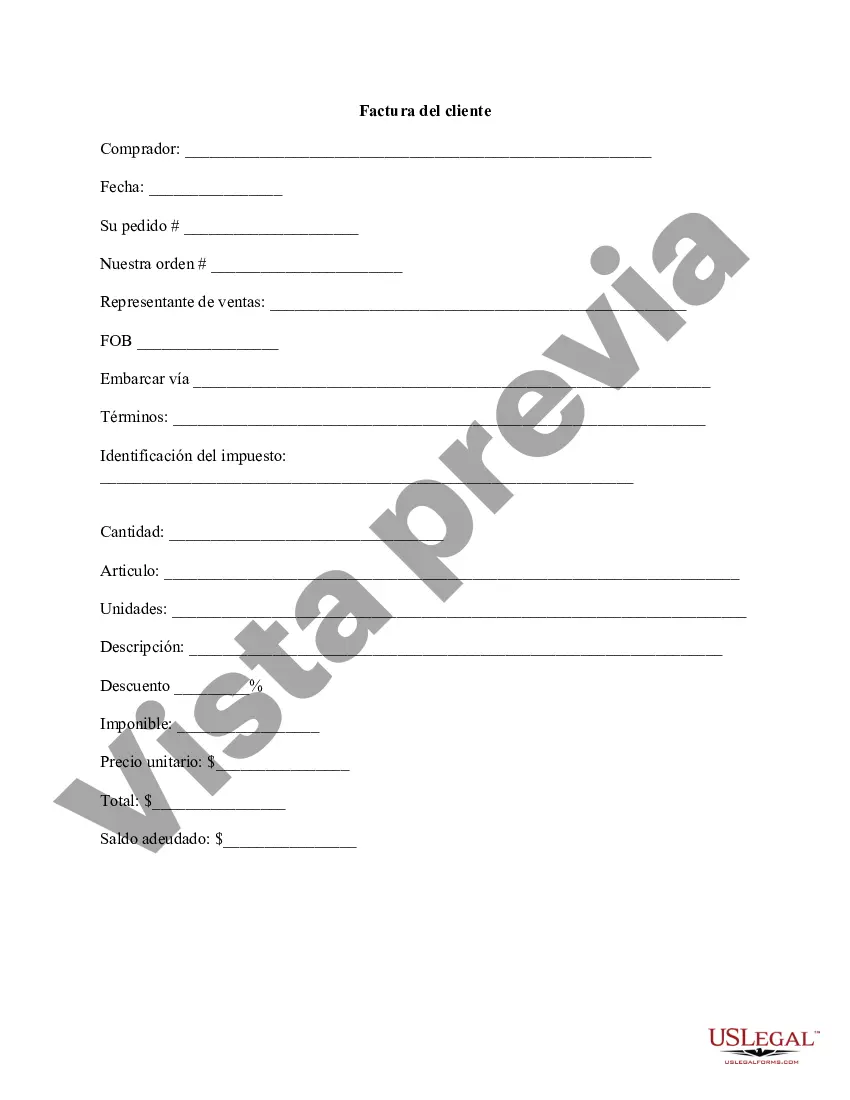

A Los Angeles California customer invoice is a formal document that outlines the details of a commercial transaction between a seller or service provider and their customer in the city of Los Angeles, California. It serves as a record of the goods or services provided, their quantity or duration, and the total amount owed by the customer. Keywords: Los Angeles California, customer invoice, detailed description, commercial transaction, seller, service provider, goods, services, quantity, duration, total amount, customer. Types of Los Angeles California customer invoices may include: 1. Retail Sales Invoices: These are issued by businesses that sell goods directly to customers in Los Angeles, California. They typically include details such as the itemized list of products purchased, unit prices, quantities, any applicable discounts, sales tax, and the final total. 2. Service Invoices: These types of invoices are used by service-based businesses operating in Los Angeles, California. They document the services provided, their duration or hourly rates, any additional fees or expenses, and the total payable amount. 3. Rental Invoices: Rental businesses in Los Angeles, California, such as car rental companies or equipment rental services, generate rental invoices. These invoices specify the rental period, daily or hourly rates, optional equipment charges, and any additional fees like insurance or fuel costs. 4. Freelancer Invoices: Freelancers or independent contractors in Los Angeles, California, utilize invoices to bill their clients for the services they provide. These invoices include details such as the specific tasks completed, the agreed-upon rate or project fee, the number of hours worked, and any applicable taxes. 5. Subscription Invoices: Companies in Los Angeles, California, that offer subscription-based services, like streaming platforms, subscription boxes, or memberships, issue subscription invoices. These invoices often specify the subscription duration, pricing tiers or plans, renewal dates, and any applicable taxes or fees. 6. Commercial Invoices: Businesses engaged in international trade in Los Angeles, California, must provide commercial invoices. These invoices accompany shipments and include details regarding the products being exported, their quantity, unit prices, total value, and any customs or trade-related information required for importing the goods. By using these relevant keywords and providing examples of different types of Los Angeles California customer invoices, this content aims to deliver a detailed description of what these invoices entail and the variations based on specific business types and industries within the city.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Factura del cliente - Customer Invoice

Description

How to fill out Los Angeles California Factura Del Cliente?

Drafting papers for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Los Angeles Customer Invoice without professional assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Los Angeles Customer Invoice on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Los Angeles Customer Invoice:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!