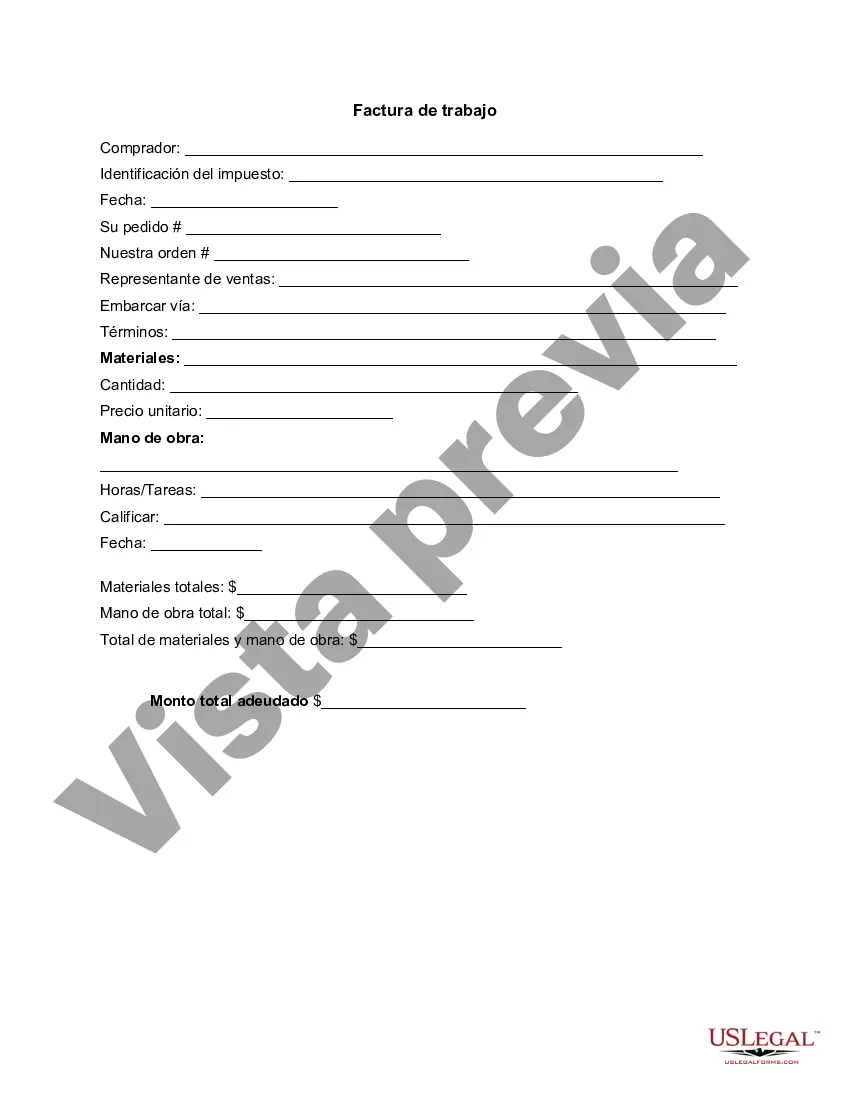

Phoenix Arizona Invoice Template for Independent Contractor: A Comprehensive Overview If you are an independent contractor residing in Phoenix, Arizona, it is of paramount importance to have a well-structured and professional invoice template to efficiently manage your financial transactions. Whether you offer services as a consultant, freelancer, or any other type of self-employed professional, a Phoenix Arizona Invoice Template for Independent Contractor can streamline your billing processes, ensuring timely payments and accurate record-keeping. Below, we'll explore the key components and different types of invoice templates available for independent contractors in Phoenix. 1. Basic Information: A Phoenix Arizona Invoice Template for Independent Contractor should contain crucial details such as your name, business name (if applicable), address, contact information, and a unique invoice number. This information helps identify and locate your invoice within your client's payment system. 2. Client Details: Include the full name, company (if applicable), address, and contact information of your client. This section ensures that both parties understand who is invoicing and who is being billed. It also simplifies communication in case of any discrepancies or queries. 3. Date and Payment Terms: Specify the invoice creation date and the due date by which the invoice should be settled. This information creates transparency regarding the agreed-upon payment terms and deadlines, minimizing confusion and potential delays. 4. Invoice Breakdown: Provide a detailed breakdown of the services rendered or products delivered, including the date of each transaction, item descriptions, quantities, rates, and the total amount due for each item. A comprehensive breakdown ensures transparency, prevents disputes, and helps your client understand the value they are receiving. 5. Subtotal, Taxes, and Additional Fees: Calculate the subtotal of all items listed on the invoice. If your services are subject to sales tax, clearly mention the tax rate and include the tax amount. Additionally, if there are any applicable fees, such as late payment charges or discounts, include them in this section. 6. Total and Payment Instructions: Calculate the total amount due by adding the subtotal, taxes, and any additional fees. Then, provide detailed instructions on how the payment should be made, such as bank transfer information or payment platform options. Specify if you accept different payment methods, such as credit cards or PayPal. Different Types of Phoenix Arizona Invoice Templates for Independent Contractors: 1. Hourly Rate Invoice Template: Ideal for professionals who charge clients based on hours worked. This template includes a section to input the number of hours worked, hourly rates, and a clear breakdown of charges. 2. Service or Product Invoice Template: Perfect for contractors offering specific services or products. It enables you to list your offerings with concise descriptions, unit prices, quantities, and the total amount for each item. 3. Retainer Invoice Template: For contractors who work on retainer basis, this template allows you to outline the agreed-upon retainer amount, the billing period, and any adjustments made during that period. By utilizing a Phoenix Arizona Invoice Template for Independent Contractor that aligns with your specific needs, you can enhance professionalism, improve payment efficiency, maintain accurate financial records, and cultivate stronger client relationships. Choose a template type that best suits your invoicing requirements and adapt it to your unique style and branding.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Plantilla de factura para contratista independiente - Invoice Template for Independent Contractor

Description

How to fill out Phoenix Arizona Plantilla De Factura Para Contratista Independiente?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Phoenix Invoice Template for Independent Contractor, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any activities related to document execution straightforward.

Here's how you can find and download Phoenix Invoice Template for Independent Contractor.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related forms or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Phoenix Invoice Template for Independent Contractor.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Phoenix Invoice Template for Independent Contractor, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you need to deal with an exceptionally challenging situation, we advise getting an attorney to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!