Fairfax Virginia Notice of Default on Promissory Note Installment is a legal document issued to inform a borrower in Fairfax, Virginia, about their failure to make timely payments on a promissory note installment. This notice serves as a warning of potential legal actions that may be taken by the lender if the default is not rectified promptly. It is essential for borrowers to understand the consequences of defaulting on their promissory note installment agreements. There are several types of Fairfax Virginia Notice of Default on Promissory Note Installment, including: 1. Preliminary Notice of Default: This initial notice is sent by the lender when the borrower misses their first payment or exhibits consistent delays in making payments. It outlines the outstanding amount, late fees, and provides a grace period for the borrower to rectify the default. 2. Final Notice of Default: When the borrower fails to resolve the payment default within the grace period provided in the preliminary notice, the lender issues a final notice. It states the total amount due, including accumulated interest, penalties, and any other charges incurred. This notice warns the borrower of potential legal actions that may be taken, such as foreclosure or seizing collateral if applicable. 3. Intent to Accelerate Notice: If the borrower fails to fulfill their obligations even after receiving a final notice, the lender issues an intent to accelerate notice. This notice demands immediate full payment of the remaining loan balance, often within a specified timeframe, failing which the lender may pursue legal remedies. 4. Notice of Sale: If all attempts for resolution fail, the lender may proceed with legal proceedings, including foreclosure. A notice of sale is issued, informing the borrower about the scheduled auction or sale of the collateral, such as a property or asset pledged as security for the promissory note. 5. Reinstatement Notice: In some cases, a borrower may be given an opportunity to cure the default and reinstate the loan by paying the overdue amount, including any additional charges. A reinstatement notice outlines the necessary steps and deadline for reinstatement. It is crucial for both lenders and borrowers in Fairfax, Virginia, to adhere to the legal obligations and procedures outlined in the Fairfax Virginia Notice of Default on Promissory Note Installment to protect their rights and interests. Prompt action and open communication between parties can often lead to mutually beneficial resolutions, minimizing the potential negative consequences associated with defaulting on promissory note installments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Notificación de Incumplimiento de Cuota de Pagaré - Notice of Default on Promissory Note Installment

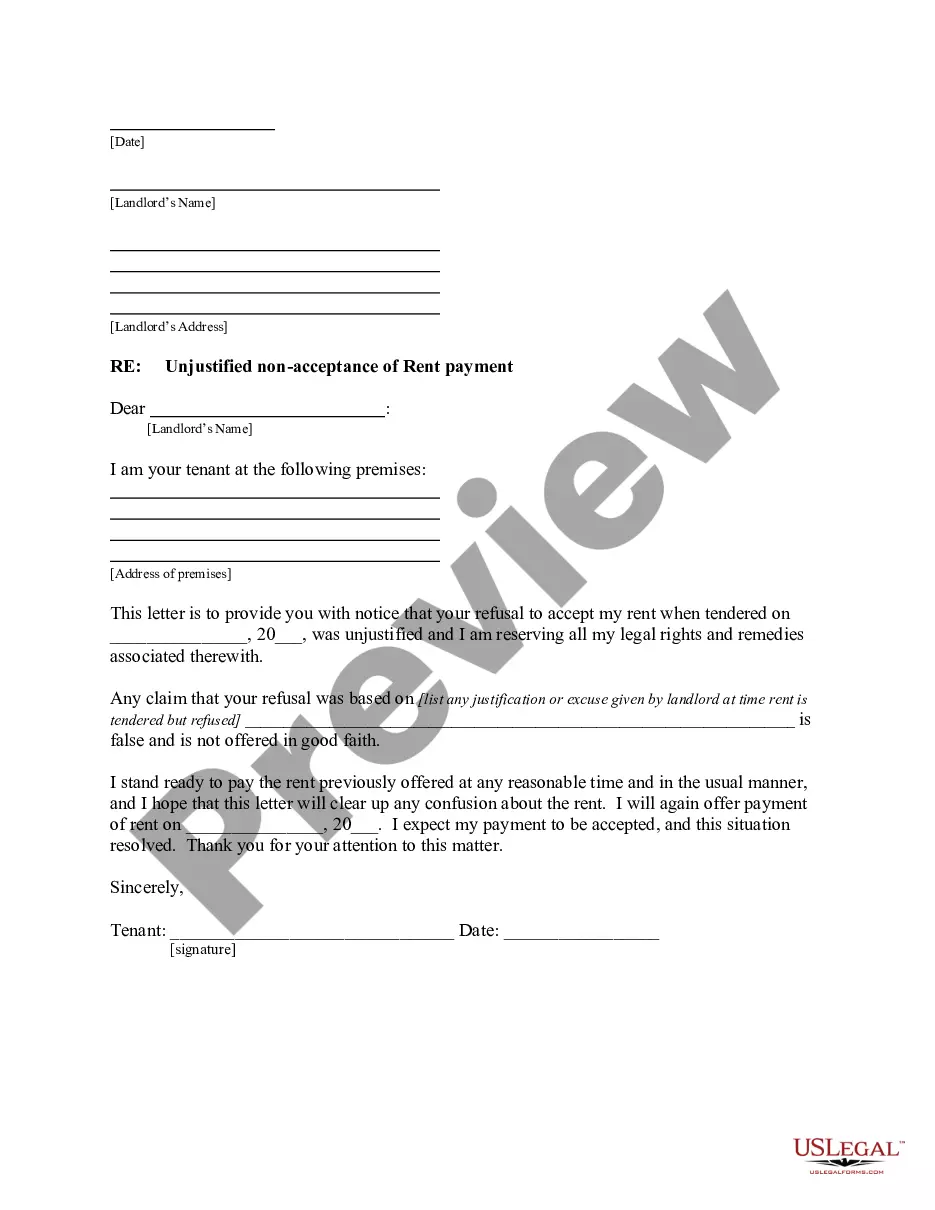

Description

How to fill out Fairfax Virginia Notificación De Incumplimiento De Cuota De Pagaré?

Draftwing forms, like Fairfax Notice of Default on Promissory Note Installment, to manage your legal affairs is a difficult and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents created for different scenarios and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Fairfax Notice of Default on Promissory Note Installment form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Fairfax Notice of Default on Promissory Note Installment:

- Make sure that your document is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Fairfax Notice of Default on Promissory Note Installment isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!