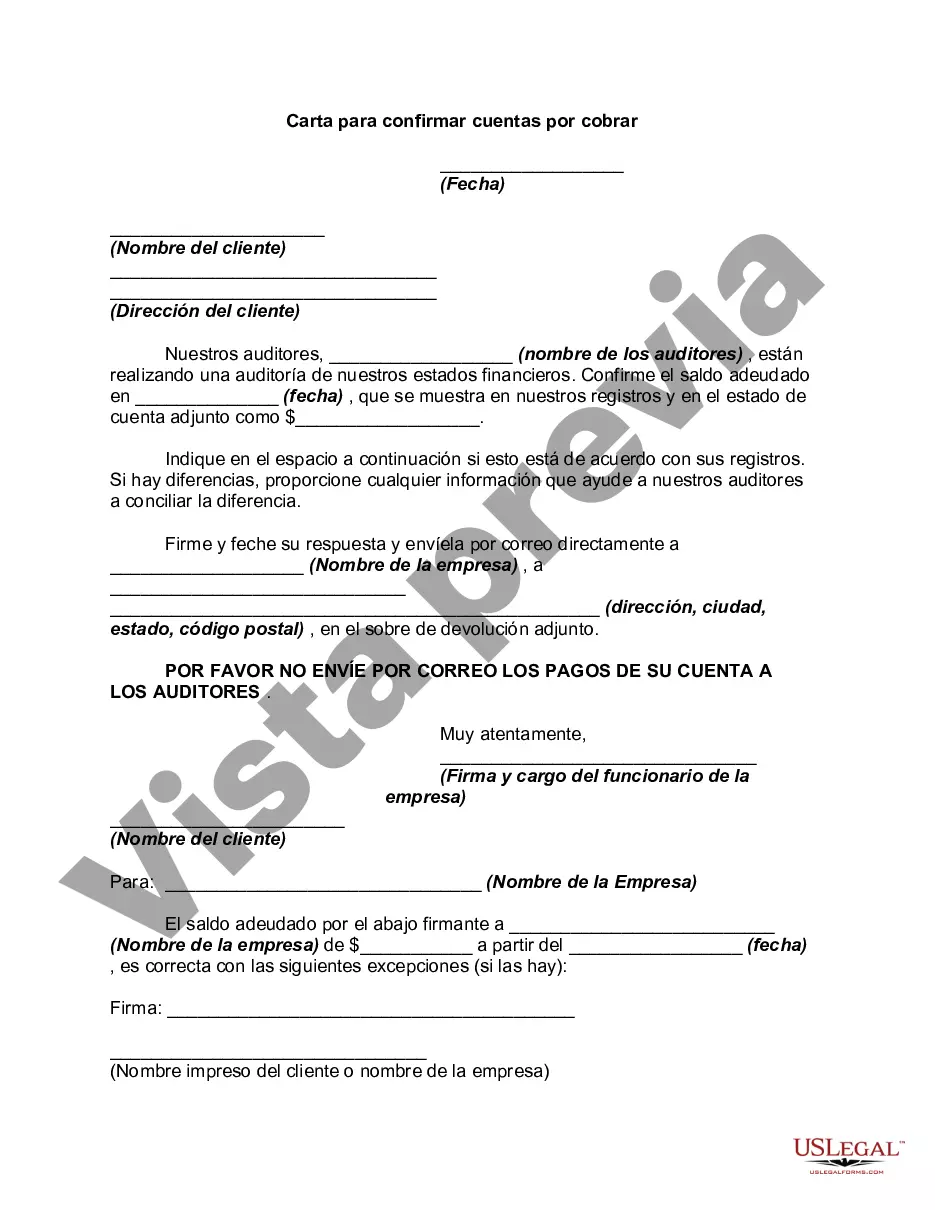

Title: Phoenix Arizona Letter to Confirm Accounts Receivable — Detailed Description and Types Introduction: A Phoenix Arizona Letter to Confirm Accounts Receivable is a crucial document used by businesses in Phoenix, Arizona, to validate or verify outstanding payments owed to them by their customers or clients. This detailed description will provide an overview of this important letter, its purpose, key elements, and potential types based on various situations. Key Elements of a Phoenix Arizona Letter to Confirm Accounts Receivable: 1. Date: The letter should start with the current date to establish a clear timeline. 2. Addressee: The name, position, and contact information of the recipient, including their company or organization name. 3. Subject: A concise and specific section clearly stating the purpose of the letter. 4. Introductory Paragraph: A formal greeting, which may include the receiver's name, followed by a courteous introduction. 5. Statement of Purpose: Clearly state the purpose of the letter, which is to confirm the outstanding accounts receivable. 6. Account Details: Provide all relevant information about the account, such as the customer's name, invoice numbers, dates of issuance, due dates, and outstanding amounts. 7. Request for Confirmation: Clearly request the recipient to verify the accuracy of the mentioned account details and bring attention to any discrepancies or errors. 8. Contact Information: Include the sender's contact information, such as name, position, phone number, and email, to facilitate communication. 9. Closing: Provide a professional closing, expressing gratitude for their cooperation, followed by the sender's name, title, and company details. Types of Phoenix Arizona Letters to Confirm Accounts Receivable: 1. Initial Confirmation Letter: This type of letter is sent as soon as an invoice becomes past due and serves as an initial reminder to the customer regarding the outstanding payment. 2. Subsequent Confirmation Letter: In case of non-payment or incomplete payment after the initial reminder, this follow-up letter is sent to emphasize the importance of resolving the outstanding balance promptly. 3. Final Confirmation Letter: If repeated reminders and follow-up attempts fail to yield results, a final confirmation letter is drafted to assert the seriousness of the situation and warn the customer about the potential consequences if the account is not settled. 4. Monthly/Quarterly Confirmation Letter: Some businesses prefer sending regular confirmations to their customers to maintain transparency and ensure timely payments. These letters summarize the outstanding balances for a specific period, such as a month or fiscal quarter. Conclusion: A Phoenix Arizona Letter to Confirm Accounts Receivable is a vital tool for businesses in Phoenix, Arizona, to manage their financials effectively. By employing this letter, companies can maintain healthy cash flow and address any discrepancies concerning unpaid balances. Suggested types include the initial, subsequent, final, and regular confirmations. Ensuring prompt communication and follow-up plays a crucial role in securing payments and fostering strong business relationships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Carta para confirmar cuentas por cobrar - Letter to Confirm Accounts Receivable

Description

How to fill out Phoenix Arizona Carta Para Confirmar Cuentas Por Cobrar?

If you need to find a trustworthy legal document provider to obtain the Phoenix Letter to Confirm Accounts Receivable, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to get and execute various documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Phoenix Letter to Confirm Accounts Receivable, either by a keyword or by the state/county the document is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Phoenix Letter to Confirm Accounts Receivable template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Phoenix Letter to Confirm Accounts Receivable - all from the convenience of your sofa.

Join US Legal Forms now!