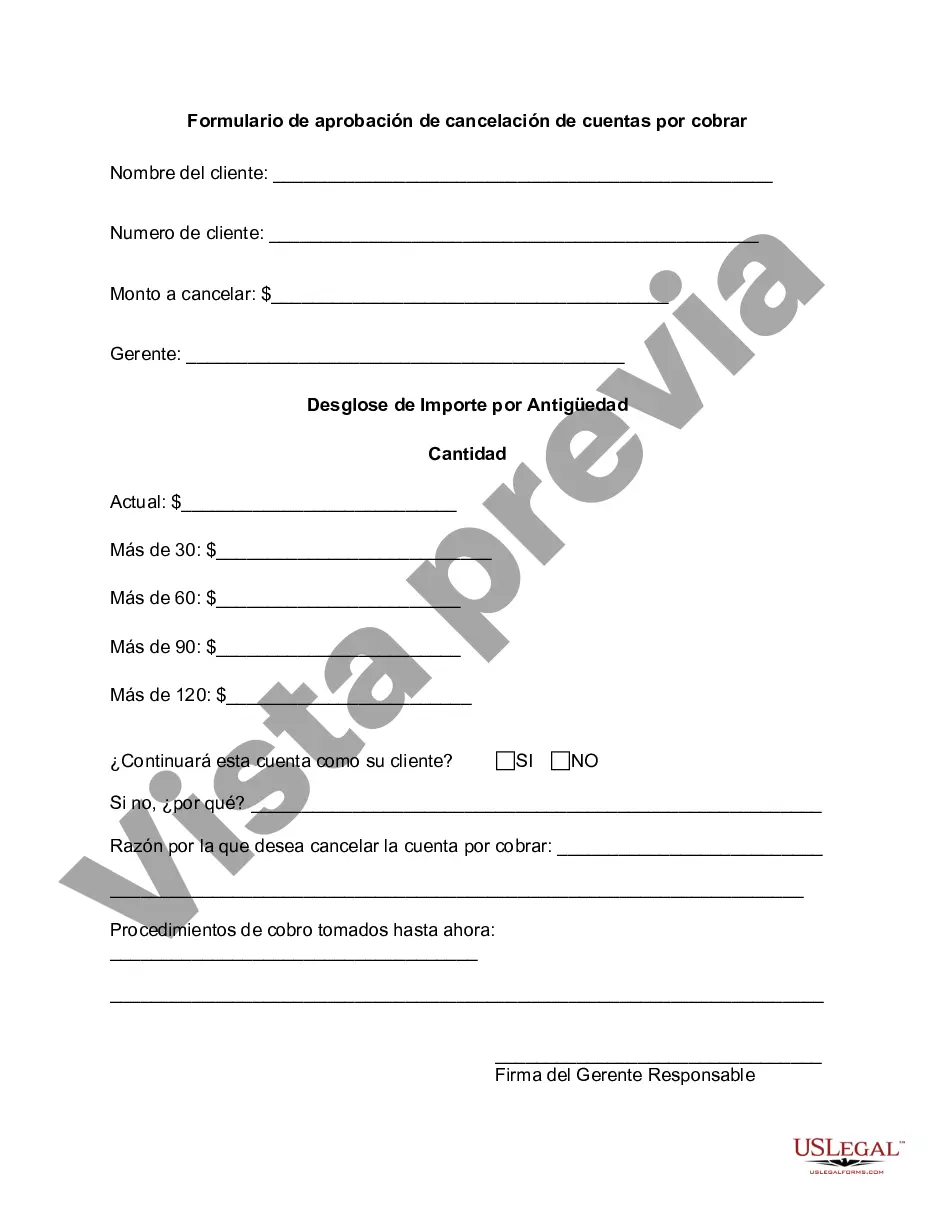

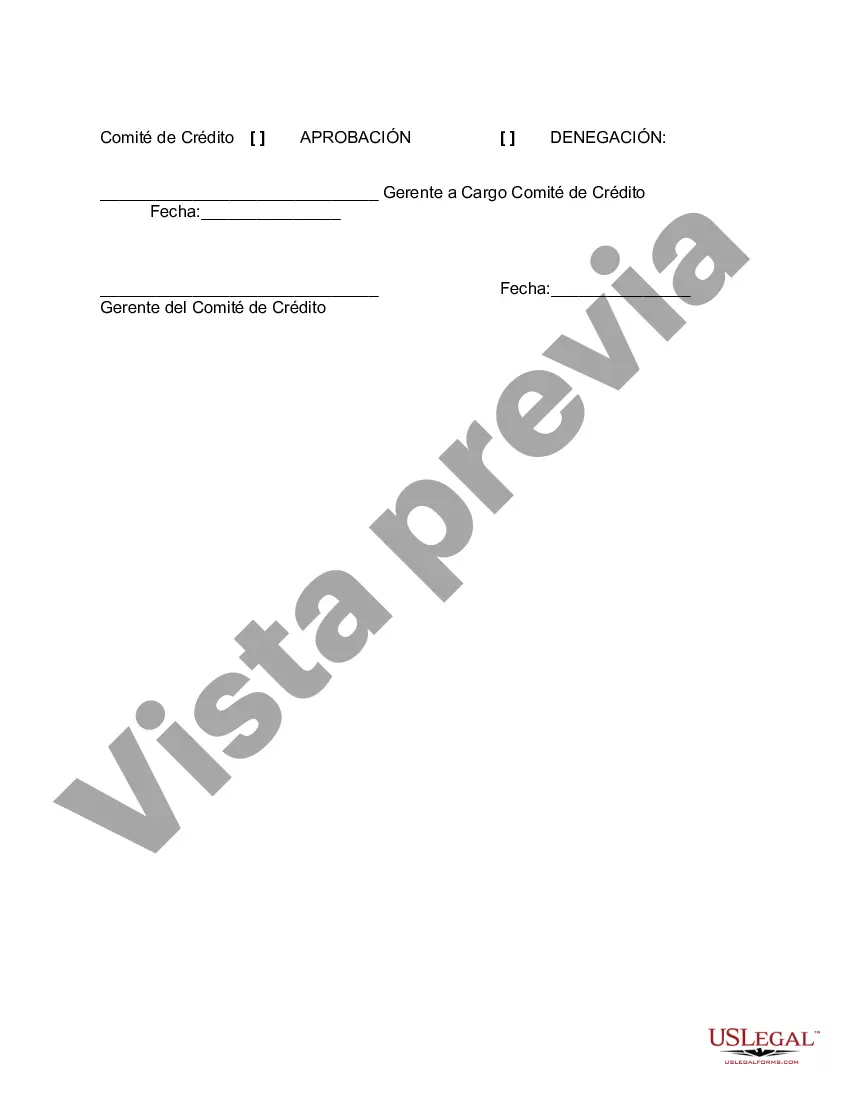

The Broward Florida Accounts Receivable Write-Off Approval Form is a crucial document utilized in the financial management process of businesses located in Broward County, Florida. This form serves as a means of officially authorizing the write-off of accounts receivable, enabling businesses to clear outstanding debts that are deemed uncollectible or irrecoverable. The primary purpose of the Broward Florida Accounts Receivable Write-Off Approval Form is to establish a systematic and well-documented process for businesses to write-off bad debts and maintain accurate financial records. By doing so, businesses can effectively manage their accounts receivable and ensure a realistic representation of their financial health. This form acts as a safeguard against potential discrepancies or fraudulent activities and ensures transparency in the company's financial statements. Key elements and details found in the Broward Florida Accounts Receivable Write-Off Approval Form typically include: 1. Company Information: The form typically includes the name, address, and contact details of the business authorizing the write-off. 2. Debtor Information: It requires the identification of the debtor, including their name, contact information, and outstanding balance. 3. Invoice Details: The form captures essential invoice information, such as the invoice number, date, and the specific amount being written off. 4. Reason for Write-Off: A comprehensive explanation of the reason for deeming the account receivable as uncollectible is required. This may include bankruptcy filings by the debtor, prolonged non-payment, or other relevant justifications. 5. Approval Section: The form involves approval from the responsible parties within the organization, usually including an authorized signatory and management personnel. Their signatures verify the decision to write off the account receivable. It's important to note that different variations of Broward Florida Accounts Receivable Write-Off Approval Forms may exist depending on the specific needs or requirements of individual businesses. These variations could include additional fields to capture additional information relevant to the business, departments, or any unique elements of the company's policies or procedures. Overall, the Broward Florida Accounts Receivable Write-Off Approval Form is an essential tool for businesses in Broward County, Florida, enabling them to effectively manage their financial records, maintain transparency, and ensure accurate representation of their accounts receivable.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Broward Florida Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Broward Accounts Receivable Write-Off Approval Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Broward Accounts Receivable Write-Off Approval Form from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Broward Accounts Receivable Write-Off Approval Form:

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!