efficiently manage and monitor their cash flow.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Tarrant Texas Registro De Control De Recibos De Efectivo?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Tarrant Cash Receipts Control Log is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Tarrant Cash Receipts Control Log. Follow the guide below:

- Make sure the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Cash Receipts Control Log in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!