Contra Costa California Consumer Credit Application is a financial document that individuals residing in Contra Costa County, California, fill out when applying for consumer credit. This application serves as a means for individuals to obtain credit from financial institutions or lenders, helping them fulfill their financial needs. The process begins by providing personal information such as full name, current address, contact information, and social security number. This aids in verifying the applicant's identity, as it is crucial for lending institutions to have accurate information to establish creditworthiness. Keywords: Contra Costa California, consumer credit, application, financial document, individuals, credit, financial institutions, lenders, personal information, full name, current address, contact information, social security number, identity, creditworthiness. There are multiple types of consumer credit applications available, catering to different needs and requirements. Some common types include: 1. Credit Card Application: This type of application is used for individuals seeking to obtain a credit card. It involves providing personal and financial information, including income, expenses, employment details, and previous credit history. Credit card applications often require individuals to indicate their preferred credit limit and provide consent for the financial institution to inquire about their credit history. 2. Auto Loan Application: Individuals interested in purchasing a vehicle can apply for an auto loan. This application typically asks for personal information, employment details, income, and expenses. The lender may also require information about the vehicle being purchased, such as make, model, and purchase price. The application will also include a section for the applicant to disclose their credit history. 3. Personal Loan Application: A personal loan application is used when individuals require funds for personal expenses, such as home renovations, education, or debt consolidation. The application process involves providing personal information, employment details, income, expenses, and the desired loan amount. Lenders may also inquire about the purpose of the loan and the applicant's credit history. 4. Mortgage Application: When applying for a home loan, individuals need to complete a mortgage application. This application is more detailed, requiring personal and financial information, employment history, income, expenses, assets, and liabilities. Additionally, applicants must provide details about the property they intend to finance, including address, purchase price, and down payment. 5. Retail Store Credit Application: Many retail stores offer credit cards to customers for convenient shopping. To apply for a retail store credit card, individuals complete an application that requires personal information, contact details, and financial information. The retailer may also include questions about shopping habits and preferences to tailor offers and promotions to the customer's needs. Keywords: Contra Costa California, consumer credit application, type, credit card application, auto loan application, personal loan application, mortgage application, retail store credit application, personal information, financial information, employment details, credit history. In summary, the Contra Costa California Consumer Credit Application is a vital document used by individuals in Contra Costa County to obtain consumer credit. It helps lenders assess an applicant's creditworthiness to determine whether to extend credit and under what terms. Various types of consumer credit applications exist, including those for credit cards, auto loans, personal loans, mortgages, and retail store credit. Each application requires specific information relevant to the type of credit being sought, ensuring lenders have a comprehensive understanding of the applicant's financial situation.

Contra Costa California Consumer Credit Application

Description

How to fill out Contra Costa California Consumer Credit Application?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Contra Costa Consumer Credit Application, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Contra Costa Consumer Credit Application from the My Forms tab.

For new users, it's necessary to make several more steps to get the Contra Costa Consumer Credit Application:

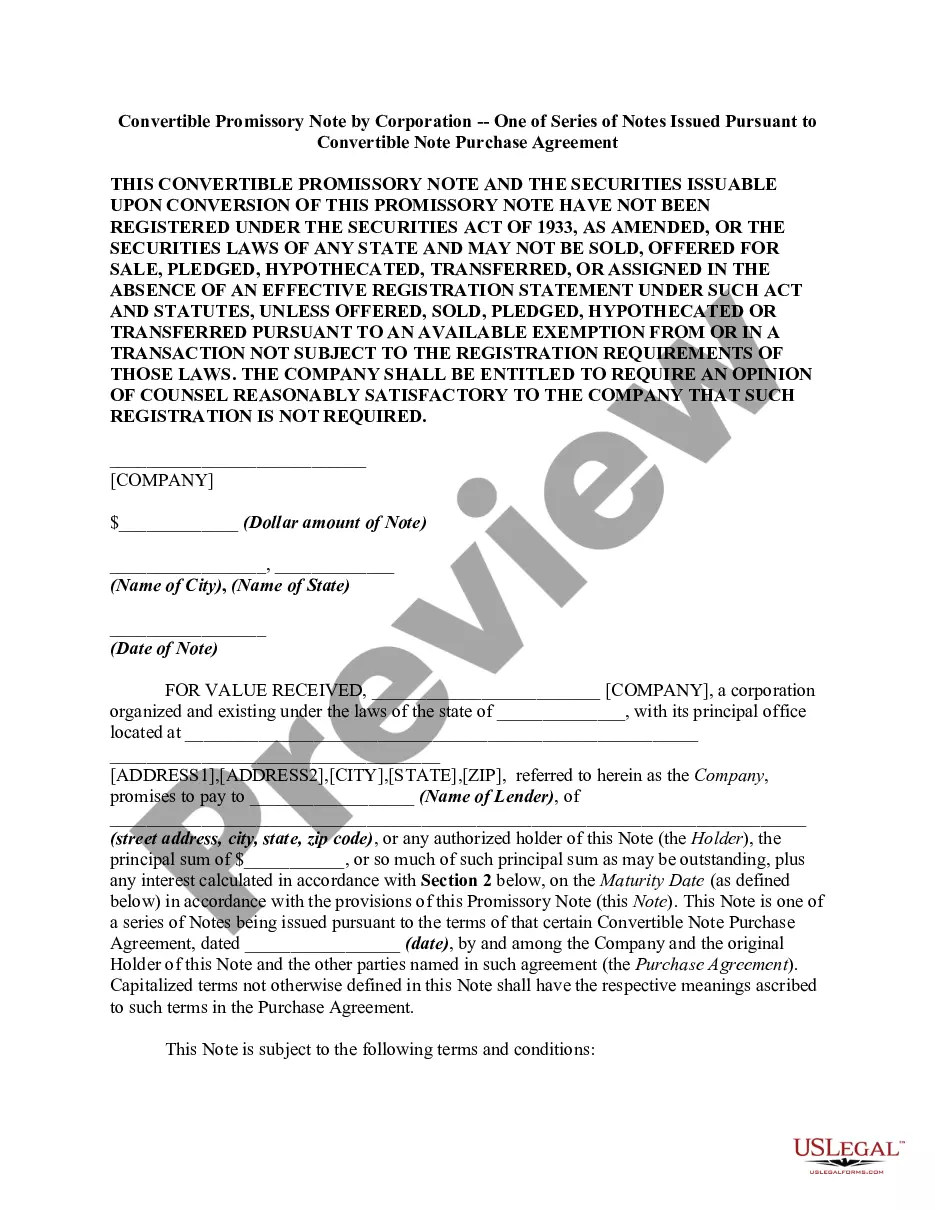

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!