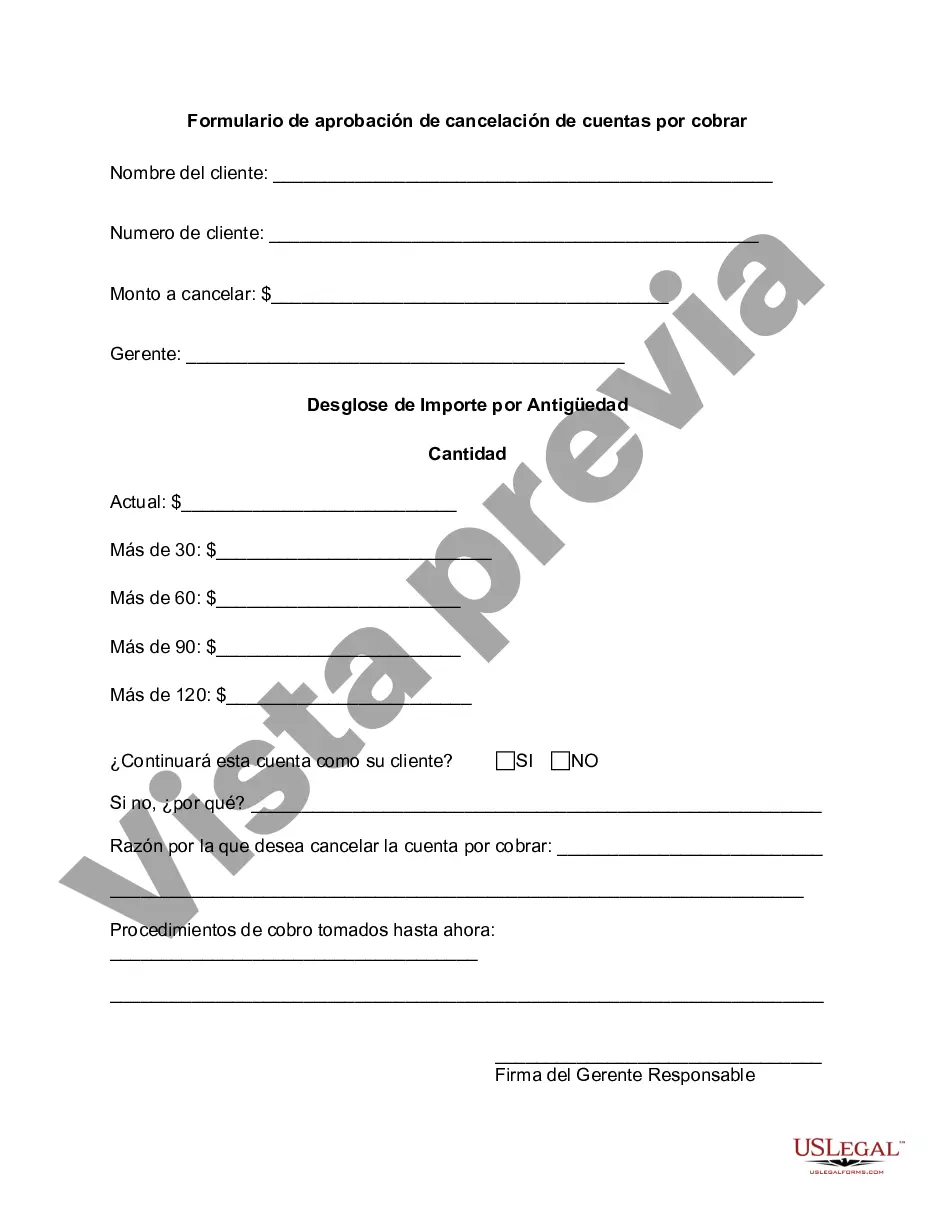

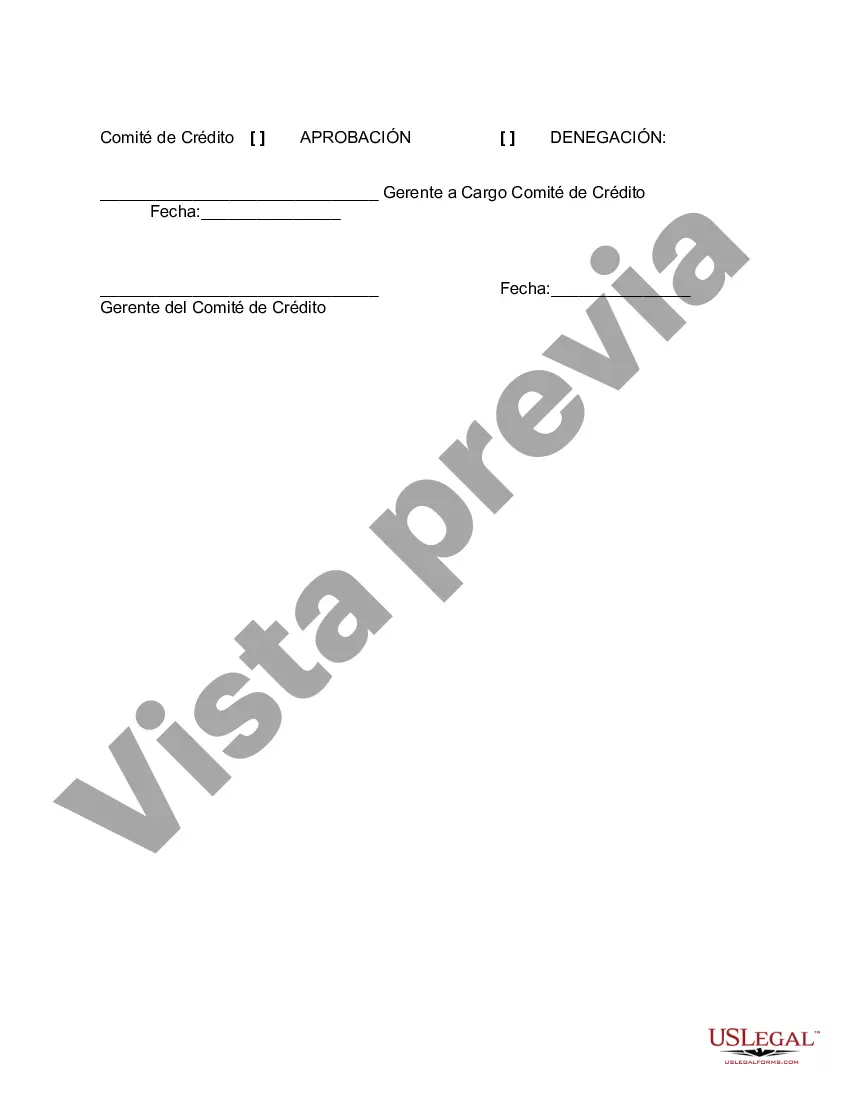

The Cook Illinois Accounts Receivable Write-Off Approval Form is a document used by the Cook Illinois Accounts Receivable department to request approval for writing off outstanding customer debts. This form is utilized when it becomes unlikely that the company will be able to collect payment from a customer. By completing this form, the department seeks authorization from the appropriate supervisor or manager to remove these unpaid amounts from the accounts receivable ledger. The Cook Illinois Accounts Receivable Write-Off Approval Form plays a critical role in maintaining the accuracy of financial records and ensuring transparency in the company's accounting practices. It enables the Accounts Receivable department to identify and address uncollectible debts promptly. This form typically includes important information such as the customer's name, account number, outstanding balance, aging of the debt, and the reason for the write-off request. The justification must provide a valid and well-documented explanation as to why it is improbable to collect the outstanding debt amount. By analyzing the submitted Cook Illinois Accounts Receivable Write-Off Approval Forms, the responsible supervisor or manager can evaluate the validity of the write-off request. They may review historical payment behavior, communication records, past collection efforts, and any specific circumstances or challenges related to the customer's ability or willingness to pay. Different types or variations of the Cook Illinois Accounts Receivable Write-Off Approval Form may exist based on the specific criteria outlined by Cook Illinois. For example, there might be different versions of the form for different departments or business units within the company, depending on their unique policies or approval processes. In summary, the Cook Illinois Accounts Receivable Write-Off Approval Form is a vital tool employed by the company's Accounts Receivable department to seek approval for eliminating non-recoverable customer debts. This form facilitates proper documentation, transparency, and adherence to financial reporting standards, ultimately contributing to the accuracy and integrity of Cook Illinois' accounting practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Cook Illinois Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Cook Accounts Receivable Write-Off Approval Form.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Cook Accounts Receivable Write-Off Approval Form will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Cook Accounts Receivable Write-Off Approval Form:

- Make sure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Cook Accounts Receivable Write-Off Approval Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!