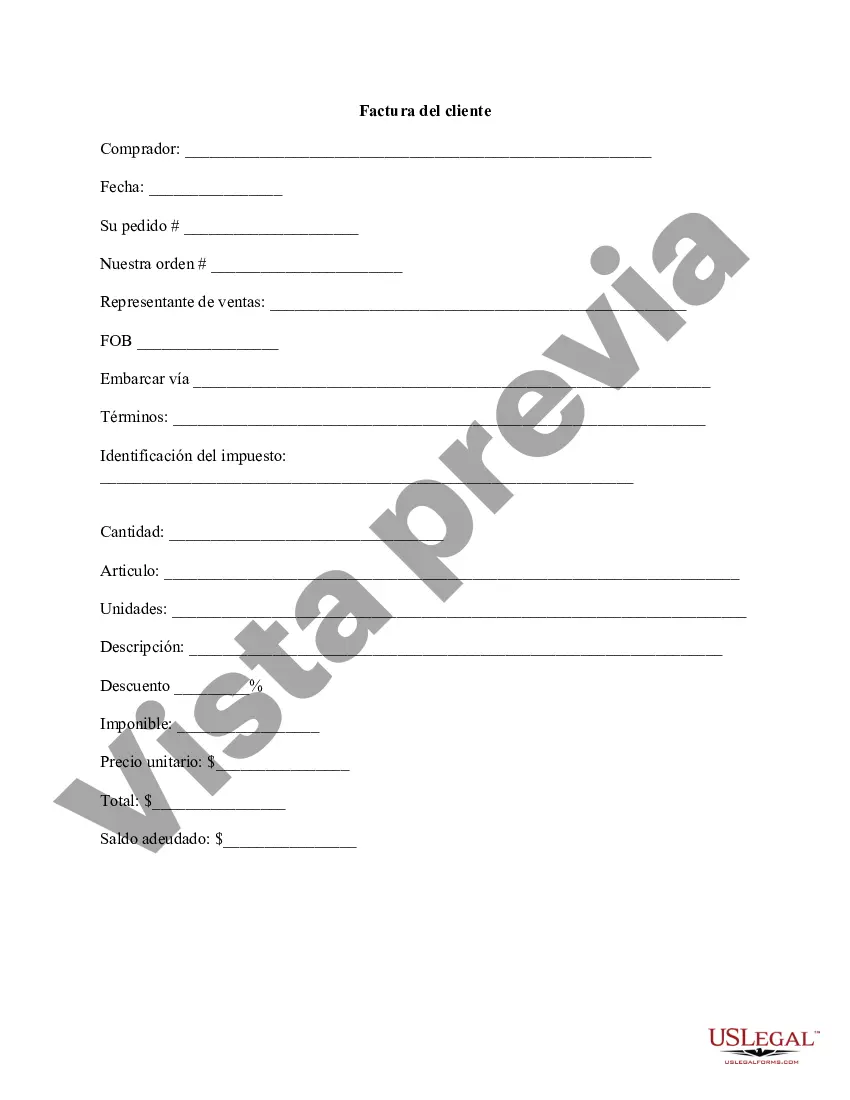

Travis Texas Customer Invoice is a document that outlines the details of a transaction between the Travis Texas company and its customers. It serves as an official record of the products or services provided, along with the corresponding charges and payment terms. This invoice plays a crucial role in facilitating a transparent and organized billing process. The Travis Texas Customer Invoice typically contains various key elements. Firstly, it includes the company's logo, name, and contact information, making it easily identifiable for both the customer and Travis Texas representatives. The customer's details, such as their name, address, and contact information, are also specified prominently on the invoice. The invoice further incorporates an invoice number, date, and the due date, which clearly indicates the timeline for payment submission. This helps avoid any confusion and ensures timely payments. The payment terms, including acceptable payment methods such as credit card, bank transfer, or check, are specified as well. A detailed breakdown of the products or services provided is an essential part of the Travis Texas Customer Invoice. Each item is listed individually, accompanied by relevant details like item description, quantity, unit price, and the total amount. This breakdown aids customers in understanding the charges and verifying their accuracy. In addition to the basic invoice elements, Travis Texas may have different types of customer invoices to meet specific requirements. Some variations could include: 1. Regular Invoice: This is the most common type of invoice where customers are billed for their purchases or services rendered by Travis Texas. 2. Proforma Invoice: This document is issued before the completion of a transaction, serving as a preliminary invoice that outlines the estimated costs. It assists customers in budgeting and provides them with an overview of the expected charges. 3. Credit Invoice: In cases where a refund or credit needs to be issued to the customer, a credit invoice is generated. It details the previous transaction, reasons for credit, and the adjusted balance. 4. Recurring Invoice: For recurring charges such as subscriptions or contracts, Travis Texas may use a recurring invoice that is automatically generated at predetermined intervals, reminding customers of upcoming payments. 5. Prepayment Invoice: This type of invoice is utilized whenever Travis Texas requires customers to make a payment in advance, often for customized or specialized orders. By consistently providing clear, well-structured, and accurate invoices, Travis Texas ensures transparency, ease of payment, and builds trust in its customer relationships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Factura del cliente - Customer Invoice

Description

How to fill out Travis Texas Factura Del Cliente?

Do you need to quickly create a legally-binding Travis Customer Invoice or maybe any other form to manage your own or corporate affairs? You can select one of the two options: hire a professional to draft a valid document for you or create it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant form templates, including Travis Customer Invoice and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, double-check if the Travis Customer Invoice is adapted to your state's or county's regulations.

- If the document comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Travis Customer Invoice template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we provide are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!