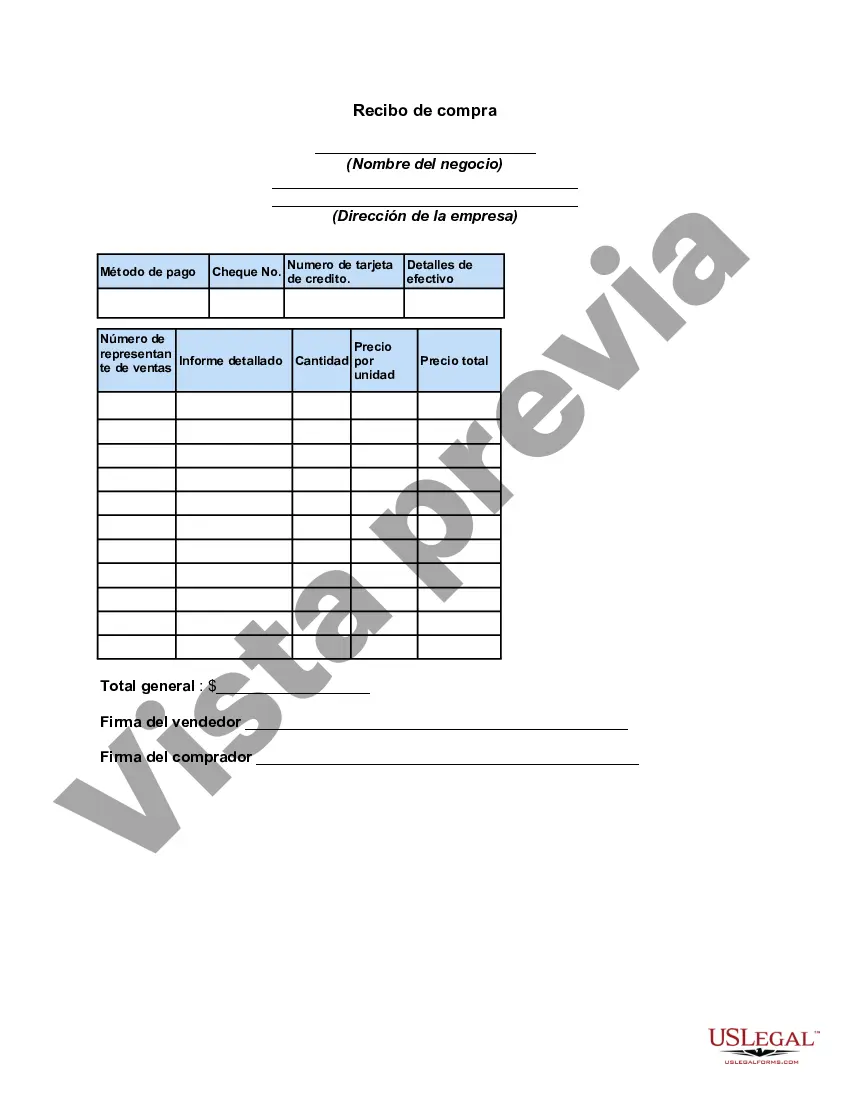

Miami-Dade Florida Sales Receipt is a document provided to customers as proof of purchase for goods or services in Miami-Dade County, Florida. It serves as evidence of a transaction and contains crucial information regarding the sale. This description will outline the key components of a typical Miami-Dade Florida Sales Receipt and highlight any specific types that may exist. 1. Title and Logo: A Miami-Dade Florida Sales Receipt typically starts with a clear title stating "Sales Receipt" along with the official county logo, demonstrating its authenticity. 2. Vendor Details: The receipt includes the vendor's essential information such as business name, address, contact details, and tax identification number. This aids in identifying the seller for any future communication or issues. 3. Customer Information: The receipt also includes the customer's details, including their name, address, and contact information. This helps in maintaining a record of the purchaser and can be used for verification or future communication if required. 4. Transaction Details: This section provides comprehensive information about the transaction, including the date and time of purchase, a unique receipt number, and the method of payment used (cash, credit card, etc.). It may also include the salesperson's name or an employee identification number. 5. Itemized List: The receipt contains an itemized list of all the goods or services purchased. Each item is typically accompanied by a description, quantity, unit price, and subtotal. This breakdown ensures transparency and helps both the buyer and seller understand the specifics of the transaction. 6. Tax Information: As per Miami-Dade County regulations, the applicable sales taxes are included in the receipt. It specifies the tax rate, total tax amount charged, and how it is calculated. This information is crucial for tax purposes and ensures compliance with local laws. 7. Total Amount and Payment Summary: The receipt provides a total amount payable, including the subtotal of all items purchased, taxes, discounts (if any), and the final grand total. It also highlights the payment method used, mentioning if it was cash, credit card, check, or any other means. 8. Additional Notes or Terms: Some Miami-Dade Florida Sales Receipts may include space for additional notes, special instructions, or terms related to the purchase. This section can be used to communicate warranty details, return policies, or any other necessary information. Different types of Miami-Dade Florida Sales Receipt may include specific variations tailored for certain industries or businesses. For instance, there might be specialized receipts for restaurants (highlighting food and beverages), retail stores (listing individual products), or service-based establishments (noting provided services). Each type aims to provide accurate and detailed information relevant to its industry while complying with the legal requirements set by the county. In conclusion, a Miami-Dade Florida Sales Receipt is a crucial document that safeguards the interests of both buyers and sellers. It accurately summarizes a transaction, providing clear information about the goods or services purchased, taxes applied, and payment details. By maintaining a comprehensive record of sales, these receipts assist businesses in managing their accounts and fulfilling legal obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Recibo de compra - Sales Receipt

State:

Multi-State

County:

Miami-Dade

Control #:

US-02929BG

Format:

Word

Instant download

Description

A sales receipt is basically a document that contains all the summarized particulars of the sales transactions.

Miami-Dade Florida Sales Receipt is a document provided to customers as proof of purchase for goods or services in Miami-Dade County, Florida. It serves as evidence of a transaction and contains crucial information regarding the sale. This description will outline the key components of a typical Miami-Dade Florida Sales Receipt and highlight any specific types that may exist. 1. Title and Logo: A Miami-Dade Florida Sales Receipt typically starts with a clear title stating "Sales Receipt" along with the official county logo, demonstrating its authenticity. 2. Vendor Details: The receipt includes the vendor's essential information such as business name, address, contact details, and tax identification number. This aids in identifying the seller for any future communication or issues. 3. Customer Information: The receipt also includes the customer's details, including their name, address, and contact information. This helps in maintaining a record of the purchaser and can be used for verification or future communication if required. 4. Transaction Details: This section provides comprehensive information about the transaction, including the date and time of purchase, a unique receipt number, and the method of payment used (cash, credit card, etc.). It may also include the salesperson's name or an employee identification number. 5. Itemized List: The receipt contains an itemized list of all the goods or services purchased. Each item is typically accompanied by a description, quantity, unit price, and subtotal. This breakdown ensures transparency and helps both the buyer and seller understand the specifics of the transaction. 6. Tax Information: As per Miami-Dade County regulations, the applicable sales taxes are included in the receipt. It specifies the tax rate, total tax amount charged, and how it is calculated. This information is crucial for tax purposes and ensures compliance with local laws. 7. Total Amount and Payment Summary: The receipt provides a total amount payable, including the subtotal of all items purchased, taxes, discounts (if any), and the final grand total. It also highlights the payment method used, mentioning if it was cash, credit card, check, or any other means. 8. Additional Notes or Terms: Some Miami-Dade Florida Sales Receipts may include space for additional notes, special instructions, or terms related to the purchase. This section can be used to communicate warranty details, return policies, or any other necessary information. Different types of Miami-Dade Florida Sales Receipt may include specific variations tailored for certain industries or businesses. For instance, there might be specialized receipts for restaurants (highlighting food and beverages), retail stores (listing individual products), or service-based establishments (noting provided services). Each type aims to provide accurate and detailed information relevant to its industry while complying with the legal requirements set by the county. In conclusion, a Miami-Dade Florida Sales Receipt is a crucial document that safeguards the interests of both buyers and sellers. It accurately summarizes a transaction, providing clear information about the goods or services purchased, taxes applied, and payment details. By maintaining a comprehensive record of sales, these receipts assist businesses in managing their accounts and fulfilling legal obligations.