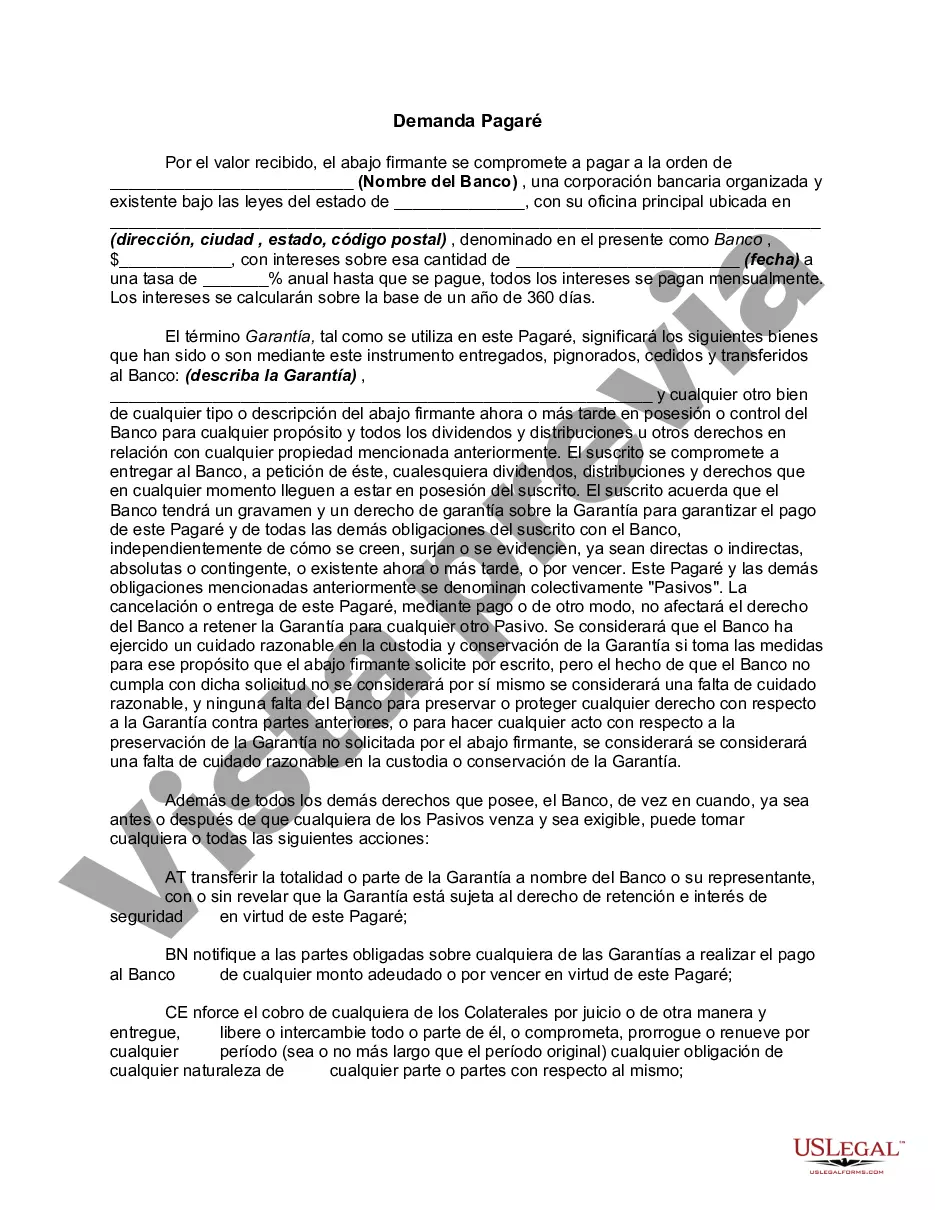

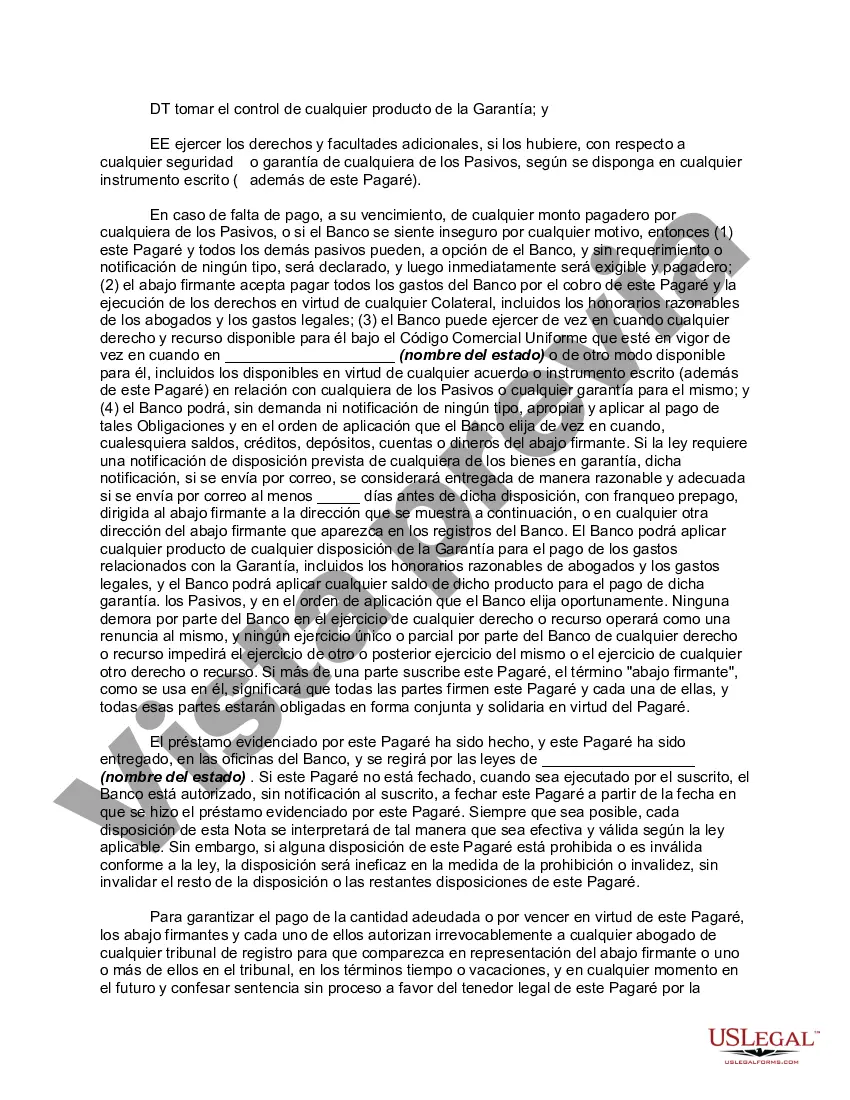

A San Diego California Demand Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in San Diego, California. It functions as a written promise from the borrower to repay a certain amount of money borrowed from the lender, typically with interest, within a specified period. The Demand Promissory Note is unique compared to other types of promissory notes as it allows the lender to demand repayment at any time without prior notice. This type of flexibility provides the lender with the option to call in the loan if the borrower fails to meet their obligations or if the lender requires immediate repayment for any reason. The San Diego California Demand Promissory Note includes essential details such as the names and addresses of both parties involved, the principal loan amount, the interest rate charged, the repayment terms, any late fees or penalties, and the consequences for defaulting on the loan. This legal document acts as evidence of the agreement between the lender and the borrower and ensures the borrower's commitment to repay the borrowed funds. Different types of Demand Promissory Notes found in San Diego, California can include variations such as secured or unsecured notes. Secured notes are backed by collateral, such as personal property or real estate, which the lender can seize in case of default. Unsecured notes, on the other hand, do not have collateral, and the lender relies solely on the borrower's creditworthiness. Both types carry their own risks and benefits for both parties involved. In conclusion, a San Diego California Demand Promissory Note is a legal contract that establishes the terms of a loan and provides flexibility for the lender to demand repayment at any time. It serves as a vital tool in ensuring the loan's enforceability, protecting both the lender and the borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California pagaré a la vista - Demand Promissory Note

Description

How to fill out San Diego California Pagaré A La Vista?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate San Diego Demand Promissory Note without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid San Diego Demand Promissory Note on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step instruction below to get the San Diego Demand Promissory Note:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a few clicks!