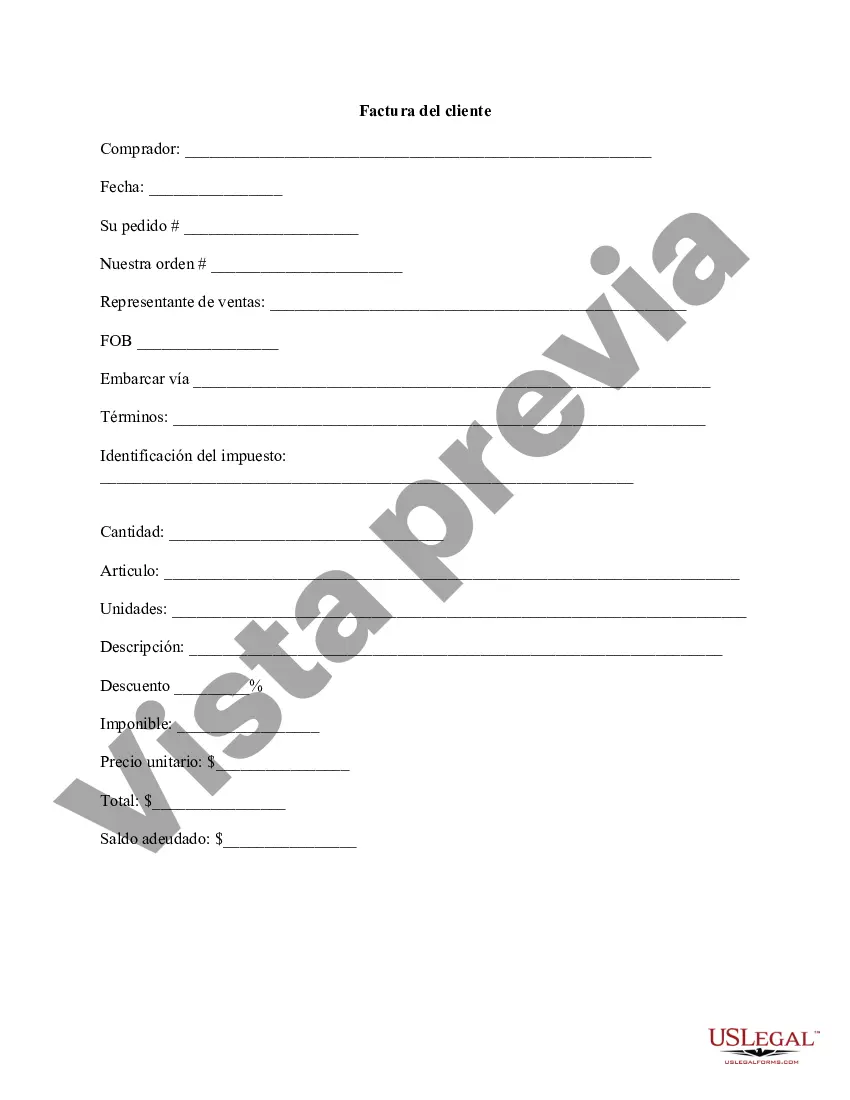

Montgomery Maryland Customer Invoice is a legal document that serves as a formal request for payment from a customer to a business in Montgomery County, Maryland. This invoice provides a detailed breakdown of the goods or services provided by the business along with the corresponding costs. The invoice includes important elements such as the customer's name, address, contact details, the invoice number, date, and payment terms. In Montgomery Maryland, there are various types of customer invoices used by businesses based on their specific requirements. Some common types include: 1. Standard Invoice: This is the most common type of invoice used in Montgomery Maryland. It contains all the essential details about the transaction, including the customer's information, itemized list of goods or services provided, quantities, unit prices, applicable taxes, discounts, and the total amount to be paid. 2. Recurring Invoice: Used for regular or subscription-based services, recurring invoices are used when businesses provide goods or services on a repeated basis, such as monthly or annually. These invoices typically mention the frequency and duration of the service, making it easier for customers to make regular payments. 3. Proforma Invoice: Proforma invoices are used before the actual sale takes place. They provide an estimate of the costs and quantities involved in a potential transaction. These invoices serve as a preliminary bill to help customers understand the anticipated expenses and make informed decisions. 4. Credit Invoice: A credit invoice is issued by the business when there is a need for adjustment or refund. It is often used when customers return goods, cancel orders, or if there is an error in the original invoice. The credit invoice mentions the original invoice number, date, and provides a negative amount to offset the payment. Businesses in Montgomery Maryland use these customer invoice types to effectively manage their billing processes, maintain proper records, and ensure timely payments from their customers. Adhering to standard invoicing practices helps create transparency and fosters smooth financial transactions between businesses and customers in Montgomery, Maryland.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Factura del cliente - Customer Invoice

Description

How to fill out Montgomery Maryland Factura Del Cliente?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Montgomery Customer Invoice without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Montgomery Customer Invoice by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Montgomery Customer Invoice:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!