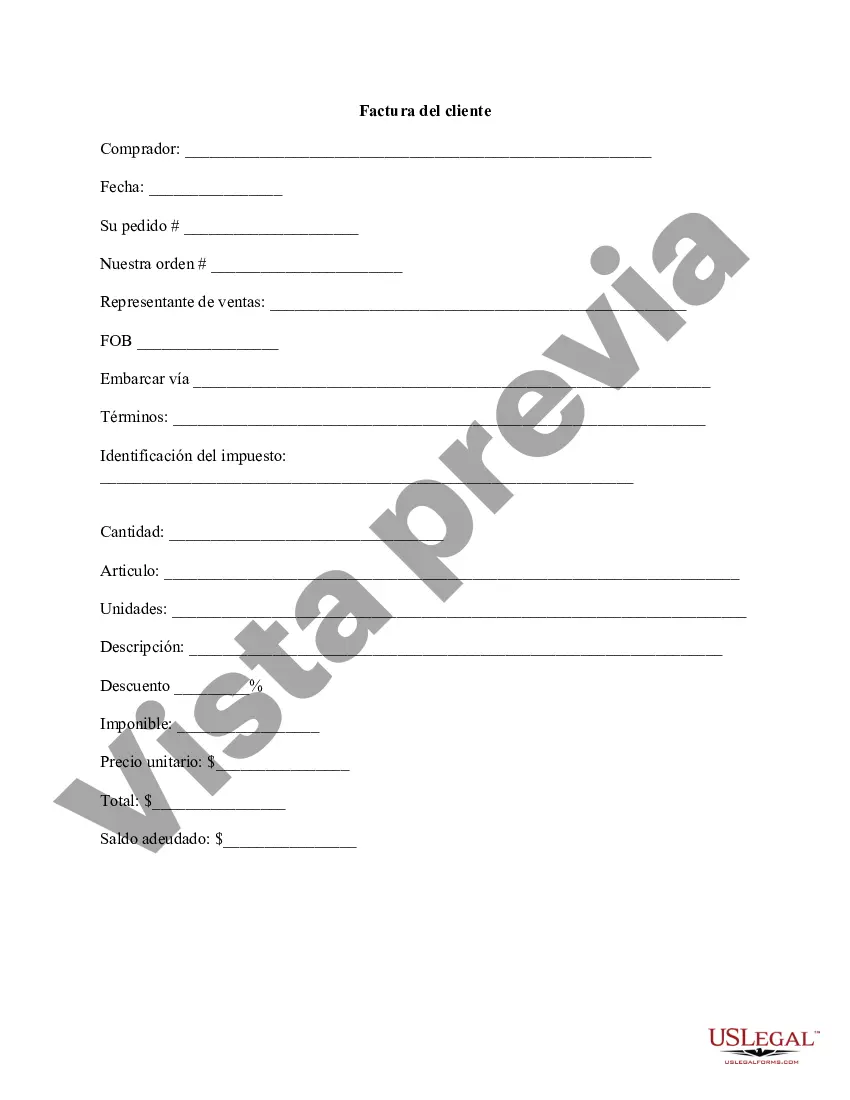

King Washington Customer Invoice is a comprehensive document that provides a detailed breakdown of the cost and charges associated with a transaction between King Washington and its customers. This invoice is an essential tool for both parties as it allows for transparent and accurate accounting of goods or services provided. The King Washington Customer Invoice typically includes important information such as: 1. Invoice number: A unique identifier assigned to each invoice for easy reference and tracking. 2. Date: The date on which the invoice is issued. 3. Customer details: The name, address, and contact information of the customer receiving the invoice. 4. King Washington details: The name, address, and contact information of King Washington. 5. Product or service description: A detailed breakdown of the goods or services provided, including quantity, unit price, and any applicable discounts or taxes. 6. Subtotal: The total cost of the products or services before any additional charges or taxes are applied. 7. Taxes: Any applicable taxes, such as sales tax or value-added tax, included in the total cost. 8. Shipping and handling charges: Any additional charges associated with shipping, packaging, or handling of the products. 9. Discounts or promotions: Any discounts or promotions applied to the invoice amount. 10. Total amount due: The final amount that the customer is required to pay, including all costs, taxes, and additional charges. There may be different types of King Washington Customer Invoices depending on the specific transaction or business model. Some of these types include: 1. Product invoice: When King Washington sells physical products to its customers, a product invoice is issued, itemizing the individual products purchased and their respective costs. 2. Service invoice: In cases where King Washington provides services to its customers, a service invoice is generated, detailing the type of service rendered and the associated charges. 3. Subscription invoice: If King Washington offers subscription-based services or products, a recurring invoice is generated periodically, outlining the subscription details along with the recurring charges. 4. Credit invoice: In the event of returns, refunds, or adjustments to a previous invoice, a credit invoice may be issued to update the customer's account accordingly. Overall, King Washington Customer Invoice serves as a crucial tool for both King Washington and its customers, ensuring transparency, accurate financial records, and facilitating smooth business transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Factura del cliente - Customer Invoice

Description

How to fill out King Washington Factura Del Cliente?

Are you looking to quickly draft a legally-binding King Customer Invoice or maybe any other form to manage your own or corporate matters? You can go with two options: contact a professional to write a valid document for you or create it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you receive professionally written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including King Customer Invoice and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, double-check if the King Customer Invoice is tailored to your state's or county's regulations.

- In case the form comes with a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the King Customer Invoice template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!