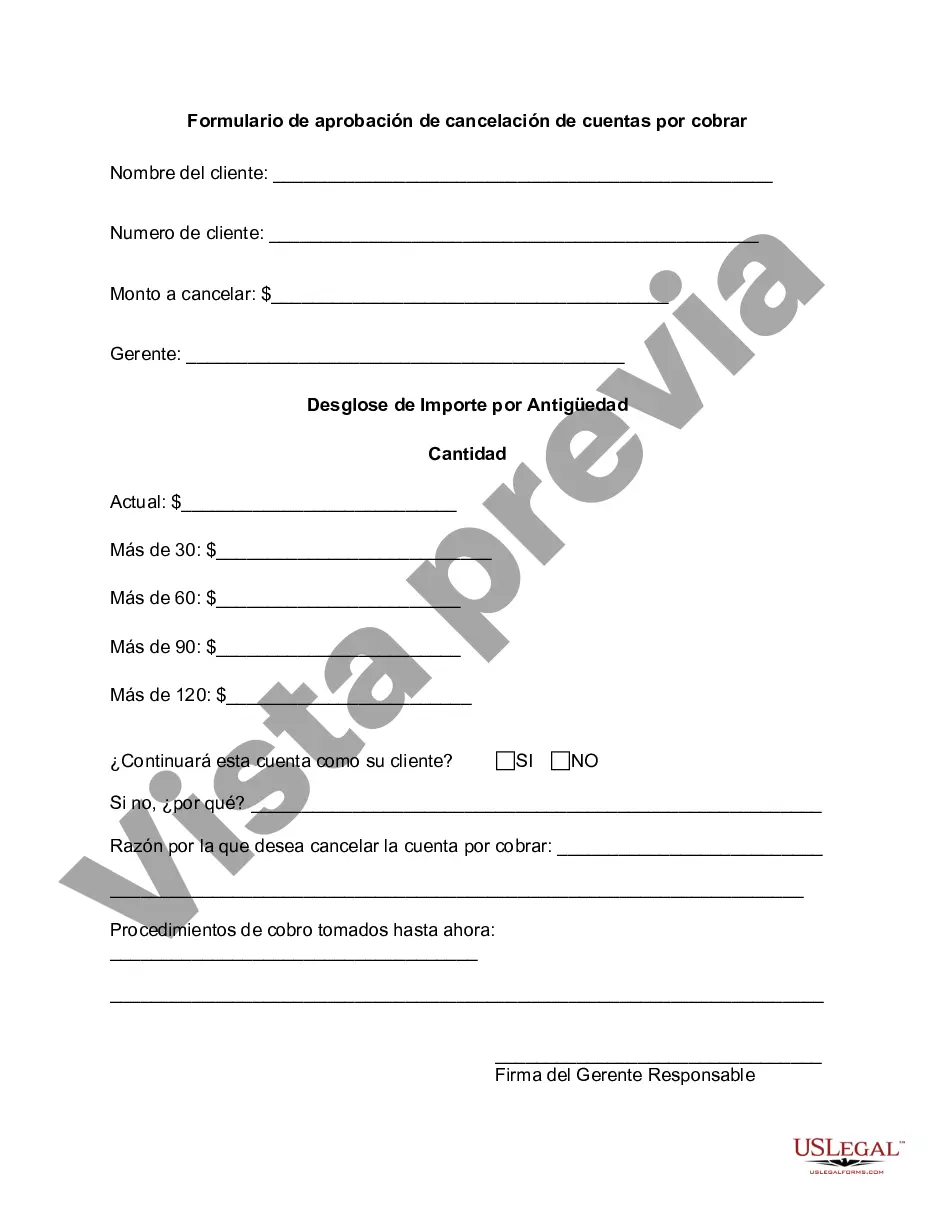

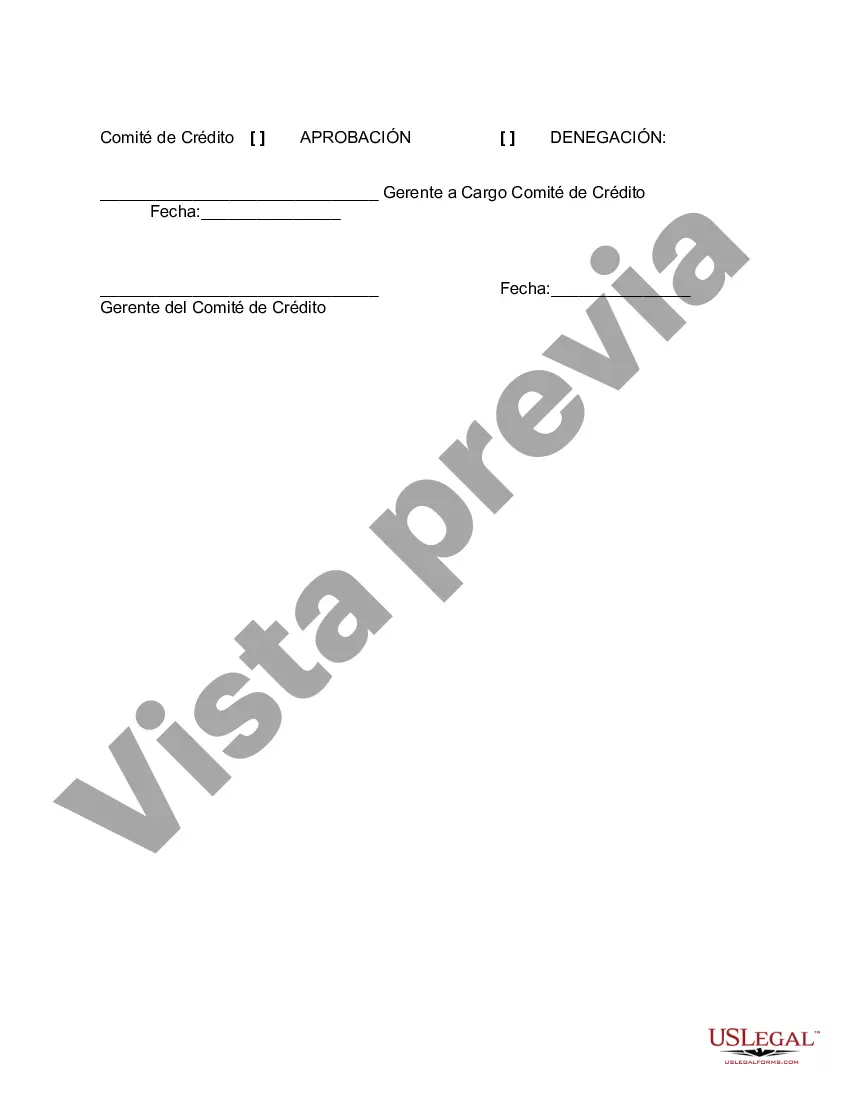

Hennepin Minnesota Accounts Receivable Write-Off Approval Form is a crucial document used in the financial management process of businesses located in Hennepin County, Minnesota. This form is utilized when a company needs to write off an outstanding accounts receivable balance that is deemed uncollectible or irrecoverable. By following a specific procedure outlined in the form, businesses can ensure compliance with local regulations and maintain accurate financial records. The Hennepin Minnesota Accounts Receivable Write-Off Approval Form serves as an official authorization for the write-off request, ensuring proper documentation and accountability. This form requires the approval of designated personnel, such as the accounts receivable manager or the finance department manager, who possess the authority to authorize such decisions. The form typically includes the following crucial details related to the write-off: 1. Business Information: The form starts with spaces to provide vital information about the company, including its name, address, contact details, and internal reference numbers. 2. Customer Details: Next, the form requests essential customer information, such as the customer's name, account number, contact information, and outstanding balance. 3. Reason for Write-Off: A section is included to explain the reason behind the decision to write off the outstanding accounts receivable balance. This description should outline any unsuccessful collection attempts, bankruptcies, disputes, or other relevant factors that led to the determination of non-collectibility. 4. Supporting Documentation: The form may necessitate attaching any supporting evidence, such as correspondence, collection logs, or legal documents, which substantiates the decision to write off the accounts receivable balance. 5. Approval Signatures: After providing all the required information, designated individuals must sign and date the form to approve the write-off request. This ensures proper authorization and accountability within the organization. It is important to note that there may be different variations or templates of the Hennepin Minnesota Accounts Receivable Write-Off Approval Form, depending on the specific needs of different businesses or industries. Some possible types of this form include: 1. Standard Hennepin Minnesota Accounts Receivable Write-Off Approval Form: This is the basic template used by most businesses in Hennepin County for write-off requests related to outstanding accounts receivable balances. 2. Hennepin Minnesota Accounts Receivable Small Claims Court Write-Off Approval Form: This specialized form is designed for cases where the business has pursued legal action in small claims court to recover the outstanding balance but was unsuccessful. It follows specific guidelines and may require additional documentation related to the court proceedings. 3. Hennepin Minnesota Accounts Receivable Bankruptcy Write-Off Approval Form: This customized form is applicable when the outstanding balance is to be written off due to the customer's bankruptcy or insolvency. It likely requires specific documentation related to bankruptcy filings and court orders. In summary, the Hennepin Minnesota Accounts Receivable Write-Off Approval Form is a critical document used to authorize and document the write-off of an outstanding account receivable balance. It ensures compliance with local regulations, maintains accurate financial records, and provides accountability for decision-making within businesses located in Hennepin County, Minnesota.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Hennepin Minnesota Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Hennepin Accounts Receivable Write-Off Approval Form without expert assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Hennepin Accounts Receivable Write-Off Approval Form on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Hennepin Accounts Receivable Write-Off Approval Form:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!