Fairfax Virginia Invoice Template for Accountant: A Comprehensive Overview Are you an accountant operating in Fairfax, Virginia, searching for a professional and reliable invoice template? Look no further! In this article, we will provide you with a detailed description of what a Fairfax Virginia Invoice Template for Accountant is and the different types available to meet your specific accounting needs. Fairfax Virginia Invoice Template for Accountant: What is it? A Fairfax Virginia Invoice Template for Accountant is a pre-designed document that accountants can use to bill their clients efficiently and effectively. It provides a systematic format for presenting detailed financial information, including service descriptions, amounts, due dates, taxes, and payment instructions. By using a well-crafted invoice template, accountants can streamline their billing process, maintain a professional image, and present their financial expertise to clients with clarity and precision. Types of Fairfax Virginia Invoice Template for Accountant: 1. Standard Invoice Template: — A fundamental invoice template suitable for general accounting purposes. — Typically includes sections for the accountant's name, address, contact information, client details, invoice number, invoice date, due date, itemized services, quantity, rate, subtotal, total amount due, and payment details. — Provides a professional appearance while capturing all necessary financial details. 2. Hourly Rate Invoice Template: — Designed specifically for accountants who charge their clients based on an hourly rate. — Includes sections to mention the number of hours worked, hourly rate, and the total billable amount for each service. — Allows accountants to present a transparent breakdown of their time spent on different tasks. 3. Retainer Invoice Template: — Ideal for accountants who work on retainer agreements with their clients. — Contains sections to mention the agreed retainer amount, retainer start and end dates, any additional services or hours worked beyond the retainer, and the corresponding charges. — Enables accountants to keep track of retainer utilization and invoice clients accordingly. 4. Expense Invoice Template: — Useful for accountants who need to bill their clients for specific expenses incurred during their services, such as travel expenses or software purchases. — Provides separate sections to mention each expense item, its description, quantity, cost per unit, and the total expense amount. — Enables easy reimbursement for the accountant's out-of-pocket expenses. 5. Recurring Invoice Template: — Designed for accountants who offer ongoing services with monthly or fixed billing cycles. — Includes sections to mention the recurring service, frequency, start and end dates, and the total amount due for each billing cycle. — Facilitates regular invoicing with minimal effort. Conclusion: A Fairfax Virginia Invoice Template for Accountant is an essential tool for accountants operating in Fairfax, Virginia, to ensure accurate and professional billing practices. With various types to choose from, including standard, hourly rate, retainer, expense, and recurring invoice templates, accountants can tailor their invoice format to perfectly suit their specific accounting needs. By utilizing these templates, accountants can efficiently manage their invoices while maintaining a professional image and ensuring clarity in financial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Plantilla de factura para contador - Invoice Template for Accountant

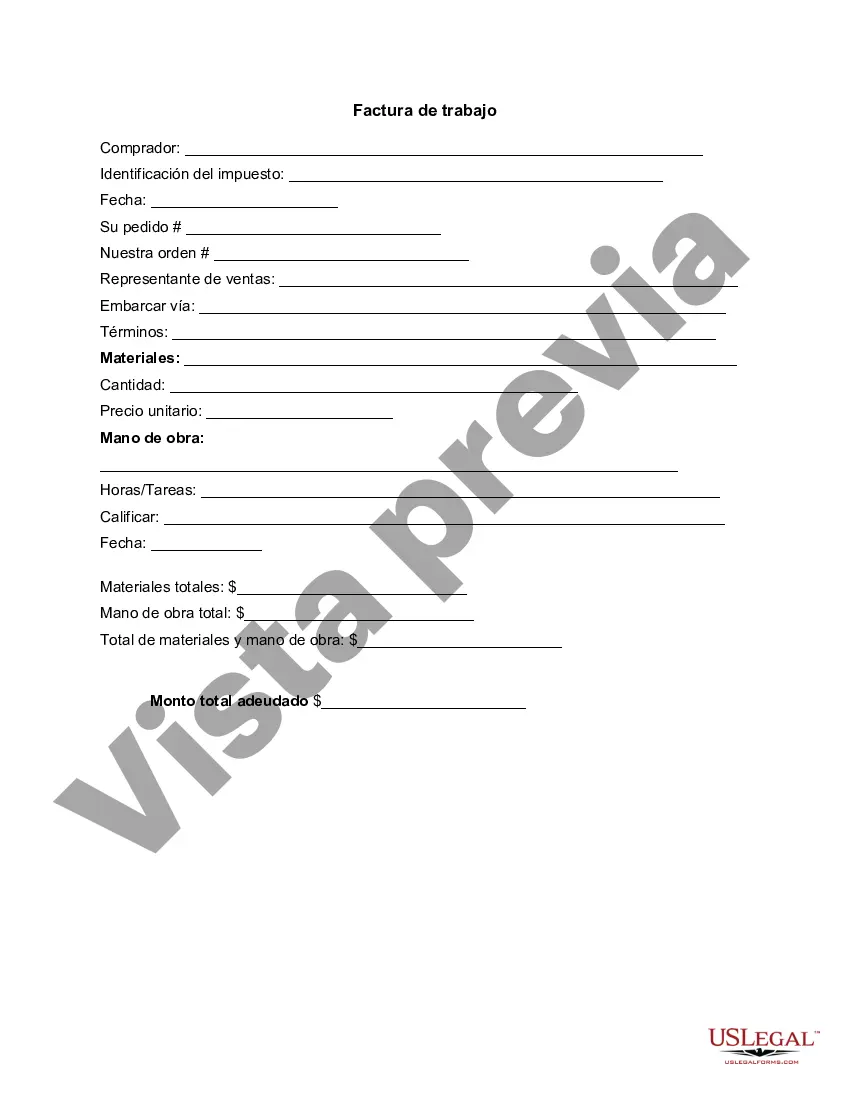

Description

How to fill out Fairfax Virginia Plantilla De Factura Para Contador?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Fairfax Invoice Template for Accountant without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Fairfax Invoice Template for Accountant by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Fairfax Invoice Template for Accountant:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!