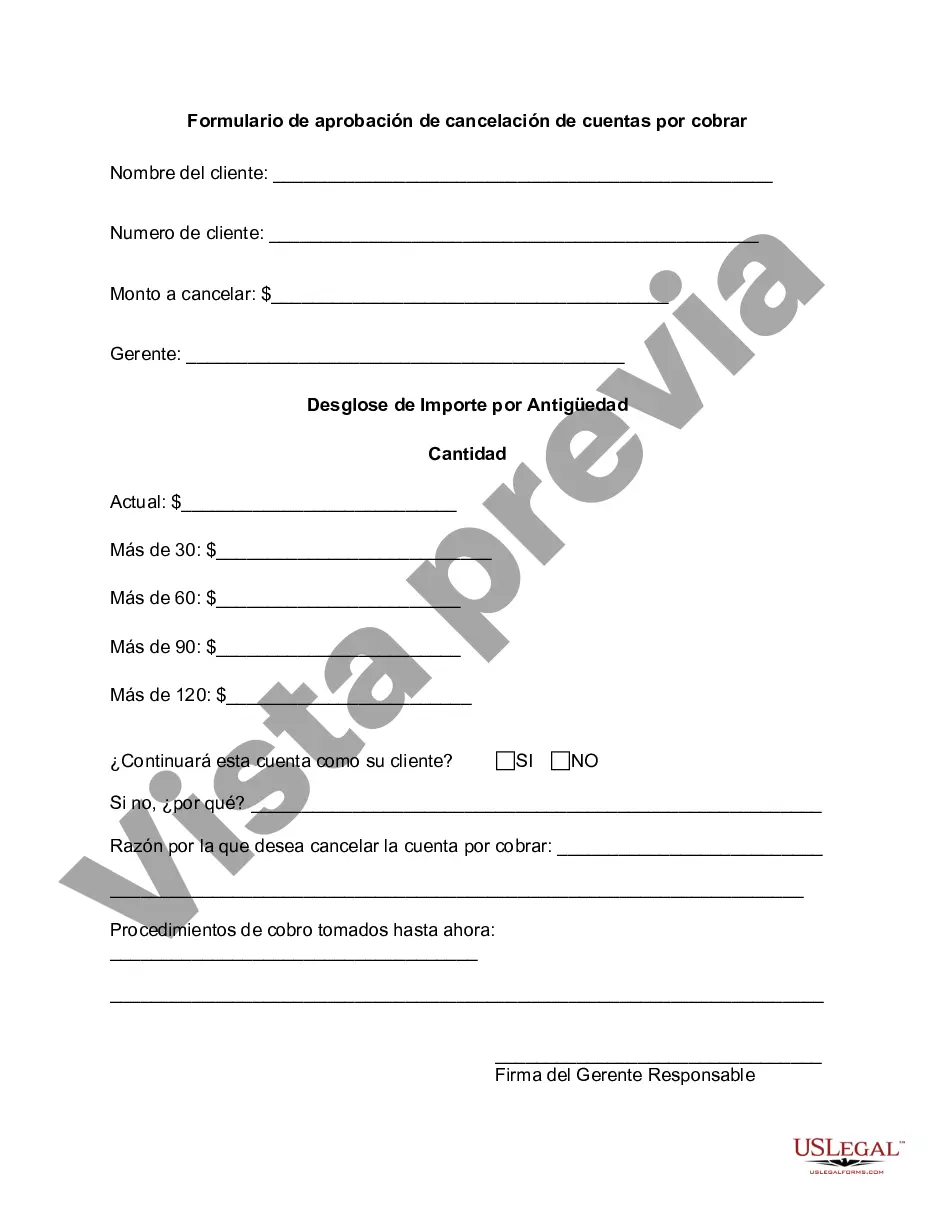

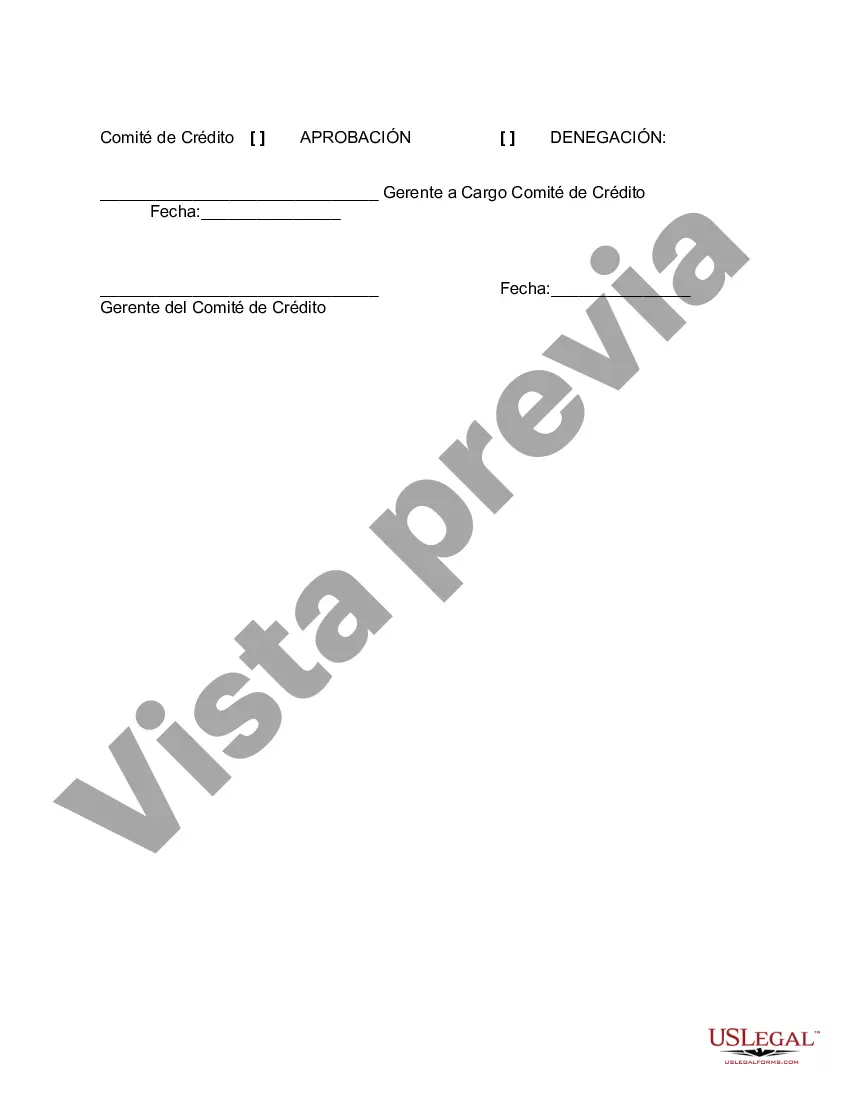

The Collin Texas Accounts Receivable Write-Off Approval Form serves as a crucial tool for businesses operating in Collin County, Texas, to handle write-offs efficiently and accurately. This comprehensive form allows organizations to document and authorize the necessary steps when removing unpaid accounts receivables from their financial records. By using this form, businesses can maintain proper financial integrity and ensure compliance with local regulations. Keywords: Collin Texas, accounts receivable, write-off, approval form, financial records, businesses, documentation, unpaid, integrity, compliance, local regulations. Different types of Collin Texas Accounts Receivable Write-Off Approval Forms may include: 1. Collin Texas Accounts Receivable Write-Off Approval Form for Small Businesses: Geared towards helping small businesses in Collin County, Texas, this form provides a simplified and user-friendly approach to write-offs, catering to their unique needs. 2. Collin Texas Accounts Receivable Write-Off Approval Form for Large Enterprises: Designed for larger businesses operating in the county, this form incorporates more extensive sections and additional documentation requirements to accommodate the complex nature of their financial operations. 3. Collin Texas Accounts Receivable Write-Off Approval Form for Nonprofit Organizations: Tailored specifically for nonprofit entities in Collin County, Texas, this form reflects the unique financial considerations and requirements applicable to these organizations. 4. Collin Texas Accounts Receivable Write-Off Approval Form for Government Agencies: Serving government agencies of Collin County, Texas, this specialized form adheres to the unique regulations and protocols governing their financial processes. Keywords: Collin Texas, accounts receivable, write-off, approval form, small businesses, enterprises, nonprofit organizations, government agencies, financial operations, documentation requirements, regulations, protocols.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Collin Texas Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Collin Accounts Receivable Write-Off Approval Form meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the Collin Accounts Receivable Write-Off Approval Form, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Collin Accounts Receivable Write-Off Approval Form:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Collin Accounts Receivable Write-Off Approval Form.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!