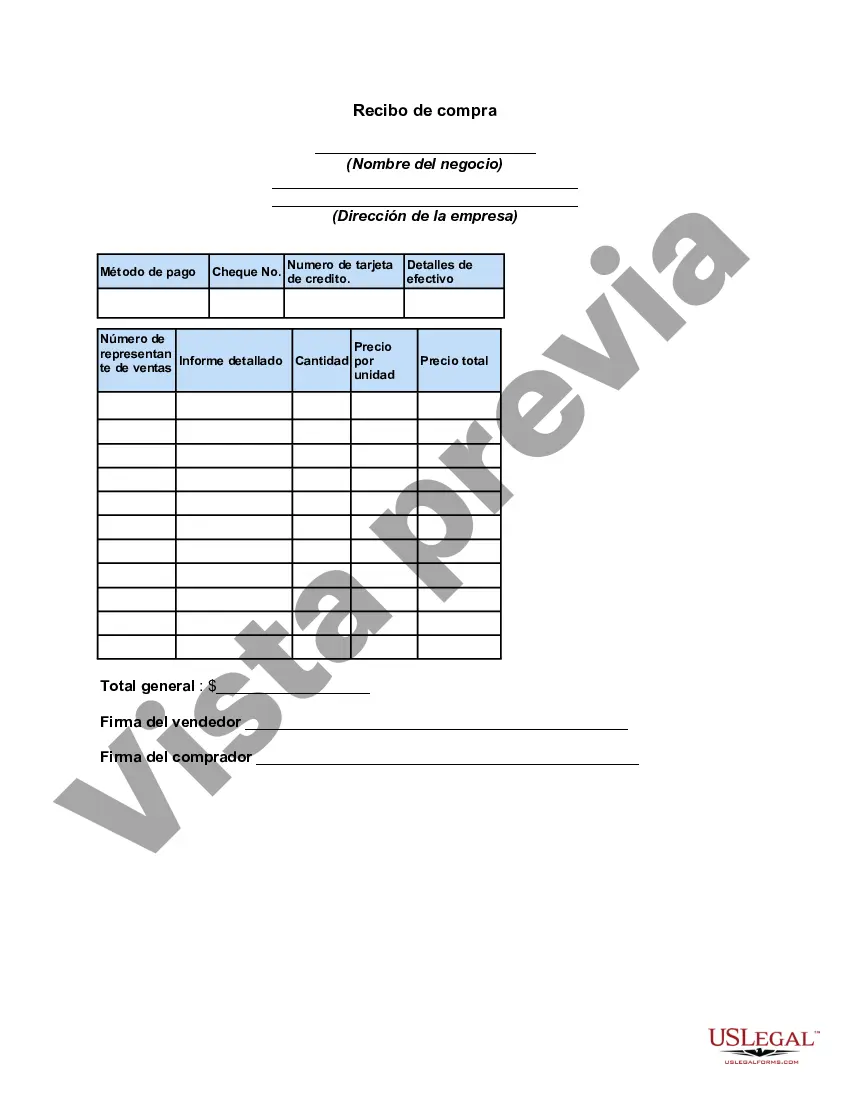

Fairfax Virginia Sales Receipt is a document provided to customers as proof of purchase for goods or services acquired in Fairfax, Virginia. It contains vital information such as the date and time of purchase, the name and address of the business, a list of items or services purchased, individual prices, applicable taxes, payment details, and any relevant discounts or promotions. The Fairfax Virginia Sales Receipt serves multiple purposes. Firstly, it helps customers keep track of their expenses for personal or business purposes, enabling them to maintain accurate records and facilitate budgeting or taxation needs. Secondly, it provides evidence of purchase, which can be essential for warranty claims, returns, or exchanges of goods. Moreover, sales receipts are also valuable for businesses, as they aid in inventory management, bookkeeping, and tracking sales trends. There are various types of Fairfax Virginia Sales Receipts depending on the nature of the business or industry. Some common types may include: 1. Retail Sales Receipt: This type of receipt is issued by retail stores and typically includes the details of the purchased products, the subtotal, any applicable taxes, and the final total amount paid by the customer. It also might include store information, return policies, and customer service contacts. 2. Restaurant Sales Receipt: Restaurants issue sales receipts that outline the ordered items (food and beverages), their quantities, individual prices, any additional charges like service fees or gratuities, and the overall total. These receipts may also include the name and contact details of the restaurant. 3. Service Sales Receipt: Businesses offering services such as car repairs, hair salons, or consulting firms provide service sales receipts. These receipts typically indicate the type of service rendered, hours worked, hourly rates or fixed fees, and any applicable taxes. They might also include the business's contact information and a description of the services performed. 4. Online Sales Receipt: With the rise of e-commerce, online sales receipts have become prevalent. These receipts are generated digitally and emailed to customers upon the completion of an online purchase. They contain similar information to traditional sales receipts but may also include order numbers, shipping addresses, and tracking information. Each type of Fairfax Virginia Sales Receipt, regardless of the industry or business, plays a vital role in maintaining accurate financial records, providing transparency, and ensuring customer satisfaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Recibo de compra - Sales Receipt

Description

How to fill out Fairfax Virginia Recibo De Compra?

Creating documents, like Fairfax Sales Receipt, to take care of your legal matters is a challenging and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms crafted for different scenarios and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Fairfax Sales Receipt form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Fairfax Sales Receipt:

- Make sure that your form is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Fairfax Sales Receipt isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!