Nassau County in New York State is home to various legal processes related to promissory notes, including the Notice of Default on Promissory Note Installment. This document serves as an official notification to the borrower that they have defaulted on their installment payment obligations according to the terms outlined in the promissory note. The following are some important keywords relevant to this topic: 1. Nassau County: Located on Long Island, New York, Nassau County is known for its vibrant communities and legal processes concerning various financial matters. 2. Notice of Default: A formal communication sent to a borrower, indicating their failure to meet the financial obligations stated in a promissory note. 3. Promissory Note: A legally binding document outlining the terms and conditions of a loan, including repayment terms and interest rates, signed by the borrower and lender. 4. Installment: A scheduled payment made by a borrower towards the principal amount and interest of the loan over a specified period. It is worth noting that the specific types of Nassau New York Notice of Default on Promissory Note Installment may vary depending on the nature of the loan agreement and the circumstances of default. However, they usually share a common goal of notifying the borrower of their default and detailing the necessary actions to be taken to rectify the situation. Some possible types of Notice of Default on Promissory Note Installment in Nassau County, New York, could include: 1. Residential Mortgage Notice of Default: Pertaining to defaults on residential mortgage loans. 2. Commercial Loan Notice of Default: Applicable when borrowers default on commercial loans used for business and commercial real estate purposes. 3. Personal Loan Notice of Default: For cases where individuals default on personal loans from banks or individuals. 4. Student Loan Notice of Default: Concerning defaults on educational loans, often provided by government or private lending institutions. In each case, the Notice of Default serves as an initial step in the legal process to address the borrower's non-compliance with the terms of repayment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Notificación de Incumplimiento de Cuota de Pagaré - Notice of Default on Promissory Note Installment

Description

How to fill out Nassau New York Notificación De Incumplimiento De Cuota De Pagaré?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Nassau Notice of Default on Promissory Note Installment is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Nassau Notice of Default on Promissory Note Installment. Adhere to the guidelines below:

- Make sure the sample fulfills your individual needs and state law regulations.

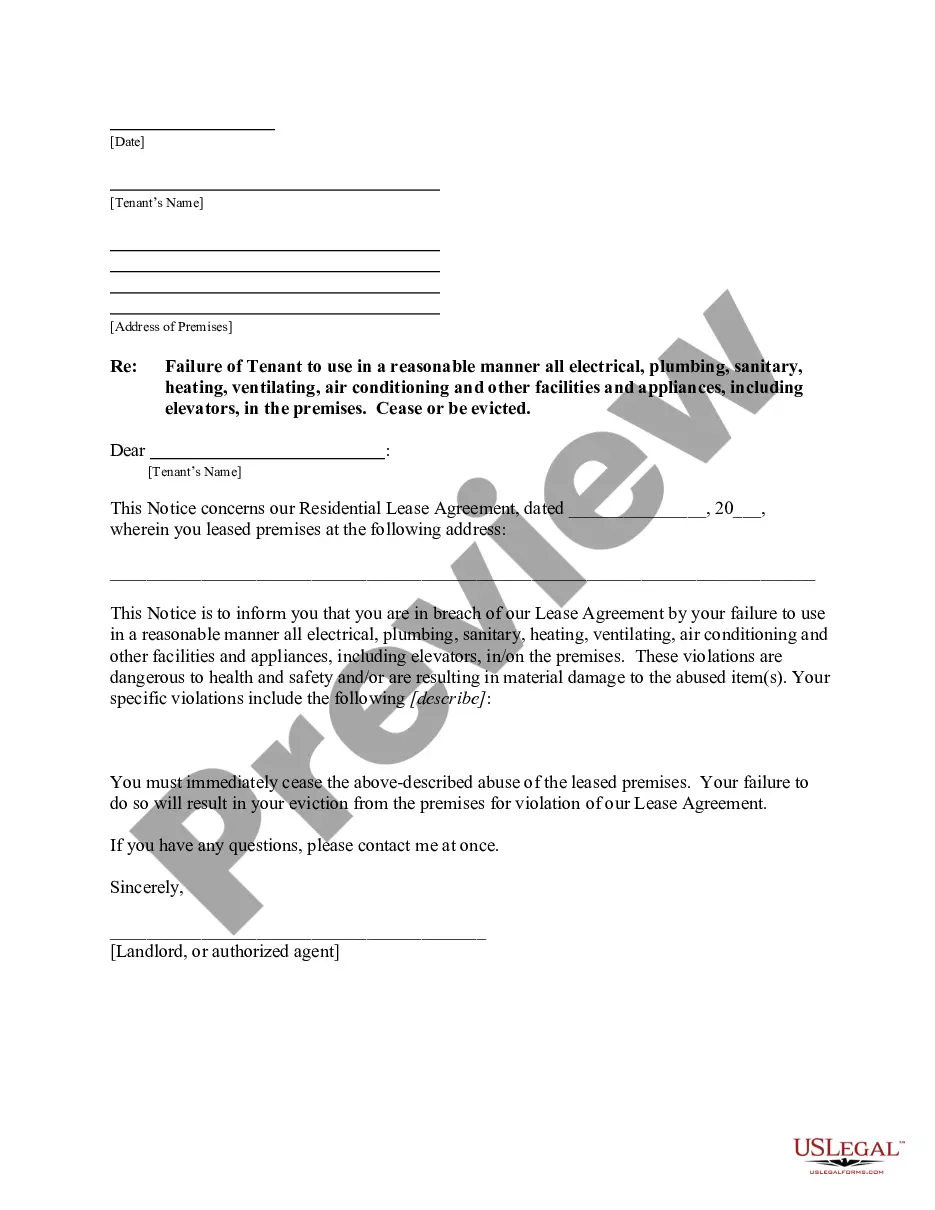

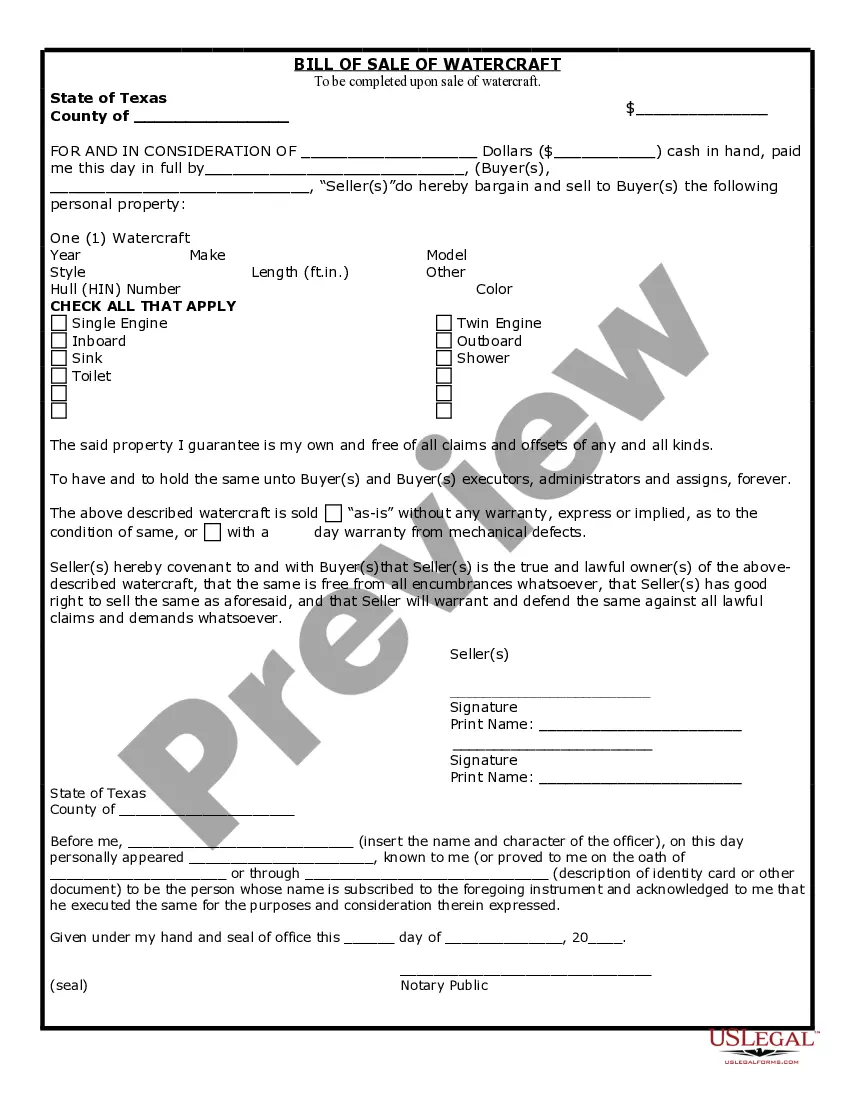

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Notice of Default on Promissory Note Installment in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!