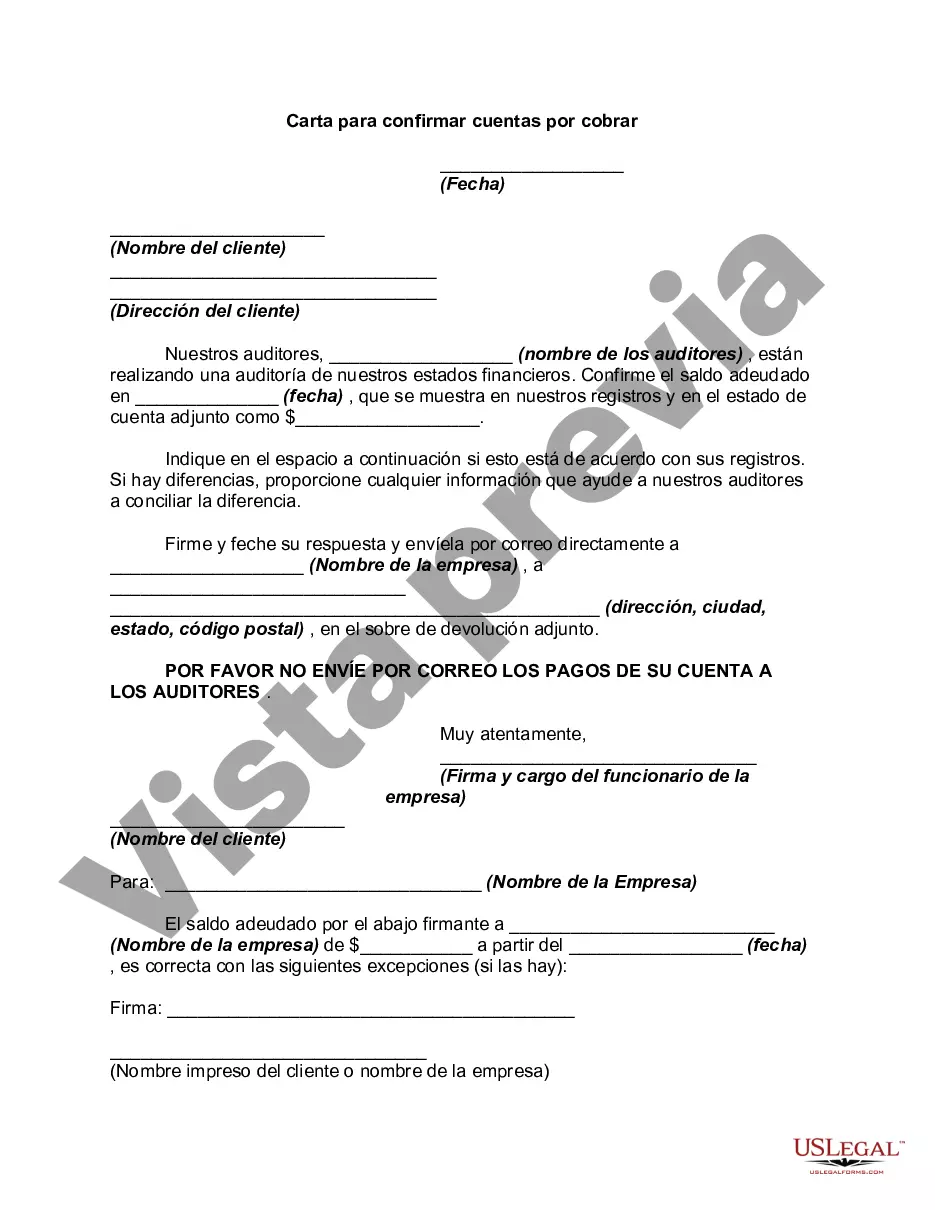

Nassau New York Letter to Confirm Accounts Receivable is a formal document used in business transactions to verify the outstanding accounts receivable of a company based in Nassau County, New York. These letters serve as a written request to confirm the outstanding balances owed by customers or clients to ensure accuracy in financial records. Accounts receivable represent the amount of money that is owed to a company for goods or services that have been delivered but not yet fully paid for. The purpose of a Nassau New York Letter to Confirm Accounts Receivable is to establish clear communication between the business and its customers, ensuring that both parties agree on the amount outstanding. These letters may be sent out periodically, typically at the end of a fiscal quarter or year, to assess the current financial standing of the company. The content of a Nassau New York Letter to Confirm Accounts Receivable usually includes: 1. Business Information: The letter will start with the company's name, address, and contact information. It may also include the customer's name and address to provide personalized communication. 2. Date and Reference Number: A Nassau New York Letter to Confirm Accounts Receivable should mention the date it was issued and a unique reference number for easy identification and record-keeping purposes. 3. Salutation and Introduction: The letter should begin with a formal salutation, such as "Dear Customer" or "To Whom It May Concern." The introduction should explain the purpose of the letter, which is to confirm the outstanding balances. 4. Outstanding Balance Details: The letter will include a detailed list of the outstanding invoices or accounts that need confirmation. Each entry should contain the invoice number, date, description of the goods or services, the amount owed, and the due date. 5. Request for Confirmation: A Nassau New York Letter to Confirm Accounts Receivable will inform the customer that their response is required to verify the accuracy of the outstanding balances. It may specify a deadline by which the customer should confirm the balance or provide any necessary adjustments. 6. Contact Information: The letter should provide the company's contact information, including a specific point of contact, email address, and phone number. This allows the customer to get in touch easily to address any discrepancies or concerns. Different types of Nassau New York Letters to Confirm Accounts Receivable may include variations based on the specific industry or business requirements. For example: 1. Construction Industry: A Nassau New York Letter to Confirm Accounts Receivable in the construction industry may include additional information such as project details, progress billing, and any retention amounts withheld. 2. Services Industry: For service-based businesses, the letter may emphasize the description of services rendered, along with any applicable hourly rates or terms of payment. 3. Retail Industry: In the retail sector, Nassau New York Letters to Confirm Accounts Receivable may focus on individual customer accounts, including details such as purchases, returns, and any store credit or outstanding refunds. In conclusion, a Nassau New York Letter to Confirm Accounts Receivable is a vital tool to ensure accurate financial record-keeping and clear communication between businesses and their customers. These letters help establish transparency and can be tailored to meet the specific requirements of different industries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Carta para confirmar cuentas por cobrar - Letter to Confirm Accounts Receivable

Description

How to fill out Nassau New York Carta Para Confirmar Cuentas Por Cobrar?

Are you looking to quickly draft a legally-binding Nassau Letter to Confirm Accounts Receivable or maybe any other form to manage your own or corporate affairs? You can go with two options: hire a professional to write a legal document for you or draft it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific form templates, including Nassau Letter to Confirm Accounts Receivable and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the Nassau Letter to Confirm Accounts Receivable is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Nassau Letter to Confirm Accounts Receivable template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the documents we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!