Miami-Dade Florida Plantilla de factura para salvavidas - Invoice Template for Lifeguard

State:

Multi-State

County:

Miami-Dade

Control #:

US-02930BG-48

Format:

Word

Instant download

Description

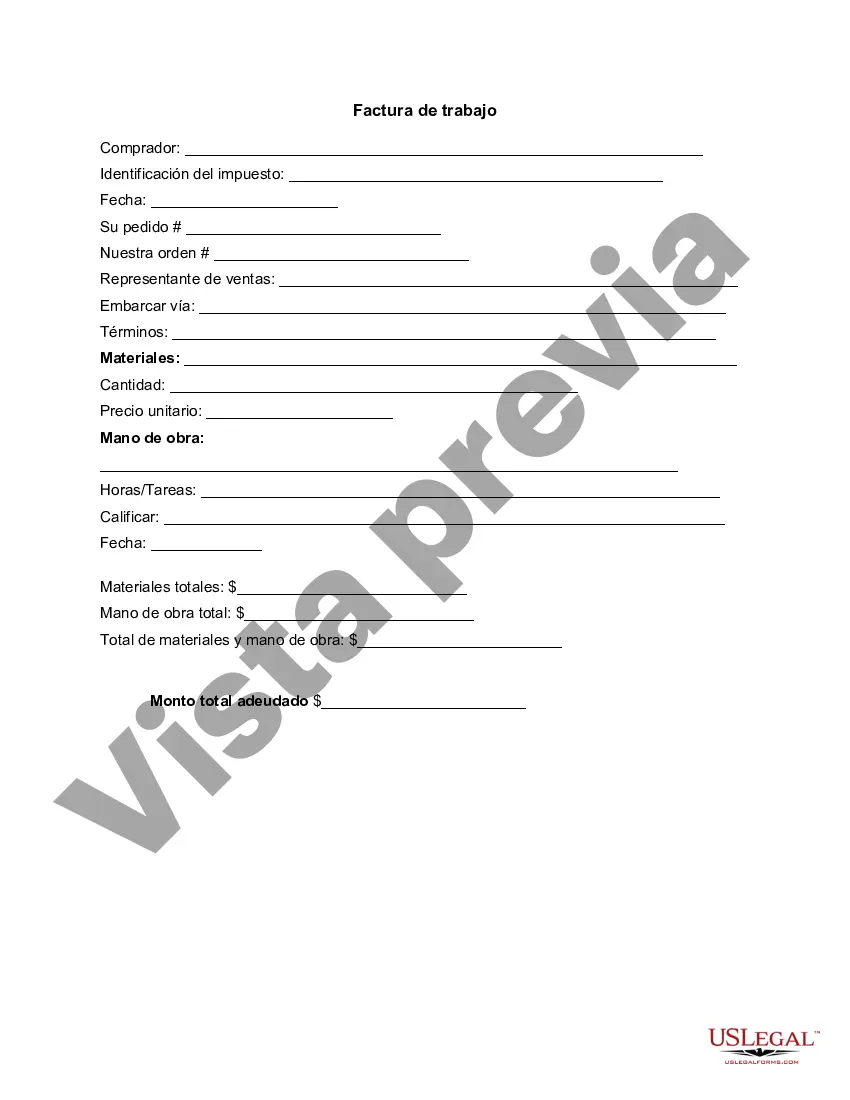

An invoice is a detailed list of goods shipped or services rendered, with an account of all costs - an itemized bill. A job invoice is an invoice detailing work that has been done.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.