A Sacramento California invoice template for Branch Manager is a professional and user-friendly tool designed to assist branch managers in efficiently creating and managing invoices in their daily operations. This template incorporates the specific requirements and regulations applicable to Sacramento, California, ensuring compliance with local business practices and legal obligations. By utilizing this template, branch managers can streamline their invoicing processes and maintain a professional image while keeping accurate financial records. Key features found in a Sacramento California invoice template for Branch Managers may include: 1. Personalized Header: The template allows customization of the header section, enabling branch managers to include their company logo, name, address, and contact information. This personalized touch enhances brand recognition and helps clients identify the source of the invoice. 2. Invoice Numbering: Sacramento California invoice templates for Branch Managers typically incorporate an automatic numbering system, ensuring each invoice is uniquely identified and easily traceable. This feature enables better organization and tracking of invoices, which is crucial for record-keeping and financial analysis. 3. Client Information: The template allows the inclusion of client details such as name, address, and contact information. This information helps identify and communicate with clients efficiently, preventing any confusion or miscommunication during the invoicing process. 4. Itemized Description: A Sacramento California invoice template includes dedicated sections for itemized descriptions of goods or services provided. Branch managers can specify each item's name, quantity, unit price, and total cost, providing clients with a clear breakdown of charges. Accurate and detailed descriptions facilitate transparency and prevent any disputes relating to the services rendered. 5. Sales Tax Calculation: Sacramento California invoice templates often incorporate automatic calculations for local sales tax rates. Branch managers can customize the tax settings based on the current tax regulations, ensuring accurate taxation and compliance with state laws. 6. Terms and Conditions: The template allows for the inclusion of specific terms and conditions governing the invoice. This section may outline payment deadlines, late fees, accepted payment methods, and other relevant information, providing clarity to clients regarding payment expectations and procedures. Different types of Sacramento California Invoice Templates for Branch Managers may include variations based on specific industries, such as construction, healthcare, consulting, or retail. These industry-specific templates might include additional fields or sections tailored to the unique needs and requirements of those particular industries. In conclusion, a Sacramento California invoice template for Branch Managers is an essential tool for maintaining accurate financial records and effectively managing invoicing processes. By utilizing such a template, branch managers can streamline operations, enhance professionalism, and ensure compliance with local regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Plantilla de factura para gerente de sucursal - Invoice Template for Branch Manager

Description

How to fill out Sacramento California Plantilla De Factura Para Gerente De Sucursal?

Preparing paperwork for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Sacramento Invoice Template for Branch Manager without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Sacramento Invoice Template for Branch Manager by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to get the Sacramento Invoice Template for Branch Manager:

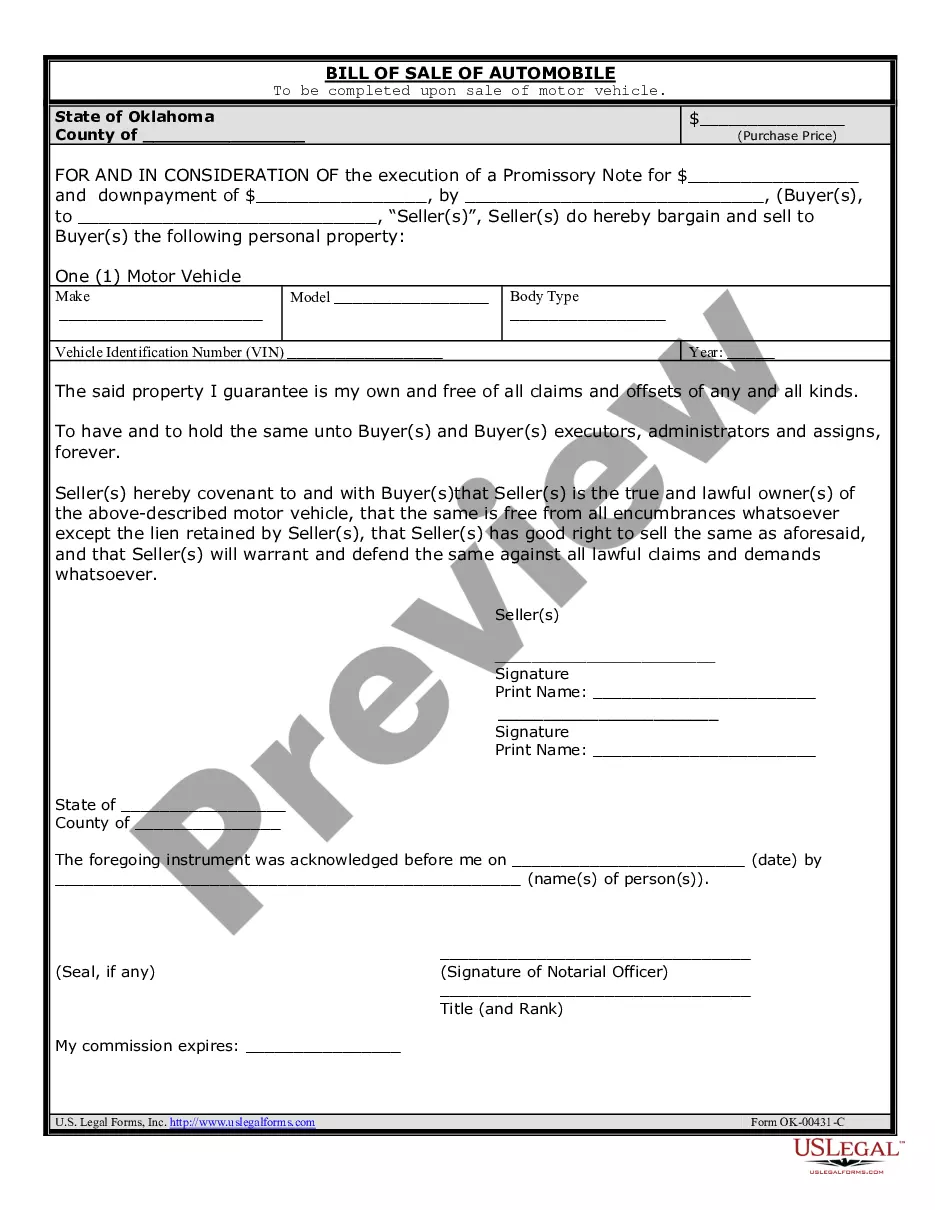

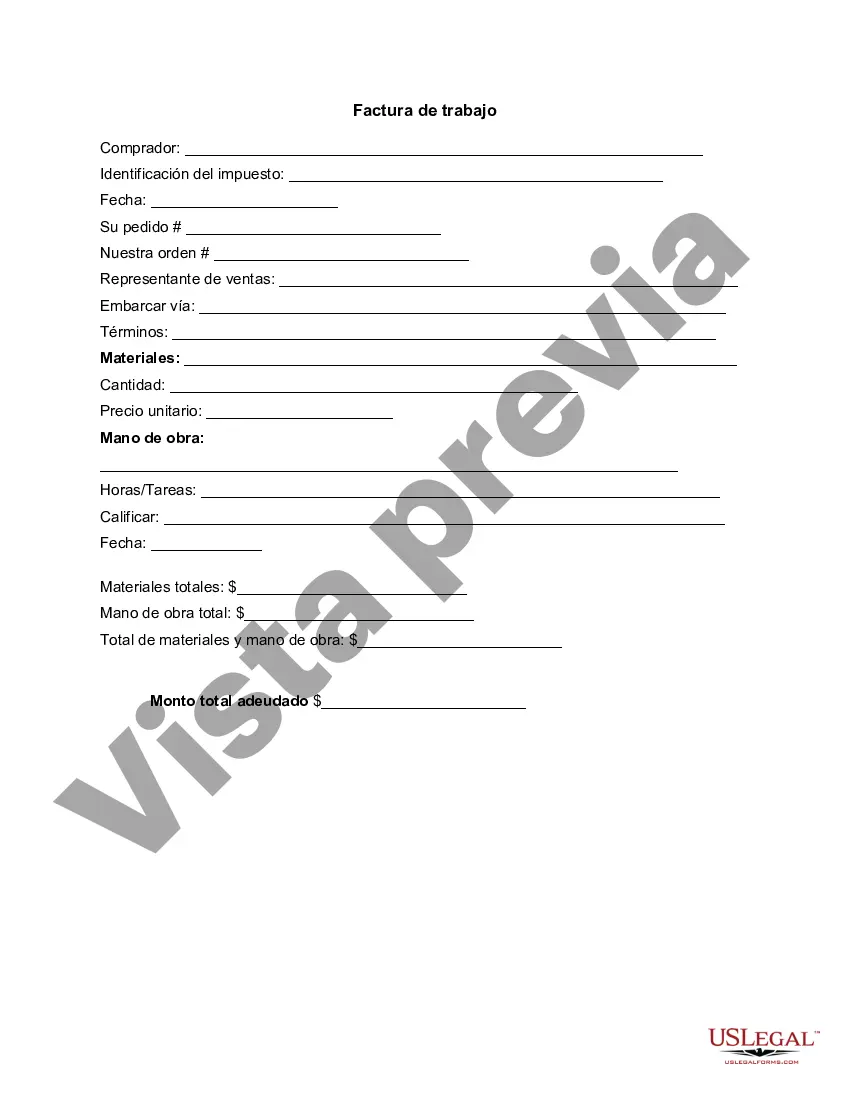

- Look through the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!