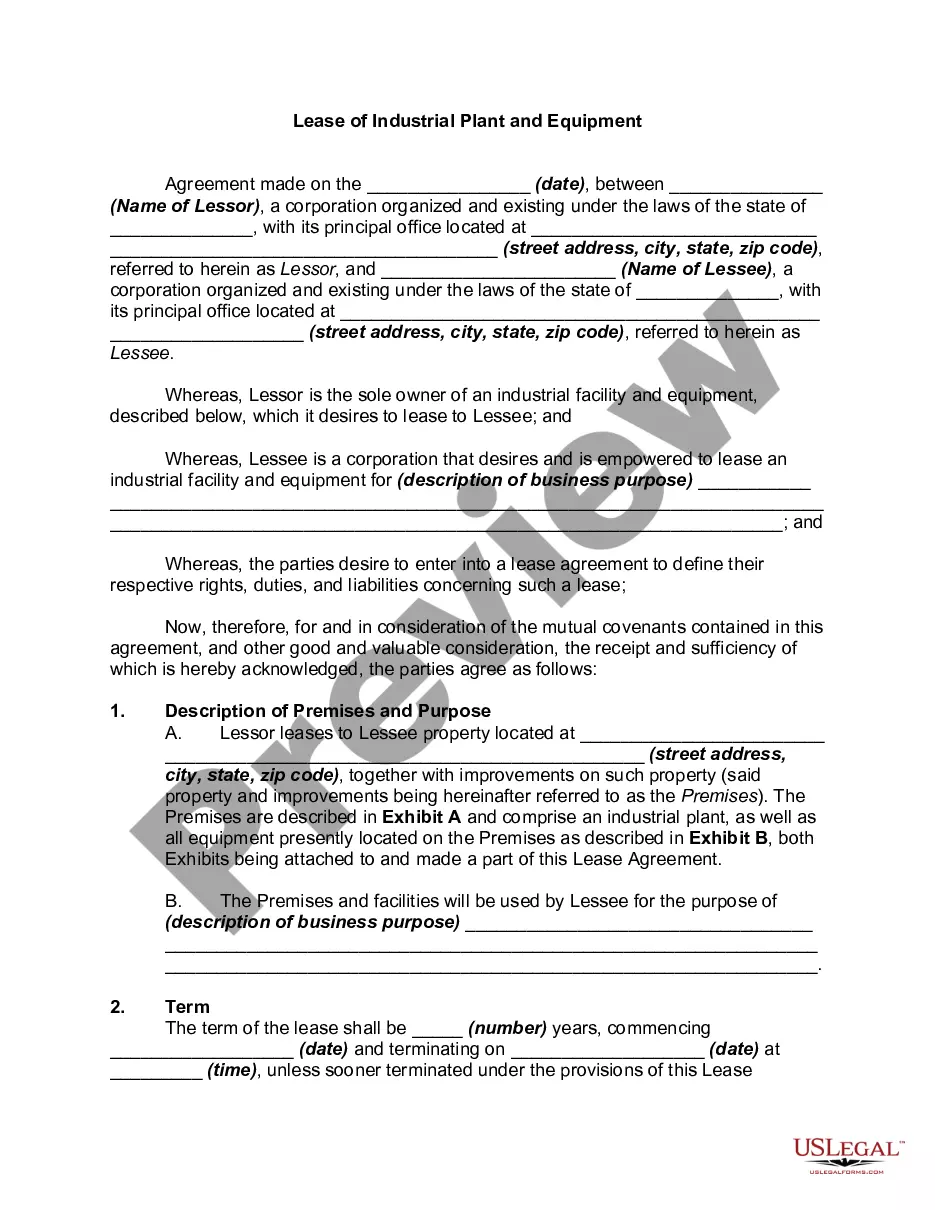

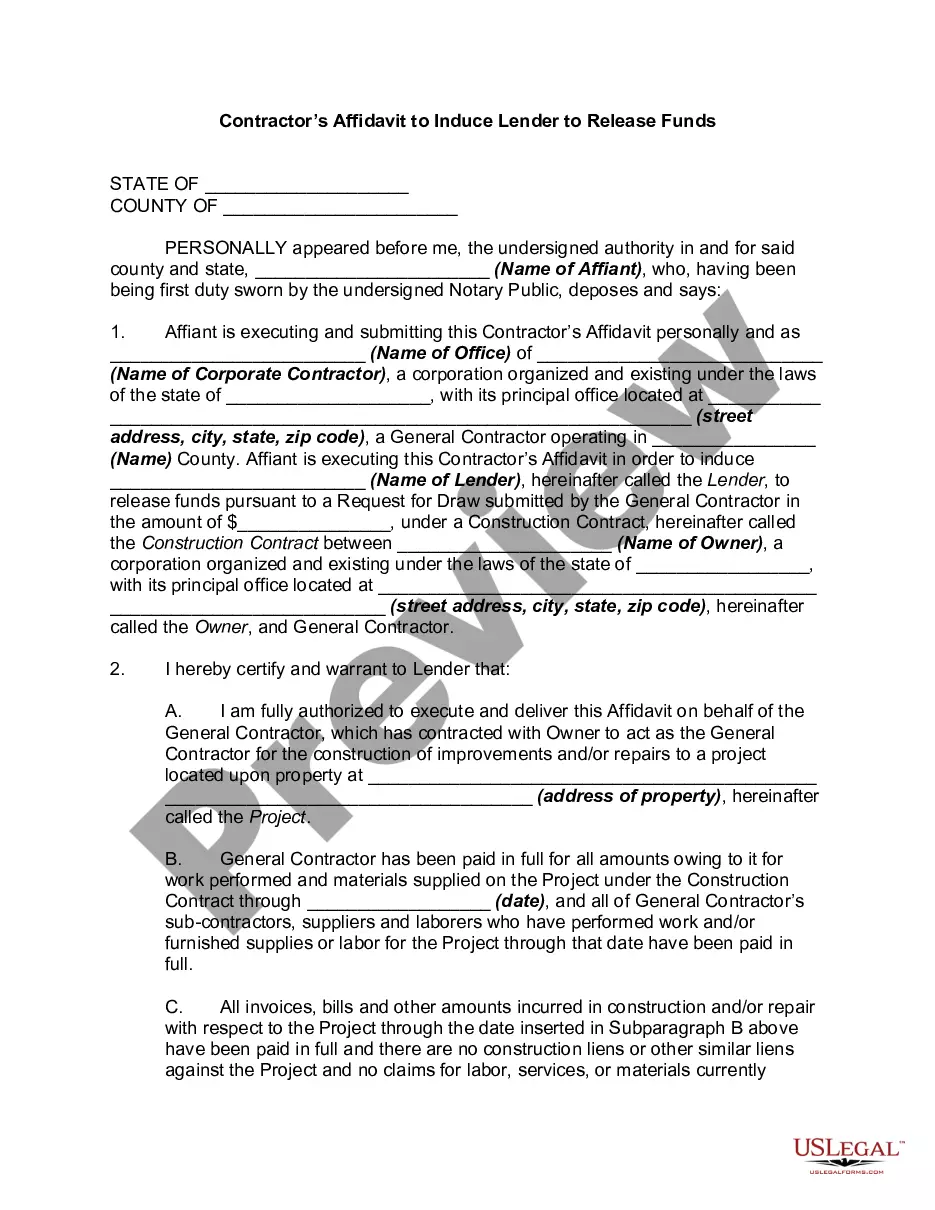

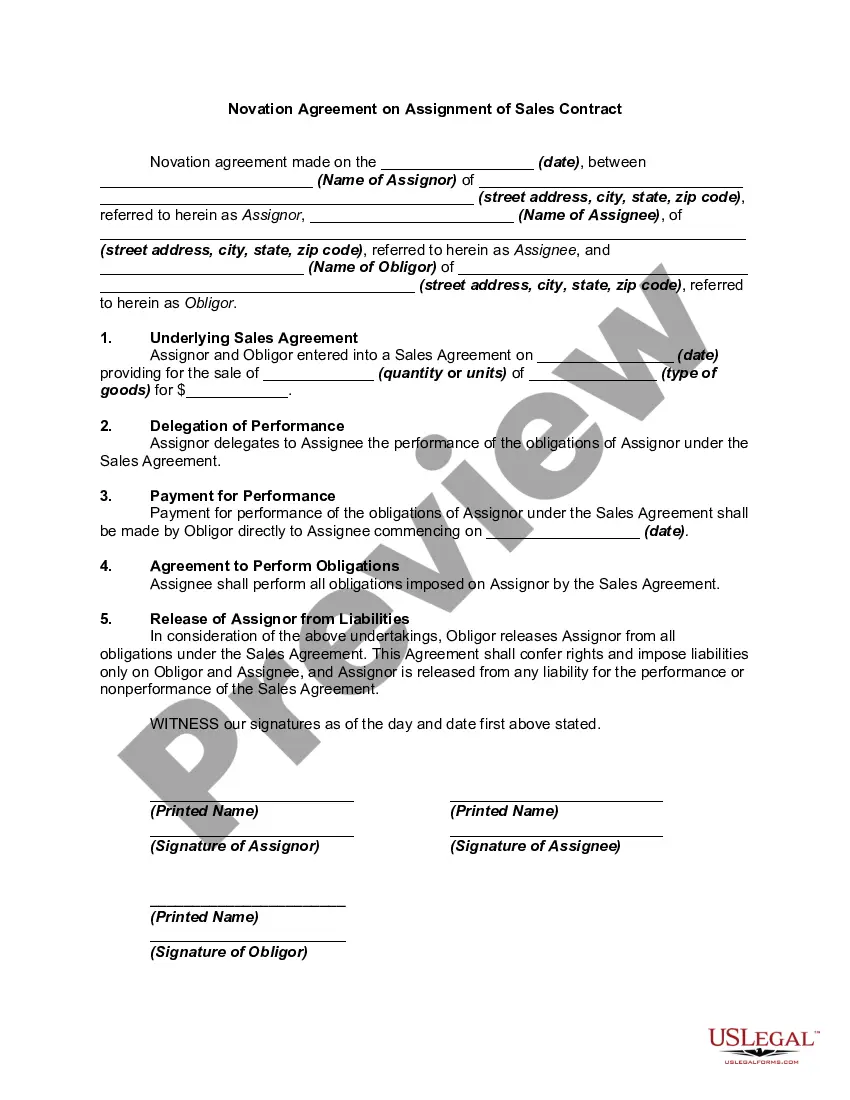

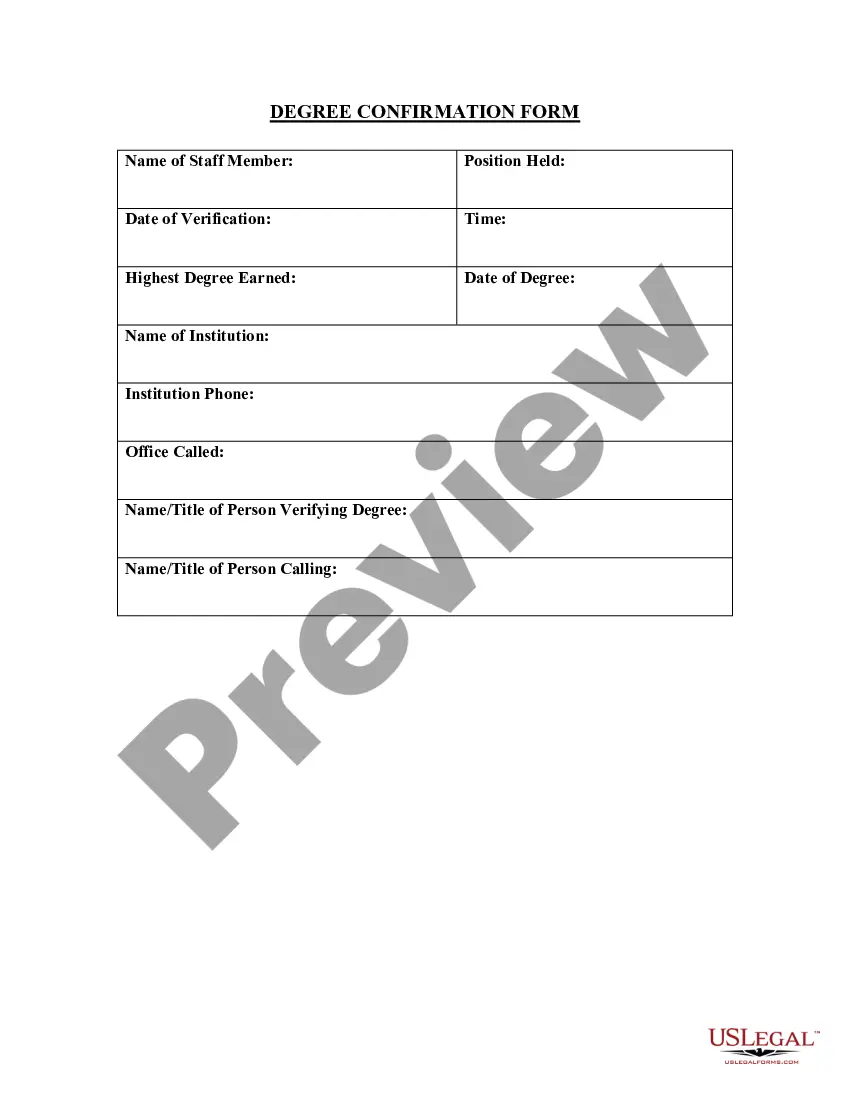

Mecklenburg North Carolina Consultant Agreement with Sharing of Software Revenues refers to a contract entered into by a consultant and a client in Mecklenburg County, North Carolina, where the consultant provides their expertise in software development or related services in exchange for a share of the software revenues. This Consultant Agreement is designed to protect both the consultant and the client's interests and outlines the terms and conditions of their collaboration. It typically includes clauses regarding the scope of services, payment terms, ownership of intellectual property rights, confidentiality, and the sharing of software revenues. One type of Mecklenburg North Carolina Consultant Agreement with Sharing of Software Revenues is the Fixed Percentage Model. In this agreement, the consultant receives a predetermined percentage of the software revenues generated by the client. The percentage can be negotiated and may vary depending on the consultant's level of contribution, involvement, and expertise. Another type is the Milestone-Based Agreement. This agreement structure involves the consultant receiving a share of revenues at specific milestones or stages of the software development process. For example, the consultant may receive a percentage of revenues upon completion and launch of the software, and additional percentages as the software achieves sales targets or reaches specific revenue thresholds. A third type of Mecklenburg North Carolina Consultant Agreement with Sharing of Software Revenues is the Royalty-Based Agreement. Here, the consultant earns a continuous stream of revenue in the form of royalties based on the sales or usage of the software. The royalty rates can be fixed or vary based on sales volumes or other predetermined factors. When entering into a Mecklenburg North Carolina Consultant Agreement with Sharing of Software Revenues, it is essential to include a comprehensive description of the services, payment terms, and revenue-sharing arrangements. The agreement should also address the prevention of unauthorized distribution or use of the software, the protection of confidential information, and the resolution of any disputes that may arise. In conclusion, Mecklenburg North Carolina Consultant Agreements with Sharing of Software Revenues are contractual arrangements between consultants and clients in Mecklenburg County, NC, where the consultant provides software-related services and receives a portion of the software revenues. The types of agreements include Fixed Percentage, Milestone-Based, and Royalty-Based, each with its own unique revenue-sharing structure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Acuerdo de consultor con participación en los ingresos del software - Consultant Agreement with Sharing of Software Revenues

Description

How to fill out Mecklenburg North Carolina Acuerdo De Consultor Con Participación En Los Ingresos Del Software?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Mecklenburg Consultant Agreement with Sharing of Software Revenues.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Mecklenburg Consultant Agreement with Sharing of Software Revenues will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Mecklenburg Consultant Agreement with Sharing of Software Revenues:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Mecklenburg Consultant Agreement with Sharing of Software Revenues on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!