Houston Texas Invoice Template for Accountant: A Comprehensive Guide Houston, Texas is a bustling city known for its vibrant business community. Accountants play a crucial role in this dynamic environment, managing financial transactions and ensuring the smooth functioning of businesses. To streamline their operations, accountants in Houston often rely on invoice templates tailored to meet their specific needs. A Houston Texas Invoice Template for Accountant is a pre-formatted document designed to help accountants create professional invoices efficiently. These templates are customized to include essential details and sections required for accurate billing and financial record-keeping. By using these templates, accountants can save time and maintain consistency in their invoicing process. Let's delve into the key features and types of invoice templates available for accountants in Houston. Key Features of Houston Texas Invoice Template for Accountants: 1. Contact Information: Invoice templates include the accountant's or accounting firm's name, address, phone number, email, and website information. This ensures that the client can easily reach out for any queries or concerns. 2. Invoice Numbering: Each invoice template assigns a unique invoice number to track and identify individual transactions. This aids in proper organization and reference for both the accountant and the client. 3. Client Details: The template allows accountants to input client information, such as name, address, and contact details, to ensure accurate billing and to establish effective communication. 4. Services or Products Rendered: The template includes a section to list the services provided or products sold, along with brief descriptions, quantities, rates, and any applicable taxes or discounts. 5. Total Amount Due: The template provides a clear and concise section to calculate and present the total amount due, including any taxes or discounts applied. This helps in avoiding confusion and disputes. 6. Payment Terms: Houston Texas invoice templates allow accountants to define the agreed-upon payment terms, including due dates, accepted payment methods, and late payment penalties, if any. 7. Additional Notes: This optional section enables accountants to include any special instructions, terms, or personalized messages to the client. Types of Houston Texas Invoice Template for Accountants: 1. Basic Invoice Template: A simple yet comprehensive template suitable for routine invoicing. It includes all the key features mentioned above for basic accounting needs. 2. Hourly Rate Invoice Template: This template caters to accountants who charge on an hourly basis. It includes fields to record the number of hours worked, the hourly rate, and the total amount due based on the hours. 3. Project-Based Invoice Template: Designed for accountants working on specific projects, this template allows for the inclusion of project details, milestones, and progress tracking. It facilitates clear invoicing for ongoing or long-term projects. 4. Recurring Invoice Template: Accountants who offer recurring services or bill clients on a regular cycle can benefit from this template. It automates recurring invoicing and provides provisions for setting up automatic reminders. 5. Tax Invoice Template: Accountants dealing with tax-related services can utilize this template. It ensures compliance with tax regulations by including specific tax-related information, such as tax identification numbers and rates. In conclusion, Houston Texas Invoice Templates for Accountants empower professionals to streamline their billing processes and maintain financial accuracy. These templates come in various types suiting different invoicing requirements, ensuring that the accounting operations in Houston run smoothly and efficiently. From basic templates to specialized ones, accountants can choose the suitable template to facilitate their unique invoicing needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Plantilla de factura para contador - Invoice Template for Accountant

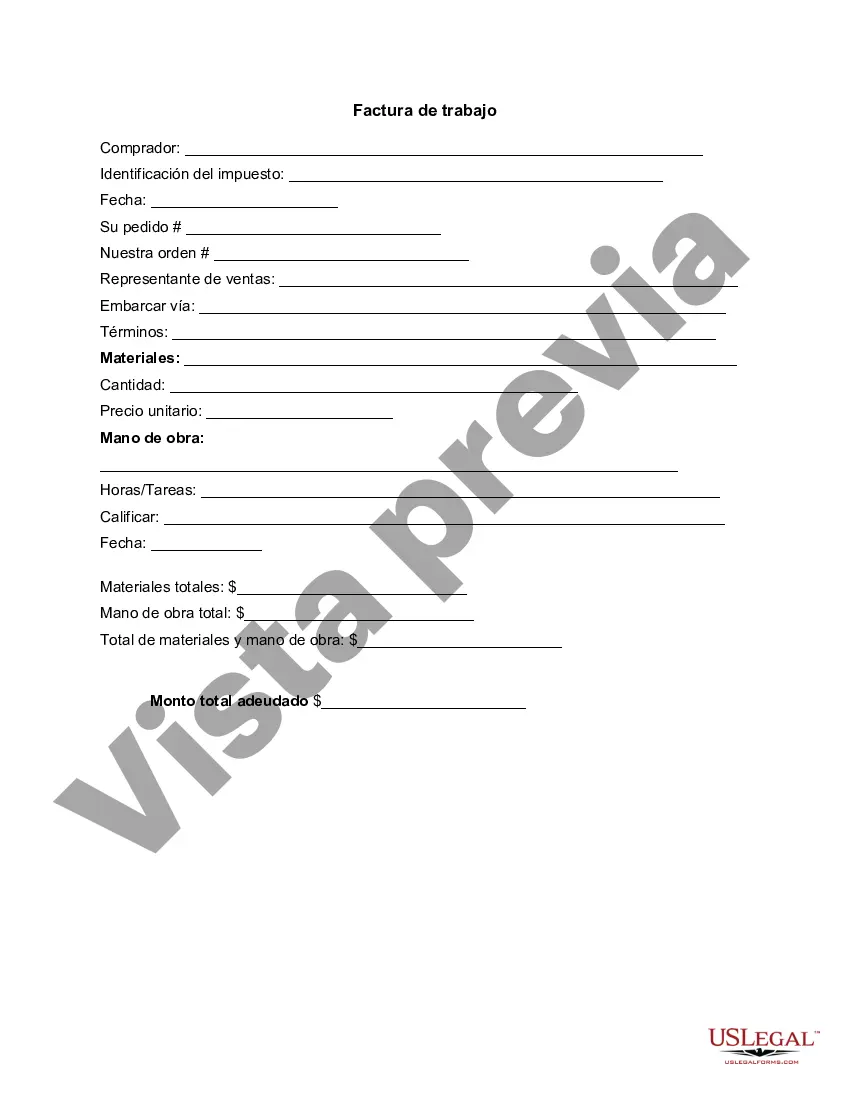

Description

How to fill out Houston Texas Plantilla De Factura Para Contador?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life scenario, locating a Houston Invoice Template for Accountant suiting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Houston Invoice Template for Accountant, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Houston Invoice Template for Accountant:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Houston Invoice Template for Accountant.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!