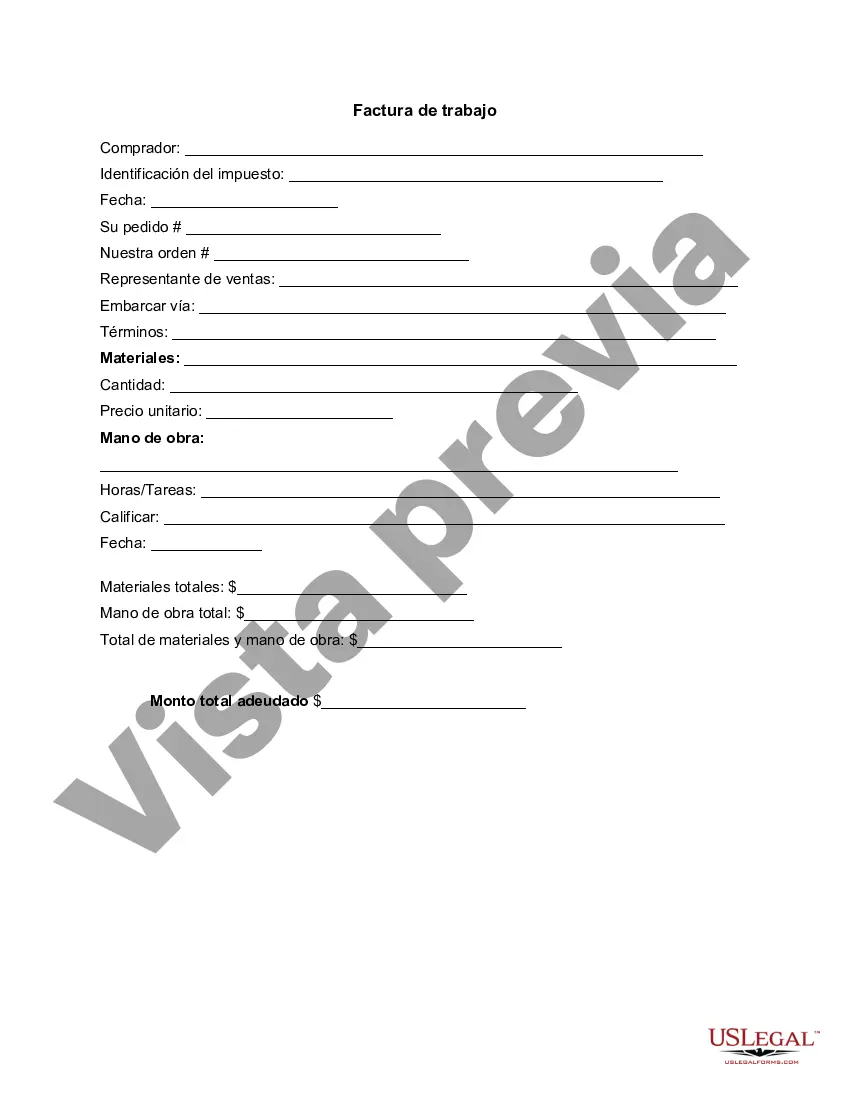

A Clark Nevada Invoice Template for Assistant Professors is a pre-designed document that helps in the efficient and accurate billing process for academic services provided by an assistant professor. This template serves as a framework to create invoices for various activities such as teaching, research, consultation, and administrative tasks. Key features of a Clark Nevada Invoice Template for Assistant Professor: 1. Personal and Institution Information: The template includes sections to input personal details of the assistant professor, such as name, contact information, identification number, and affiliation details of the academic institution. 2. Invoice Number and Date: It provides a dedicated space to include a unique invoice number and the date of issue. This helps in the organization and tracking of invoices. 3. Billing Period: The template allows for specifying the billing period, usually denoted as a start and end date. This provides clarity regarding the duration for which services were rendered. 4. Services Rendered: The template provides a comprehensive table or section to list down the various services provided by the assistant professor. This may include teaching specific courses, conducting research, supervising students, delivering seminars or workshops, and any other professional activities. 5. Hourly or Unit Rates: There are options to include the hourly or unit rates for each service provided. This allows for clear communication of the monetary value assigned to each task. 6. Quantity and Total Amount: The template provides columns or spaces to enter the quantity or duration of each service rendered. Multiplied by the respective rates, this automatically calculates the total amount for each service and generates a subtotal. 7. Additional Charges or Discounts: If there are any additional charges or discounts applicable, the template can accommodate such adjustments, ensuring accurate invoicing. 8. Tax and Total Amount Due: The template includes sections to specify tax details, if applicable, and calculates the total amount due by summing up all the individual service charges and tax amount. 9. Payment Terms and Methods: It allows for mentioning the preferred payment terms, expected payment date, and accepted payment methods (e.g., check, bank transfer, online payment). Types of Clark Nevada Invoice Templates for Assistant Professor: 1. Teaching Services Invoice: Specifically designed for invoicing teaching-related services provided by an assistant professor. It includes columns or sections for listing courses taught, the number of lectures, and grading assistance, along with related rates. 2. Research Services Invoice: This template focuses on invoicing research work conducted by an assistant professor. It includes sections for specifying research projects, hours spent, data analysis, and any publications or reports generated. 3. Consultation Services Invoice: Geared towards billing consultation or advisory services provided by an assistant professor to external organizations, industries, or government bodies. It includes sections for outlining the nature and extent of consultations, hours spent, and consultancy rates. 4. Miscellaneous Services Invoice: This type of template caters to any miscellaneous professional services provided by an assistant professor, such as manuscript reviewing, committee participation, attending conferences, or administrative tasks. It allows customization to add specific details and rates as per the situation. In conclusion, a Clark Nevada Invoice Template for Assistant Professor streamlines the invoicing process by providing a structured format to clearly outline the services rendered and their associated costs. It reduces administrative work, ensures accuracy, and promotes transparent communication between the assistant professor and the recipient of the invoice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Plantilla de factura para profesor asistente - Invoice Template for Assistant Professor

Description

How to fill out Clark Nevada Plantilla De Factura Para Profesor Asistente?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Clark Invoice Template for Assistant Professor suiting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Clark Invoice Template for Assistant Professor, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Clark Invoice Template for Assistant Professor:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Clark Invoice Template for Assistant Professor.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!