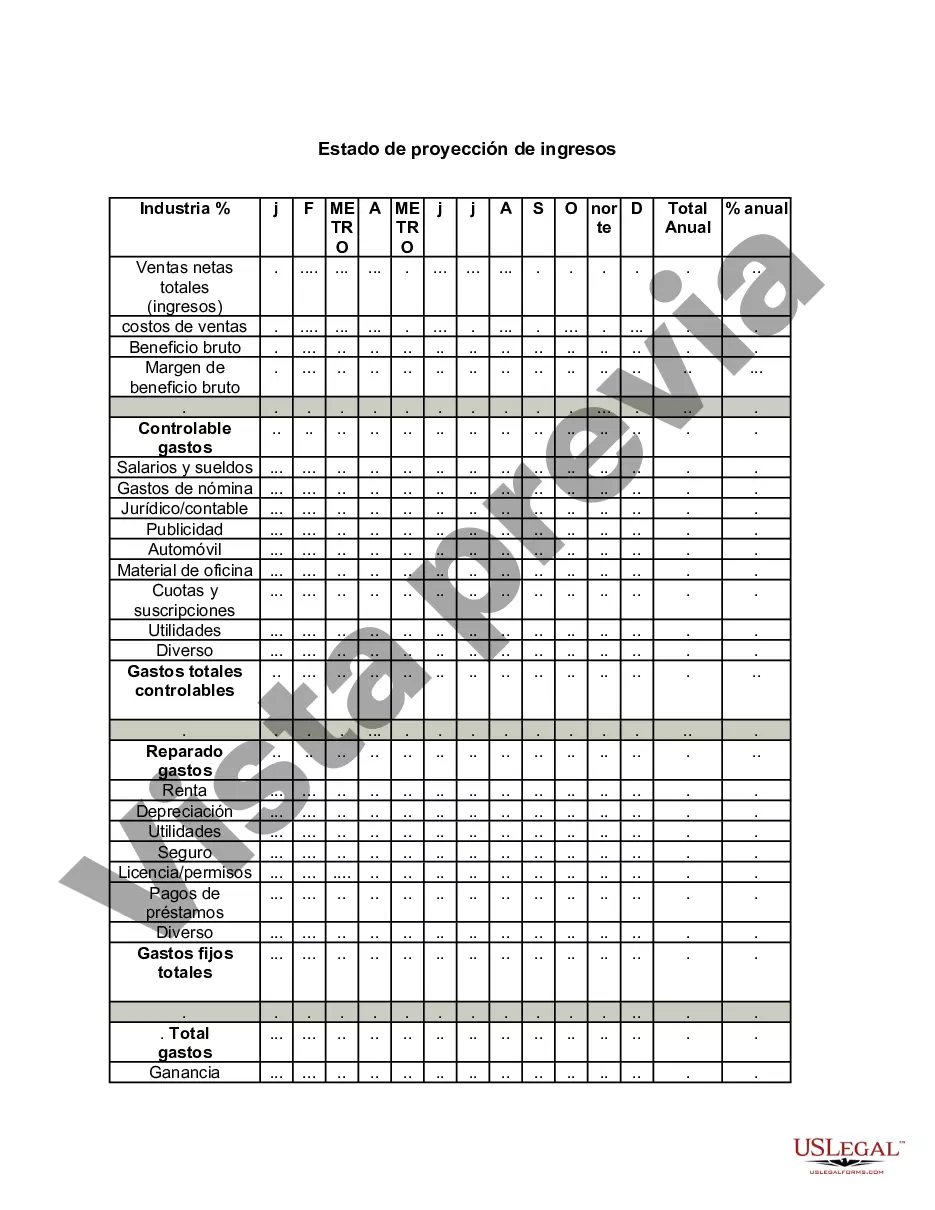

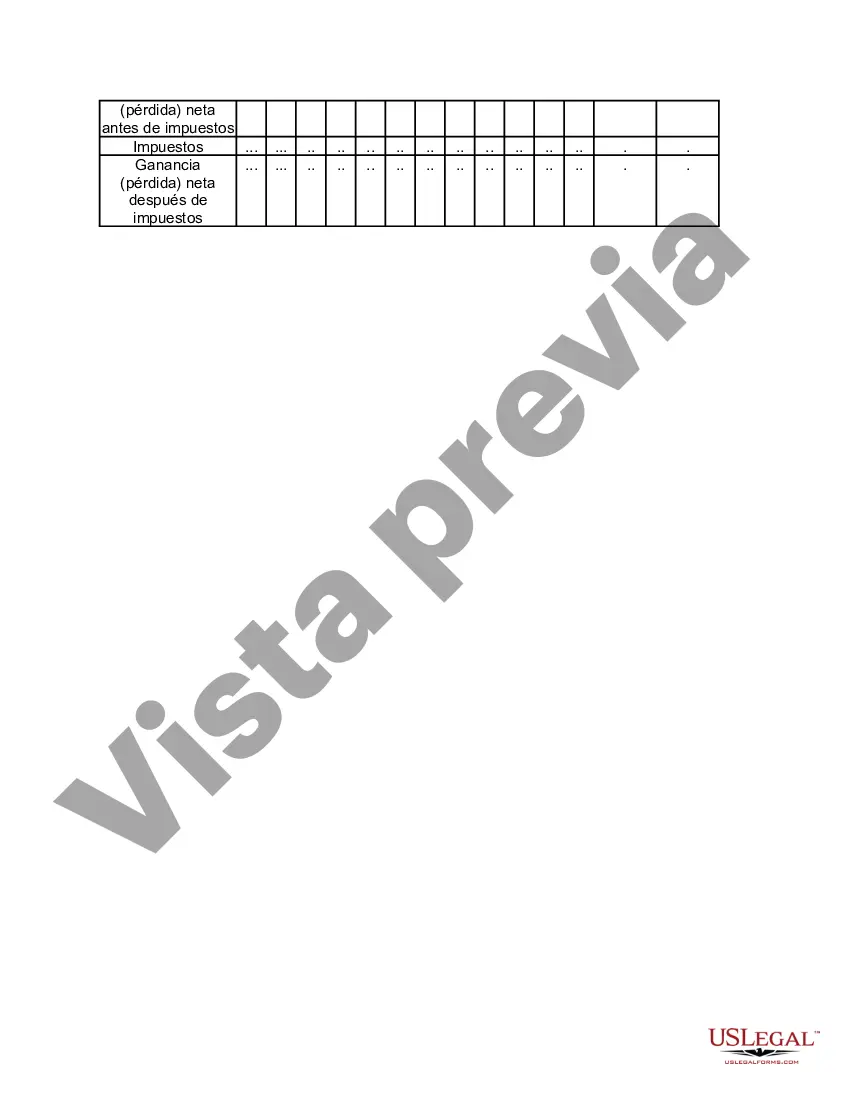

Philadelphia Pennsylvania refers to the vibrant city of Philadelphia, located in the state of Pennsylvania, in the United States. The Philadelphia Pennsylvania Income Projections Statement provides a detailed analysis of the projected income for individuals or businesses operating within the city. The Income Projections Statement is a financial document that estimates the expected revenue and expenses over a specified period, typically for one year. It serves as a valuable tool for financial planning, decision-making, and forecasting future financial health. By examining various factors like demographics, economic trends, and market analysis, the Income Projections Statement provides an approximation of the expected income levels in Philadelphia Pennsylvania. There are different types of Income Projections Statements utilized in Philadelphia Pennsylvania, catering to the distinct needs and purposes of various entities. Some of these types include: 1. Individual Income Projections Statement: This type focuses on estimating the projected income of an individual residing in Philadelphia Pennsylvania. It factors in various sources of income such as salaries, investments, rental properties, and self-employment earnings to provide a comprehensive glimpse into an individual's expected earnings. 2. Business Income Projections Statement: For businesses in Philadelphia Pennsylvania, this statement predicts the anticipated revenue and expenses based on historical data, industry trends, and market analysis. It assists businesses in understanding potential profit margins, identifying areas for improvement, and making informed financial decisions. 3. Real Estate Income Projections Statement: This statement specializes in estimating income projections for real estate investments in Philadelphia Pennsylvania. It considers factors like property value appreciation, rental income, property management costs, and occupancy rates to give investors an idea of expected returns on their investment. 4. Non-Profit Income Projections Statement: Non-profit organizations in Philadelphia Pennsylvania can benefit from this type of statement. It helps in projecting potential revenue streams, including grants, donations, sponsorships, and fundraising activities. It aids in assessing financial sustainability, budgeting, and strategic planning for these organizations. 5. Government Income Projections Statement: This type of Income Projections Statement caters to the financial planning of various government entities in Philadelphia Pennsylvania. It estimates revenue sources like taxation, federal grants, fines, and other income streams to determine the expected income which plays a crucial role in budgeting for public services and initiatives. Overall, the Philadelphia Pennsylvania Income Projections Statement serves as a valuable financial tool for individuals, businesses, real estate investors, non-profit organizations, and government entities. It enables them to plan, make informed decisions, and develop strategies to achieve their financial goals effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Estado de proyección de ingresos - Income Projections Statement

Description

How to fill out Philadelphia Pennsylvania Estado De Proyección De Ingresos?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Philadelphia Income Projections Statement, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the current version of the Philadelphia Income Projections Statement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Philadelphia Income Projections Statement:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Philadelphia Income Projections Statement and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!