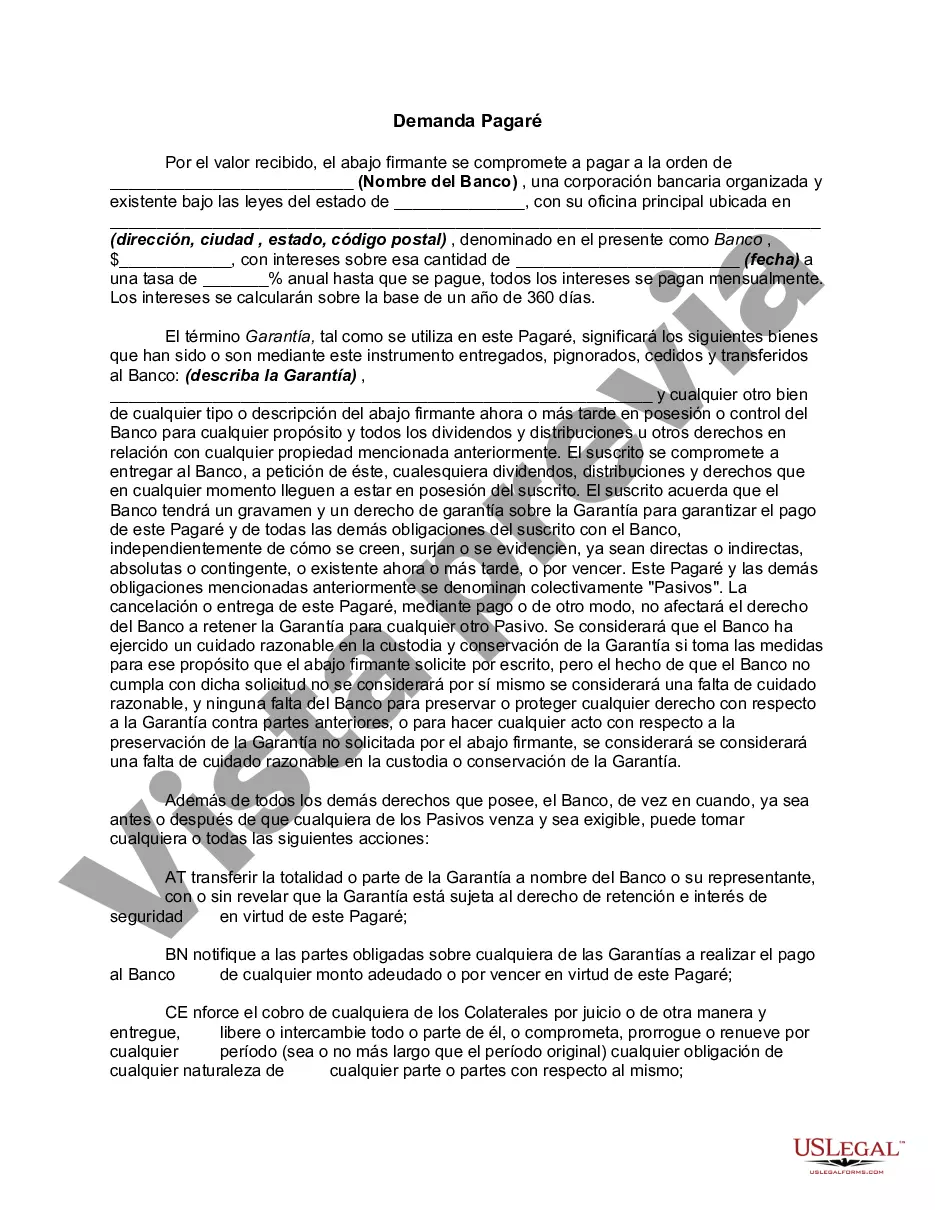

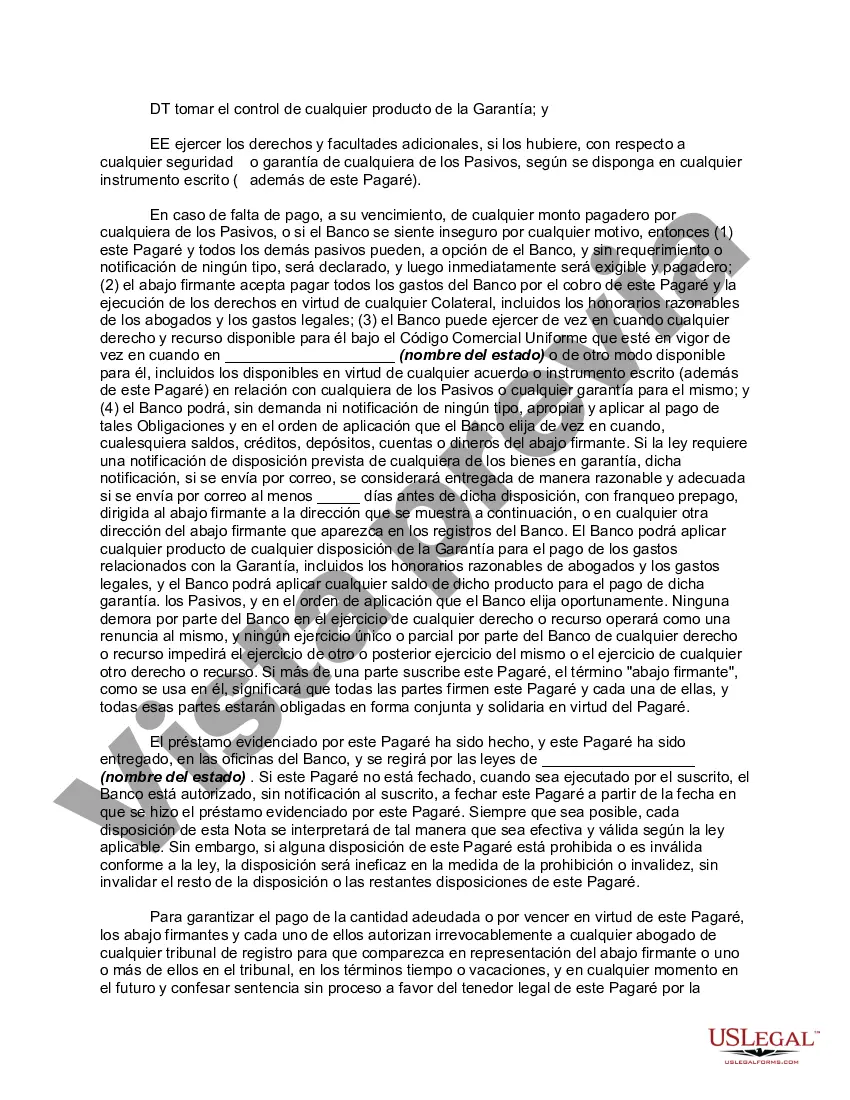

San Antonio, Texas, is a vibrant city located in the southern part of the United States. Known for its rich history, diverse culture, and iconic landmarks, San Antonio offers a unique blend of tradition and modernity. In the financial sector, a San Antonio Texas Demand Promissory Note holds significance for individuals and businesses seeking an agreement of repayment. A Demand Promissory Note is a legally binding document that outlines the terms of a loan or financial obligation between two parties. It serves as evidence of a borrower's commitment to repay a specified amount of money to the lender under certain conditions. The Demand Promissory Note is characterized by the lender's ability to demand repayment in full at any time, instead of adhering to a fixed repayment schedule. Within San Antonio, various types of Demand Promissory Notes are commonly utilized, tailored to specific scenarios and requirements. Some notable variations include: 1. Unsecured Demand Promissory Note: This type of promissory note does not require collateral, meaning it does not have any assets pledged as security against the loan. 2. Secured Demand Promissory Note: In contrast to an unsecured note, a secured demand promissory note requires the borrower to pledge collateral (such as real estate, vehicles, or other valuables) to secure the repayment. 3. Line of Credit Demand Promissory Note: This type of demand promissory note functions as a revolving credit facility where borrowers can access funds up to a specific limit as needed. Interest is charged only on the utilized portion of the line of credit. 4. Demand Promissory Note with Interest-Free Period: Certain demand promissory notes may include an agreed-upon interest-free period where the borrower is exempted from paying any interest for a specific timeframe. 5. Demand Promissory Note with Installment Payments: While demand promissory notes typically allow the lender to demand full repayment at any time, some variations may specify a repayment plan in installments, similar to a traditional loan, providing the borrower with a structured repayment schedule. When drafting or entering into a San Antonio Texas Demand Promissory Note, it is essential to consult with legal professionals or financial advisors who are well-versed in local laws and regulations to ensure compliance and protect the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas pagaré a la vista - Demand Promissory Note

Description

How to fill out San Antonio Texas Pagaré A La Vista?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a San Antonio Demand Promissory Note suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the San Antonio Demand Promissory Note, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your San Antonio Demand Promissory Note:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Antonio Demand Promissory Note.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!