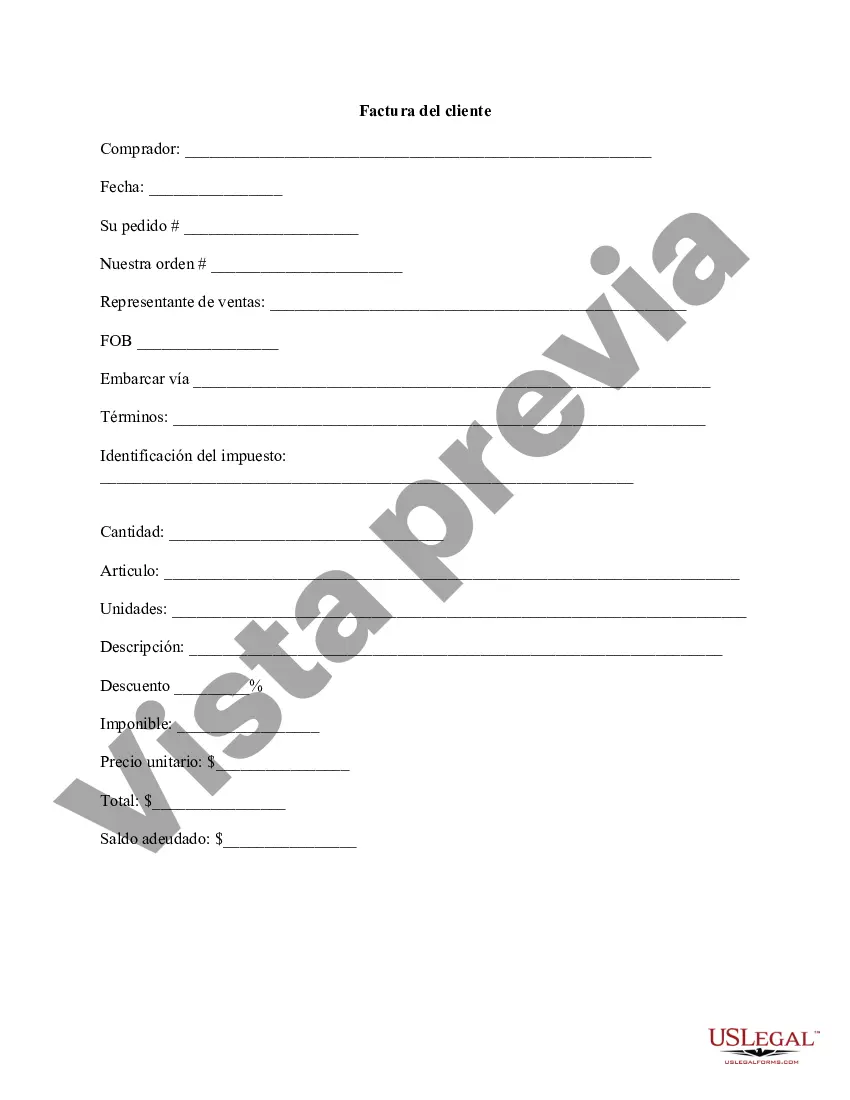

A San Diego California Customer Invoice is a comprehensive document that serves as a billing statement issued by a business in the city of San Diego, California. It outlines the details of products or services provided to a customer along with the corresponding charges. This invoice is both a record of the transaction and a formal request for payment from the customer. Keywords: San Diego, California, customer invoice, billing statement, products, services, charges, transaction, payment. There can be several types of San Diego California Customer Invoices, each with its own purpose and format. Some of these include: 1. Sales Invoice: This type of invoice is used to bill customers for products or goods sold. It includes details such as item descriptions, quantities, unit prices, and any applicable taxes or discounts. 2. Service Invoice: A service invoice is issued when a business provides services to a customer. It covers charges for labor, consultation fees, or any other services rendered. It may also include any additional expenses incurred during the service provision. 3. Recurring Invoice: Businesses that offer subscription-based services or have ongoing contracts with customers often use recurring invoices. These invoices are automatically generated at specific intervals, such as monthly or annually, to bill for recurring charges. 4. Credit Invoice: In cases where customers are entitled to a refund or credit adjustment, a credit invoice is issued. It reverses a previous invoice's charges, reducing the customer's outstanding balance or providing a credit note for future purchases. 5. Proforma Invoice: This type of invoice is commonly used before a transaction occurs as a way to provide the customer with a detailed estimate of costs, including products or services, quantities, prices, and any applicable taxes or discounts. It serves as a reference point for the final invoice. 6. Past Due Invoice: If a customer fails to make a payment within the agreed-upon timeframe, a past due invoice is generated. It includes a reminder of the outstanding balance, any late fees, or penalties. 7. Progress Invoice: Progress invoices are often used in construction projects or long-term service contracts. They allow businesses to bill customers incrementally as stages or milestones are completed. These invoices track the progress of the project and help ensure timely payment. By utilizing the relevant keywords and providing detailed descriptions of each type, this content aims to give an in-depth understanding of what a San Diego California Customer Invoice entails.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Factura del cliente - Customer Invoice

Description

How to fill out San Diego California Factura Del Cliente?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from the ground up, including San Diego Customer Invoice, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities related to paperwork completion simple.

Here's how to purchase and download San Diego Customer Invoice.

- Go over the document's preview and description (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Examine the related forms or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and purchase San Diego Customer Invoice.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed San Diego Customer Invoice, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional entirely. If you need to cope with an exceptionally complicated case, we recommend using the services of a lawyer to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific paperwork effortlessly!