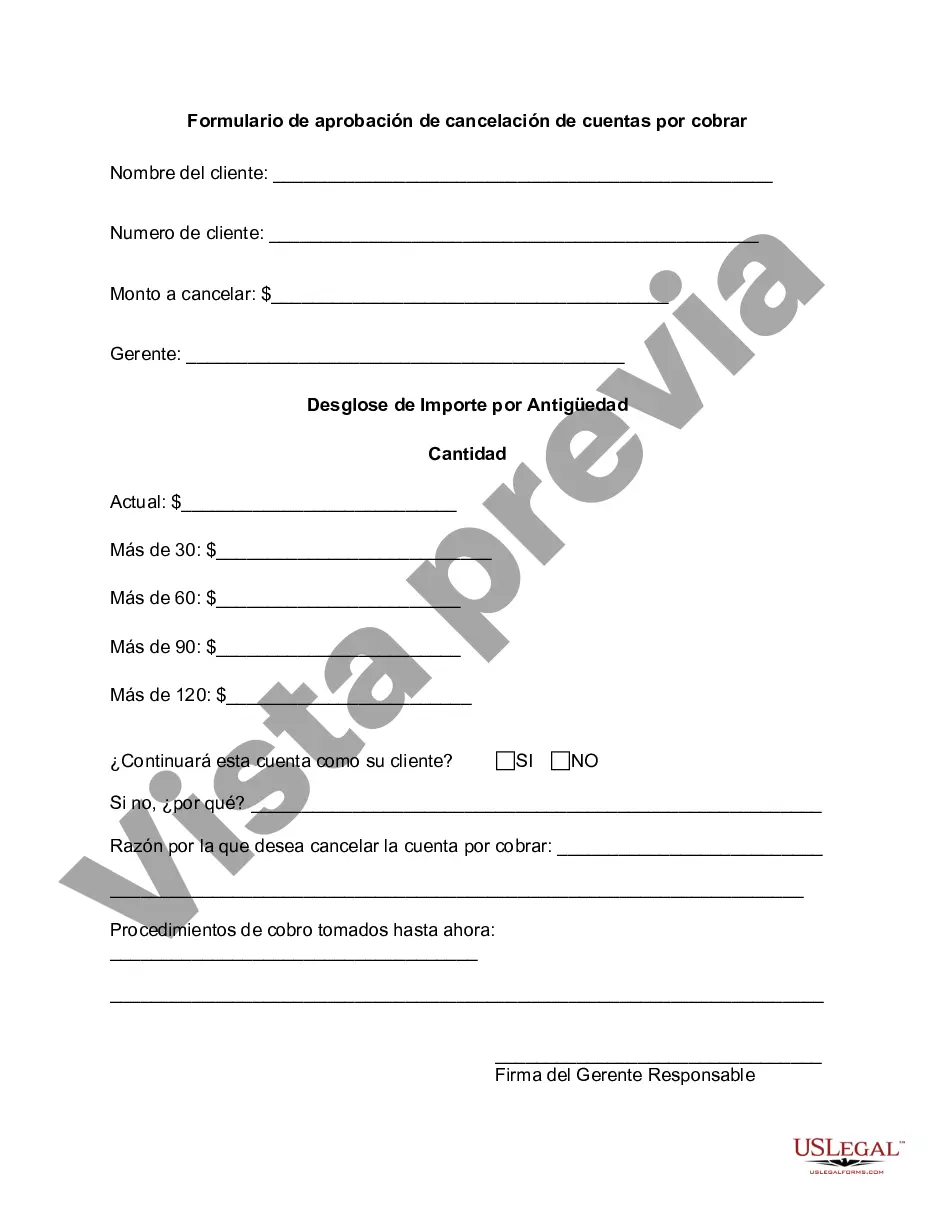

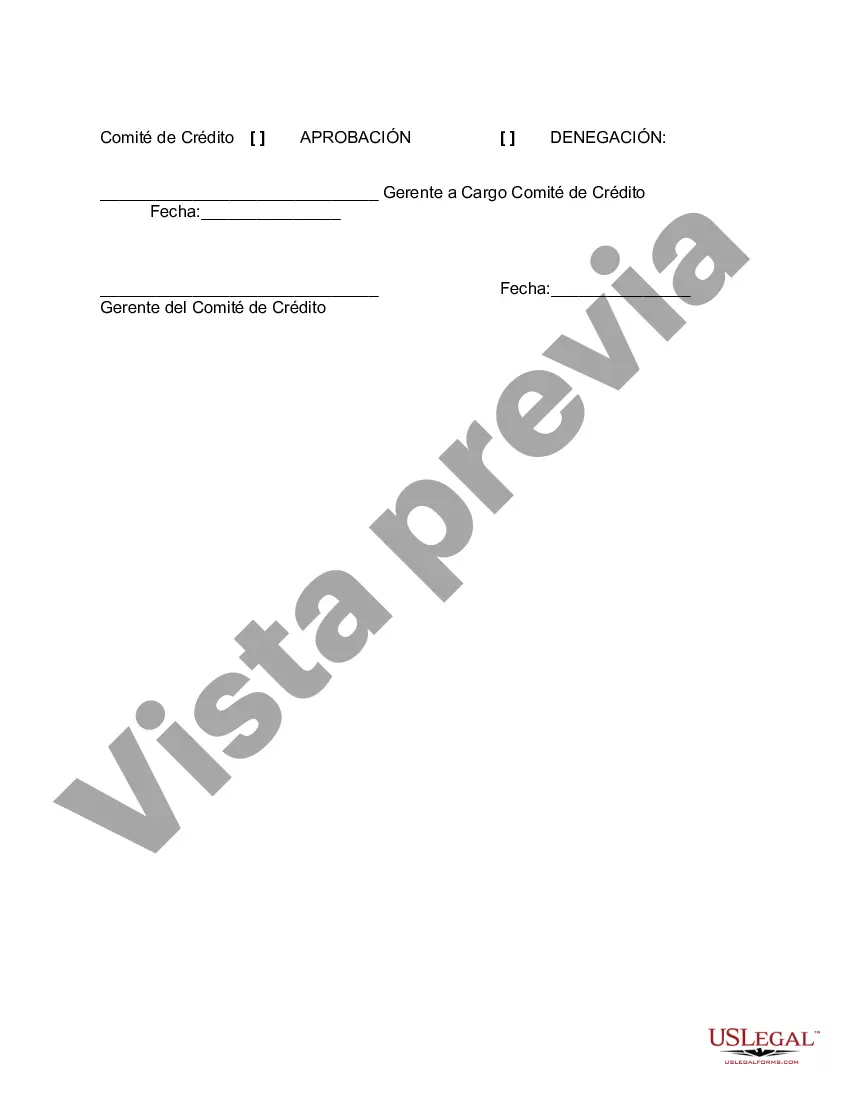

Harris Texas Accounts Receivable Write-Off Approval Form is a crucial document used in financial management to authorize the write-off of unpaid or uncollectible accounts receivable in the Harris County, Texas area. This form acts as a comprehensive record of the approval process and ensures compliance with financial policies and procedures. The Harris Texas Accounts Receivable Write-Off Approval Form includes various relevant sections that require detailed information. These sections typically consist of: 1. Company Information: This section captures essential details about the company or organization initiating the write-off request, such as the name, address, and contact information. 2. Customer Information: Here, the form requires the inclusion of customer-related data, including name, account number, and outstanding balance. This information allows for accurate identification and tracking of the specific account in question. 3. Reason for Write-Off: This section prompts the requester to provide a comprehensive explanation for the write-off. Common reasons may include bankruptcy filings, accounts with no recent activity, irrecoverable debts, etc. The form may also request supporting documentation or evidence to substantiate the write-off request. 4. Amount to be Written Off: This section demands the exact amount or specific balance to be written off. It is crucial to enter the correct figure to ensure accurate financial reporting and record-keeping. 5. Approval Signatures: To maintain accountability and adhere to internal controls, the form must be signed by all relevant parties involved in the approval process. This usually includes authorized personnel from finance, credit management, and higher-level management. Apart from the standard Harris Texas Accounts Receivable Write-Off Approval Form, there may be variations or specific types tailored to certain sectors or industries. These variations might include: — Harris Texas Accounts Receivable Medical Write-Off Approval Form: This form is designed specifically for healthcare providers or medical institutions to handle the write-off of unpaid medical bills or accounts. — Harris Texas Accounts Receivable Legal Write-Off Approval Form: This form caters to law firms or legal entities dealing with the write-off of outstanding legal fees or uncollectible invoices. — Harris Texas Accounts Receivable Utility Write-Off Approval Form: Utilities companies or service providers may use this form to legally write off delinquent accounts for services such as water, electricity, gas, or telecommunications. In conclusion, the Harris Texas Accounts Receivable Write-Off Approval Form is a vital financial document used to authorize the write-off of unpaid accounts receivable in Harris County, Texas. This form ensures proper tracking, compliance with financial policies, and accurate reporting. Additional variations of the form may exist to serve specific industries or sectors such as healthcare, legal services, or utilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Harris Texas Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Harris Accounts Receivable Write-Off Approval Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any tasks associated with paperwork completion simple.

Here's how you can find and download Harris Accounts Receivable Write-Off Approval Form.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Examine the similar document templates or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Harris Accounts Receivable Write-Off Approval Form.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Harris Accounts Receivable Write-Off Approval Form, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you need to cope with an extremely complicated situation, we advise using the services of a lawyer to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents with ease!