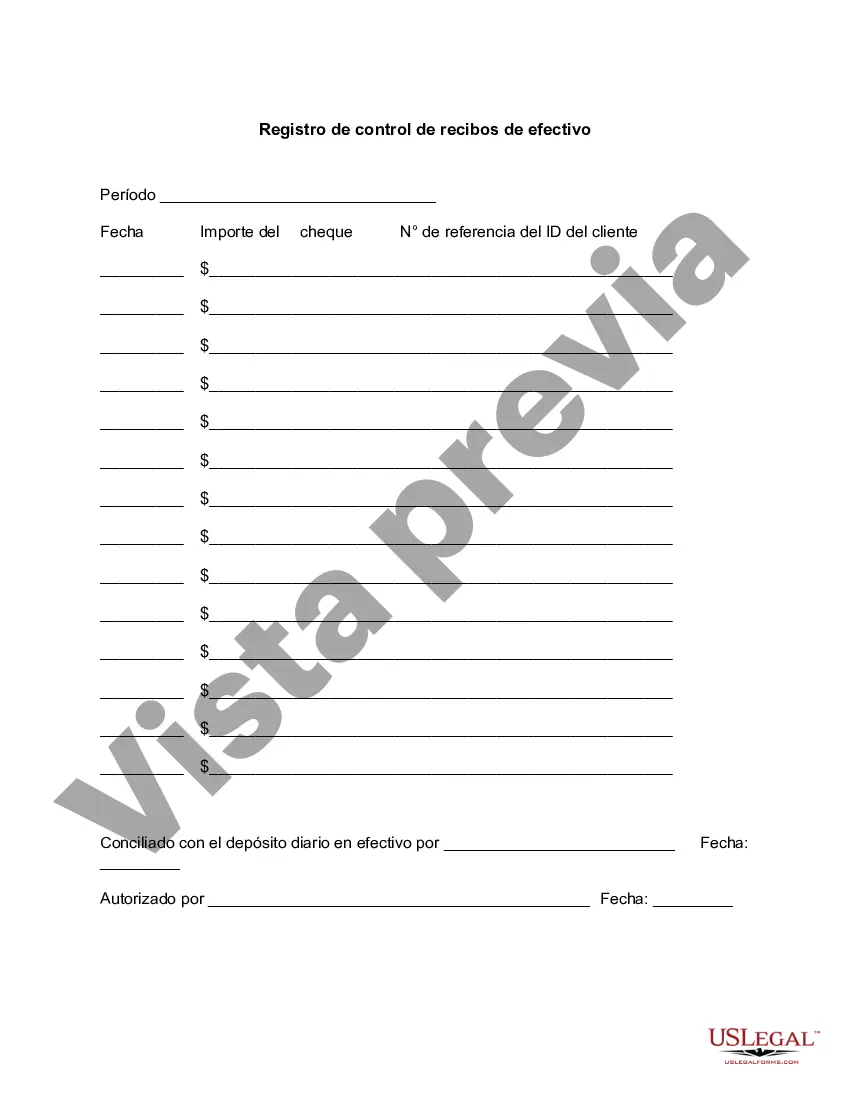

Wake North Carolina Cash Receipts Control Log is a crucial document used by organizations in Wake County, North Carolina, to monitor and track cash receipts and maintain financial control. This log helps ensure accuracy, transparency, and accountability in financial transactions. The Cash Receipts Control Log is an essential tool for recording all incoming cash transactions accurately. It helps organizations detect discrepancies, identify potential errors or irregularities, and prevent any misappropriation of funds. Some key features of Wake North Carolina Cash Receipts Control Log include: 1. Date and Time: Each cash receipt is logged with its corresponding date and time of receipt. This helps in tracking and cross-referencing transactions. 2. Source of Receipt: The log records the source from where the cash is received, such as sales, donations, fees, or funds from grants. This information provides a clear understanding of the origin of the funds. 3. Amount: The log requires the entry of the specific amount received, ensuring accuracy and preventing any misplacement or theft of cash. 4. Description/Purpose: This section allows the recording of a brief description or purpose of the cash receipt, providing transparency and facilitating future references. 5. Responsible Person: The person responsible for handling or receiving the cash is identified in the log, aiding in accountability and responsibility. 6. Receipt Number: Each transaction is assigned a unique receipt number, which helps in tracking and cross-referencing the corresponding receipt issued. Different Types of Wake North Carolina Cash Receipts Control Log: 1. General Cash Receipts Log: This log is used for a wide range of organizations, such as retail stores, service providers, and non-profit organizations, to record all cash receipts received from various sources. 2. Event-Specific Cash Receipts Log: In cases where organizations host events or fundraisers, an event-specific cash receipts log is used to track all incoming cash transactions related to that particular event. It helps in tracking event-specific revenue and expenditure. 3. Departmental Cash Receipts Log: In larger organizations with multiple departments, there may be a need for department-specific cash receipts logs. Each department maintains its own log to record cash receipts related to their operations, ensuring proper departmental financial control. 4. Tax-Related Cash Receipts Log: For tax purposes, some organizations may maintain a specific cash receipts log recording taxable transactions, ensuring compliance with tax regulations and accurate reporting. In conclusion, the Wake North Carolina Cash Receipts Control Log is an indispensable tool for organizations operating in Wake County, North Carolina. Whether it's for general financial control or specific event tracking, this log assists in maintaining accurate records, ensuring transparency, and preventing any financial discrepancies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Wake North Carolina Registro De Control De Recibos De Efectivo?

Draftwing documents, like Wake Cash Receipts Control Log, to manage your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for a variety of scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Wake Cash Receipts Control Log template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before downloading Wake Cash Receipts Control Log:

- Make sure that your document is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Wake Cash Receipts Control Log isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our service and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!