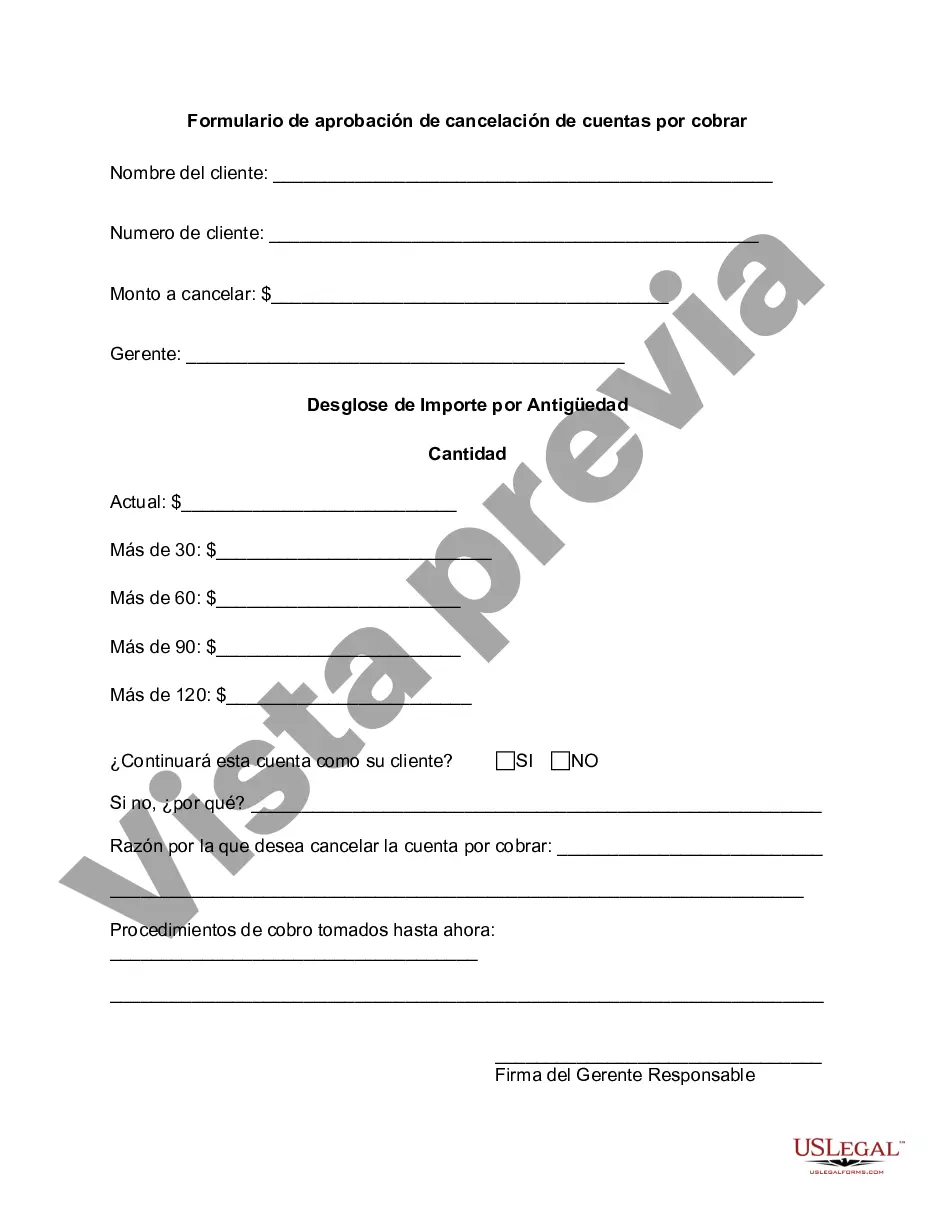

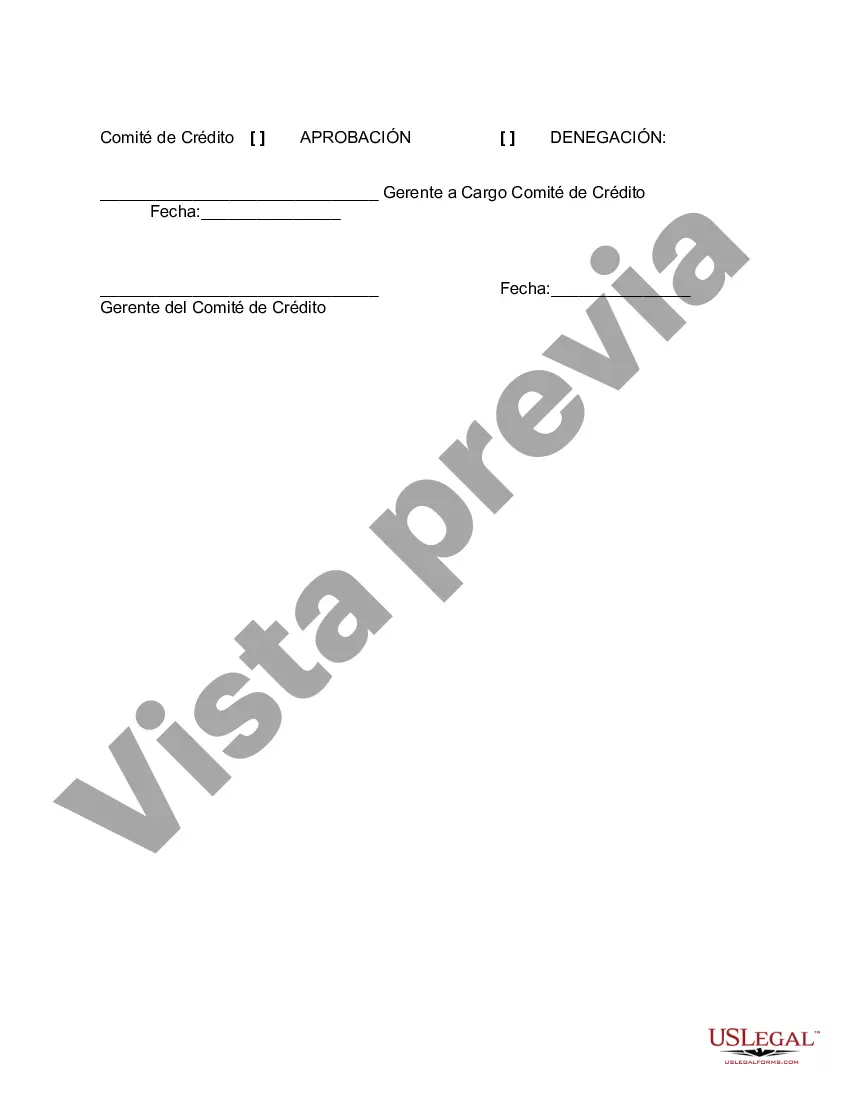

The Houston Texas Accounts Receivable Write-Off Approval Form is a crucial document used by businesses in the state of Texas to request authorization for writing off uncollectible accounts receivable. This form provides a systematic process for documenting and justifying the need to remove unpaid or delinquent accounts from the company's financial records. Keywords: Houston Texas, Accounts Receivable, Write-Off Approval Form, uncollectible, delinquent, financial records, authorization There are two main types of Houston Texas Accounts Receivable Write-Off Approval Forms commonly used: 1. Individual Write-Off Approval Form: This form is utilized when a specific account receivable is deemed uncollectible, and the business seeks approval to remove it from the financial records. It requires detailed information about the customer, the outstanding balance, attempts made to collect the debt, and supporting documentation such as correspondence or communication records. 2. Batch Write-Off Approval Form: Often businesses encounter multiple uncollectible accounts, especially in situations where they have gone through an extensive debt recovery process. The Batch Write-Off Approval Form allows companies to request approval to write off multiple accounts simultaneously. This form typically includes a summary of all the delinquent accounts, the total outstanding balance for each account, and information regarding previous collection efforts. To ensure accuracy and completeness, it is essential to provide all relevant details, including customer names, account numbers, amounts owed, and supporting evidence of collection efforts. Additionally, the forms may require the approval of multiple parties, such as the accounts receivable manager, finance director, or designated authority within the organization. Submitting an Accounts Receivable Write-Off Approval Form is a critical step in maintaining accurate financial statements and minimizing the impact of uncollectible debts on a company's bottom line. By documenting the decision-making process involved in writing off bad debt, businesses can demonstrate transparency, accountability, and adherence to regulatory standards. Overall, the Houston Texas Accounts Receivable Write-Off Approval Form is a vital tool for businesses to manage their accounts receivable effectively, ensuring accurate financial reporting and enabling efficient debt recovery processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Houston Texas Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Houston Accounts Receivable Write-Off Approval Form meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Apart from the Houston Accounts Receivable Write-Off Approval Form, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Houston Accounts Receivable Write-Off Approval Form:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Houston Accounts Receivable Write-Off Approval Form.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!