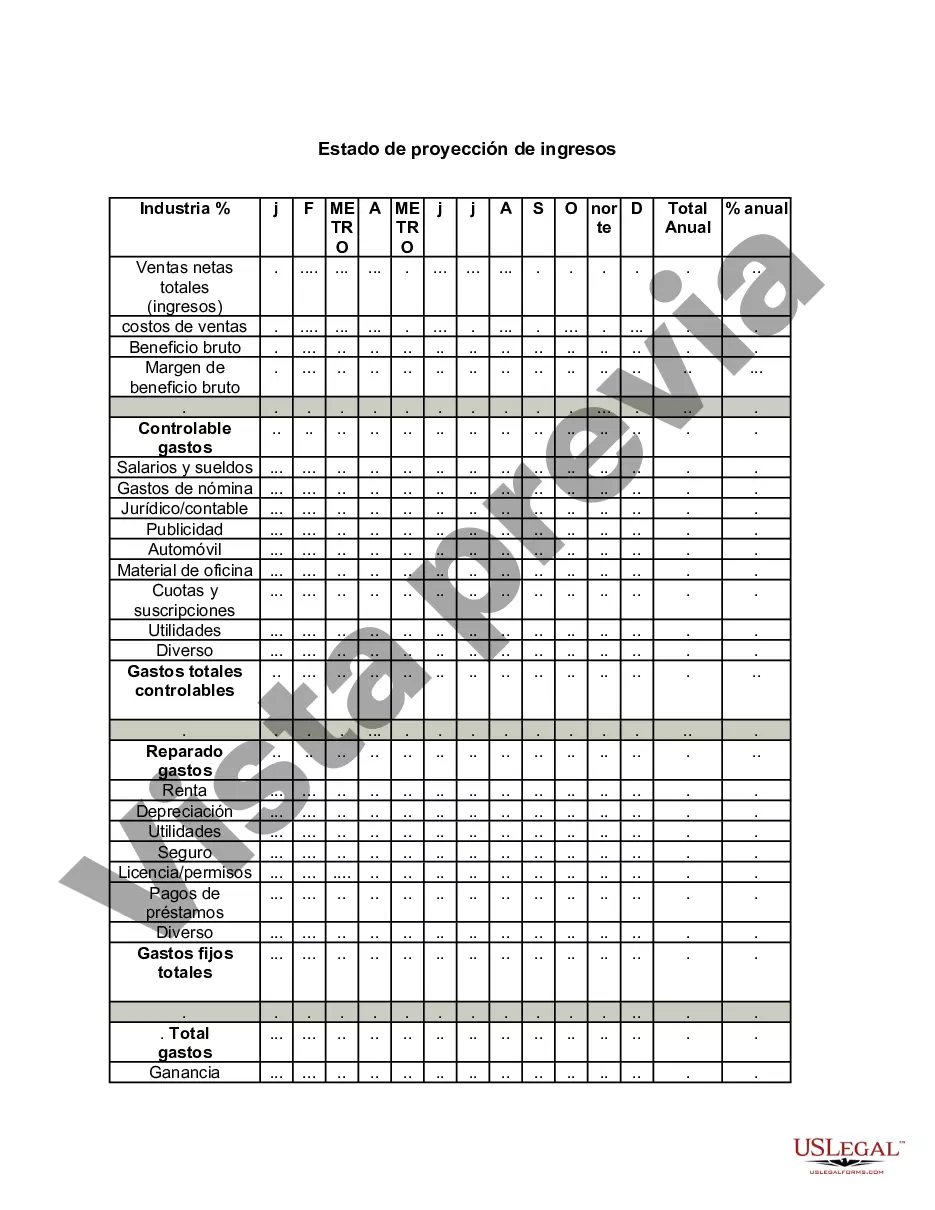

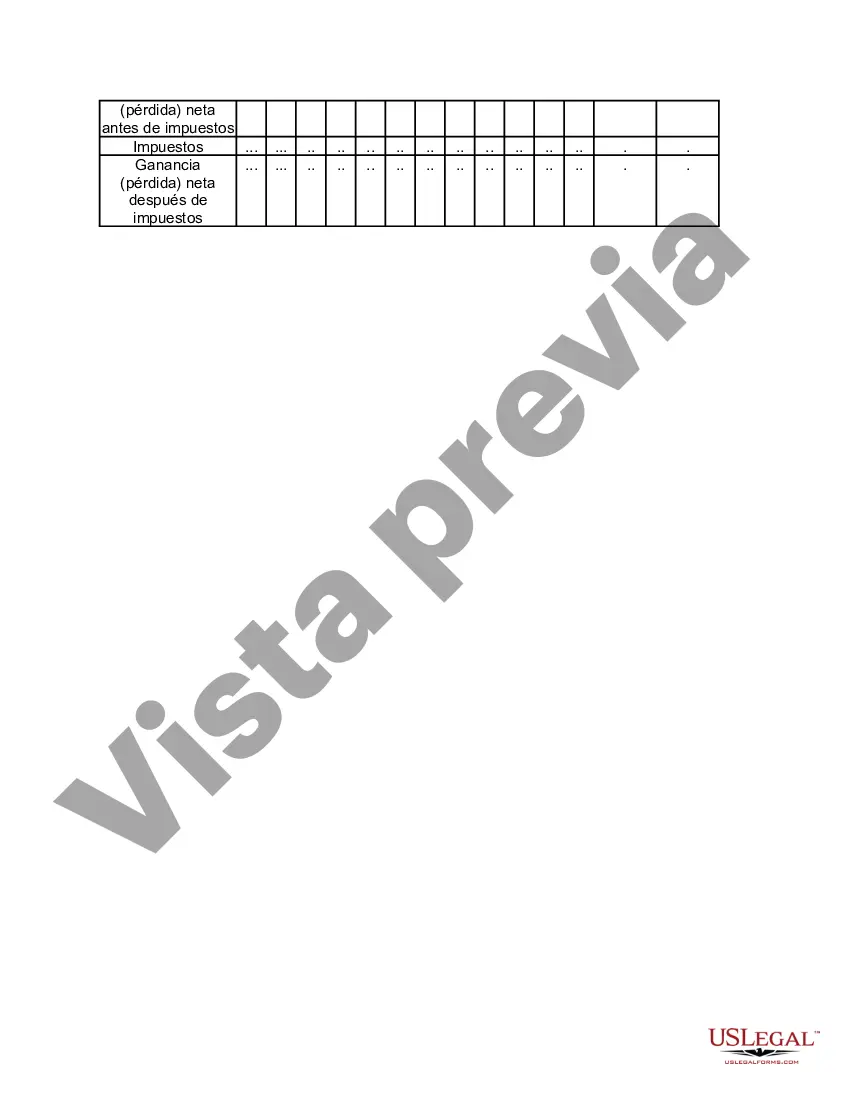

The Nassau New York Income Projections Statement is a financial document that provides a detailed forecast of expected income for individuals or businesses in Nassau, New York. This statement plays a crucial role in financial planning, budgeting, and decision-making processes. It enables individuals, organizations, or investors to gain insights into future income streams and make informed decisions accordingly. The Nassau New York Income Projections Statement considers various factors contributing to income generation, such as salaries, wages, investments, business revenue, rental income, royalties, interest, commissions, and any other sources of income. By analyzing historical data, industry trends, economic indicators, and market conditions, this statement estimates the future income potential accurately. Different types of Nassau New York Income Projections Statements can be categorized based on the entities they represent: 1. Personal Income Projections Statement: This statement is designed for individual taxpayers who want to project their future income streams in Nassau, New York. It helps individuals plan their expenses, savings, investments, and tax obligations accordingly. 2. Business Income Projections Statement: This statement is specifically tailored for businesses operating in Nassau, New York. It forecasts the expected revenue, sales, and other income sources over a defined period. Business owners can utilize this statement to make strategic decisions, set sales targets, determine pricing strategies, budget for expenses, and gauge profitability. 3. Real Estate Income Projections Statement: For individuals or entities involved in real estate investments in Nassau, New York, this statement estimates the expected rental income and property appreciation. It considers factors like occupancy rates, rental rates, property maintenance expenses, and market trends, aiding investors in making informed decisions regarding property acquisitions, management, or sales. 4. Investment Income Projections Statement: This type of statement focuses on projecting income generated from investments, such as stocks, bonds, mutual funds, or any other financial instruments. It estimates dividend income, capital gains, interest income, and other potential investment returns. Investors in Nassau, New York can use this statement to evaluate the performance and expected income from their investment portfolios. 5. Nonprofit Income Projections Statement: Designed for nonprofit organizations operating in Nassau, New York, this statement forecasts the expected income from fundraising activities, grants, donations, memberships, sponsorships, and other sources. It helps nonprofits plan their budget, program allocations, and fundraising efforts to fulfill their missions effectively. In summary, the Nassau New York Income Projections Statement is a vital financial tool available in various types, serving diverse entities in Nassau, New York. It offers valuable insights into future income potential, empowering individuals, businesses, and organizations to plan, strategize, and make informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Estado de proyección de ingresos - Income Projections Statement

Description

How to fill out Nassau New York Estado De Proyección De Ingresos?

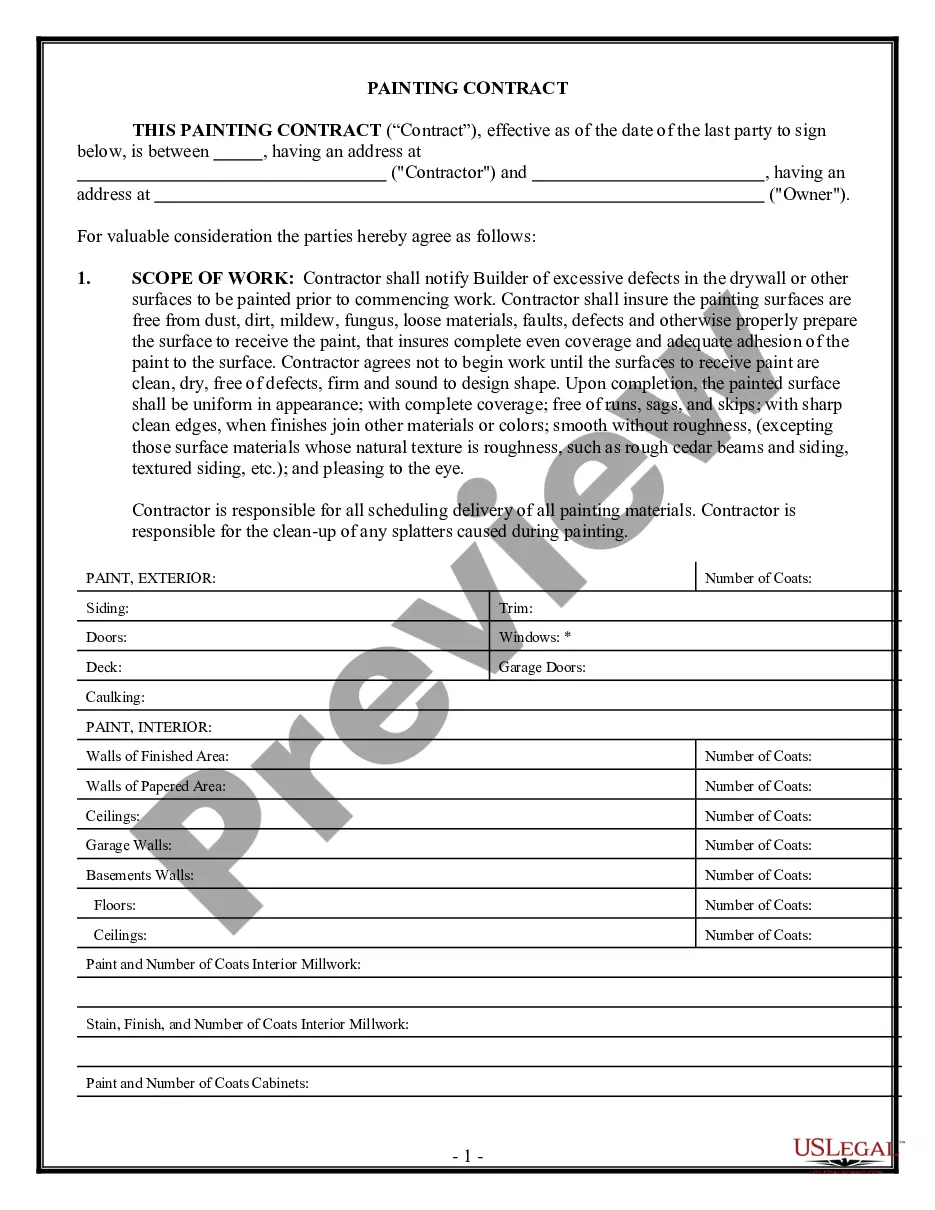

Drafting papers for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Nassau Income Projections Statement without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Nassau Income Projections Statement on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Nassau Income Projections Statement:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!