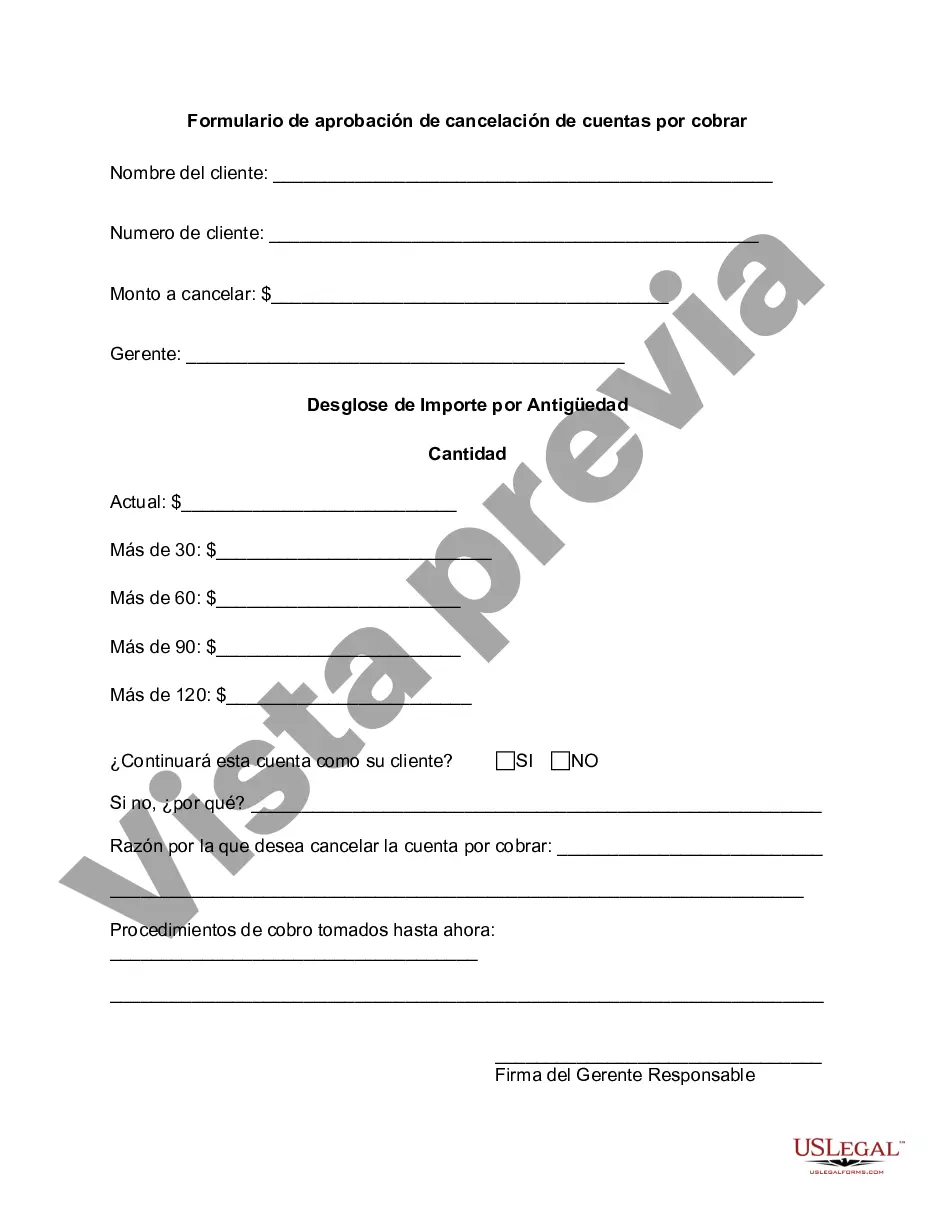

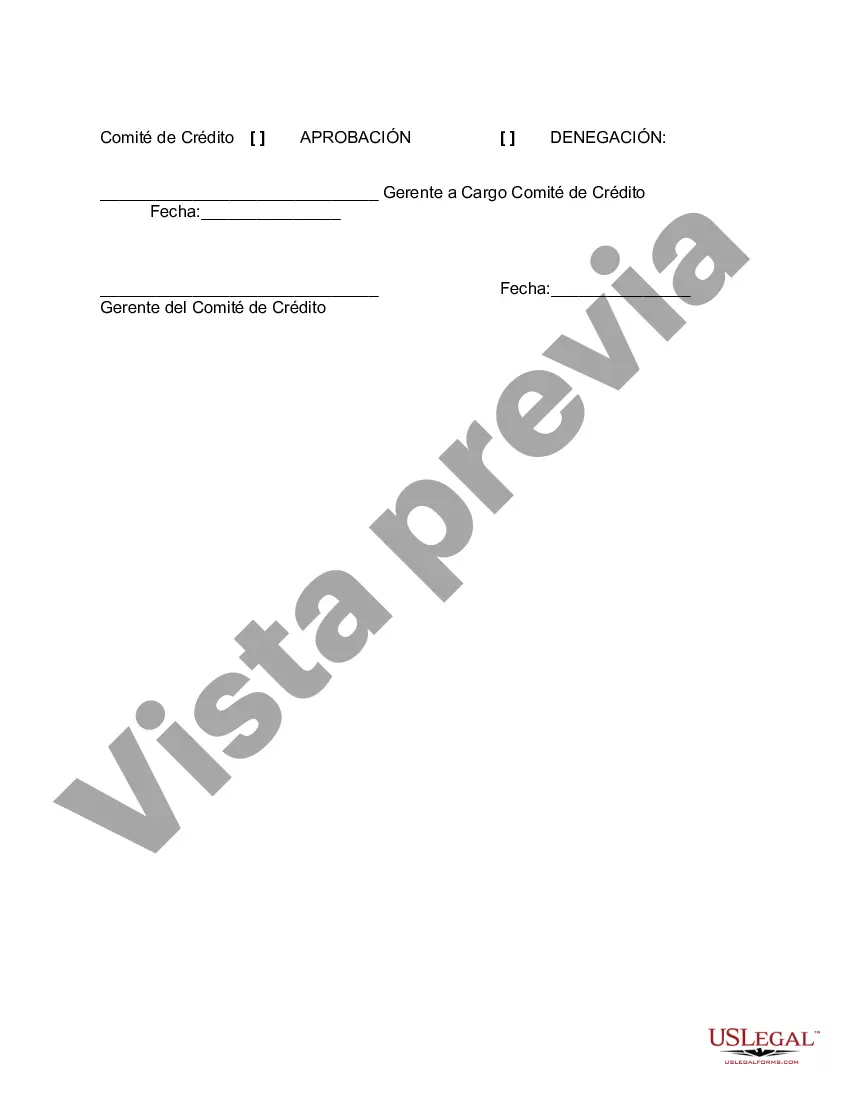

Maricopa Arizona Accounts Receivable Write-Off Approval Form is a document designed to streamline and authorize the process of writing off unpaid customer invoices or non-collectible debts in the town of Maricopa, Arizona. This form is utilized by businesses or organizations operating within Maricopa to ensure proper and efficient management of unpaid accounts and maintain accurate financial records. Key features of the Maricopa Arizona Accounts Receivable Write-Off Approval Form may include: 1. Organization details: The form starts by capturing essential information about the organization, such as name, address, contact details, and any unique identifiers necessary for internal records or identification purposes. 2. Customer details: This section involves recording comprehensive details about the customer with the delinquent account. It includes their name, contact information, account number, outstanding amount, and other relevant identification details to ensure proper identification of the account in question. 3. Justification: Businesses are required to provide a detailed justification for why they wish to write off the outstanding balance as irrecoverable. This explanation should outline the measures taken to collect the debt, any communication records, and any other relevant information supporting the decision to write off the account. 4. Approval process: This part specifies the authorization required for the write-off to take place. It typically includes fields for relevant personnel or departments to sign and date the approval, ensuring accountability and proper review of the request. 5. Documentation: The form may include a section for attaching necessary supporting documentation, such as copies of invoices, correspondence, or other evidence used to establish the legitimacy of the write-off request. Different types of Maricopa Arizona Accounts Receivable Write-Off Approval Forms may exist based on the specific needs of businesses or organizations. Some variations may include: 1. General Write-Off Approval Form: This form is used for write-offs that apply to various types of accounts or debt, capturing essential information required for approval, regardless of the specific nature of the unpaid balance. 2. Specific Write-Off Approval Form: This type of form is tailored to a particular type of account or debtor. For example, businesses may have separate forms for write-offs related to individual customers, corporate clients, or different types of services or products provided. 3. Threshold Write-Off Approval Form: This variation is used when businesses have predefined thresholds for write-offs. For instance, if the outstanding amount of an account does not exceed a predetermined limit, an expedited write-off approval process might be implemented with a simplified form. Maricopa Arizona Accounts Receivable Write-Off Approval Form is a critical tool for businesses in Maricopa to effectively manage their accounts and ensure accurate financial reporting. By incorporating the above-mentioned features and tailoring them to their specific requirements, businesses can streamline their write-off processes and maintain transparency in their financial operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Maricopa Arizona Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Maricopa Accounts Receivable Write-Off Approval Form, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can purchase and download Maricopa Accounts Receivable Write-Off Approval Form.

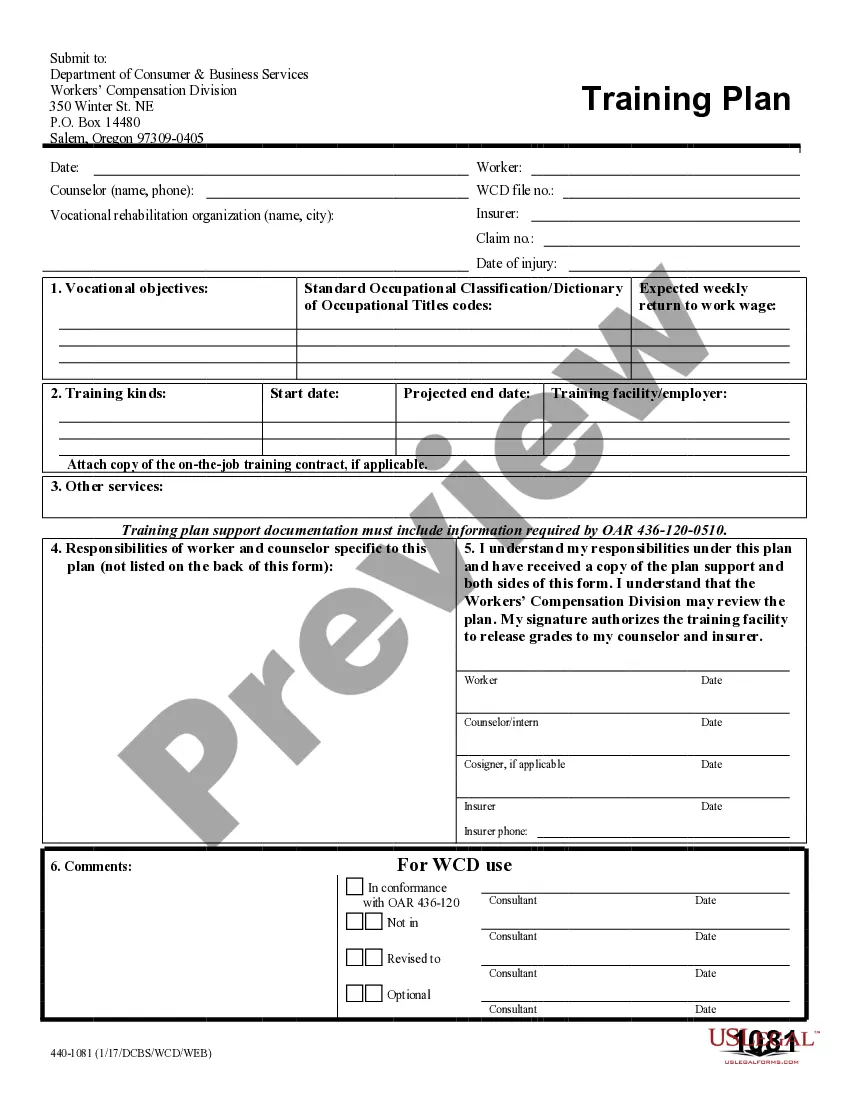

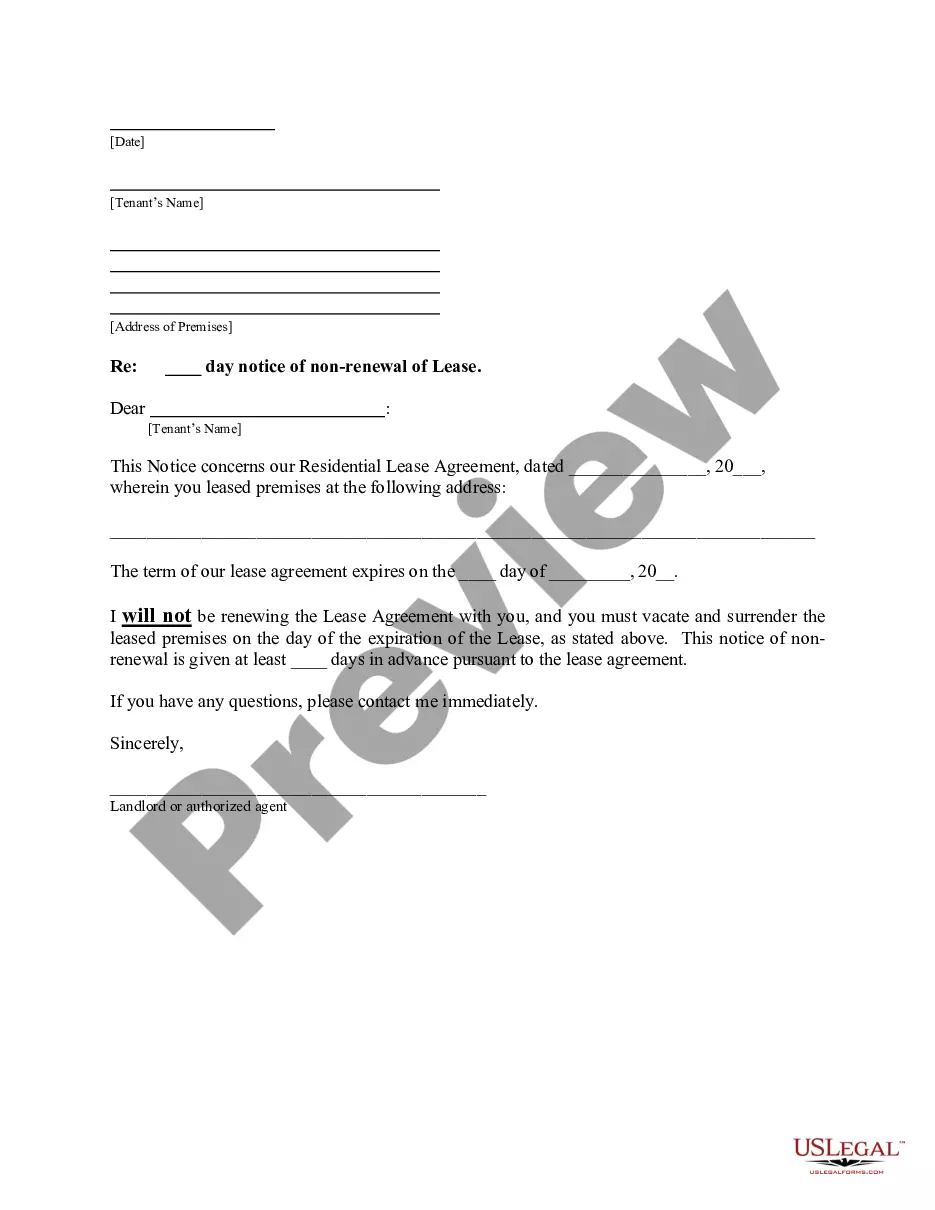

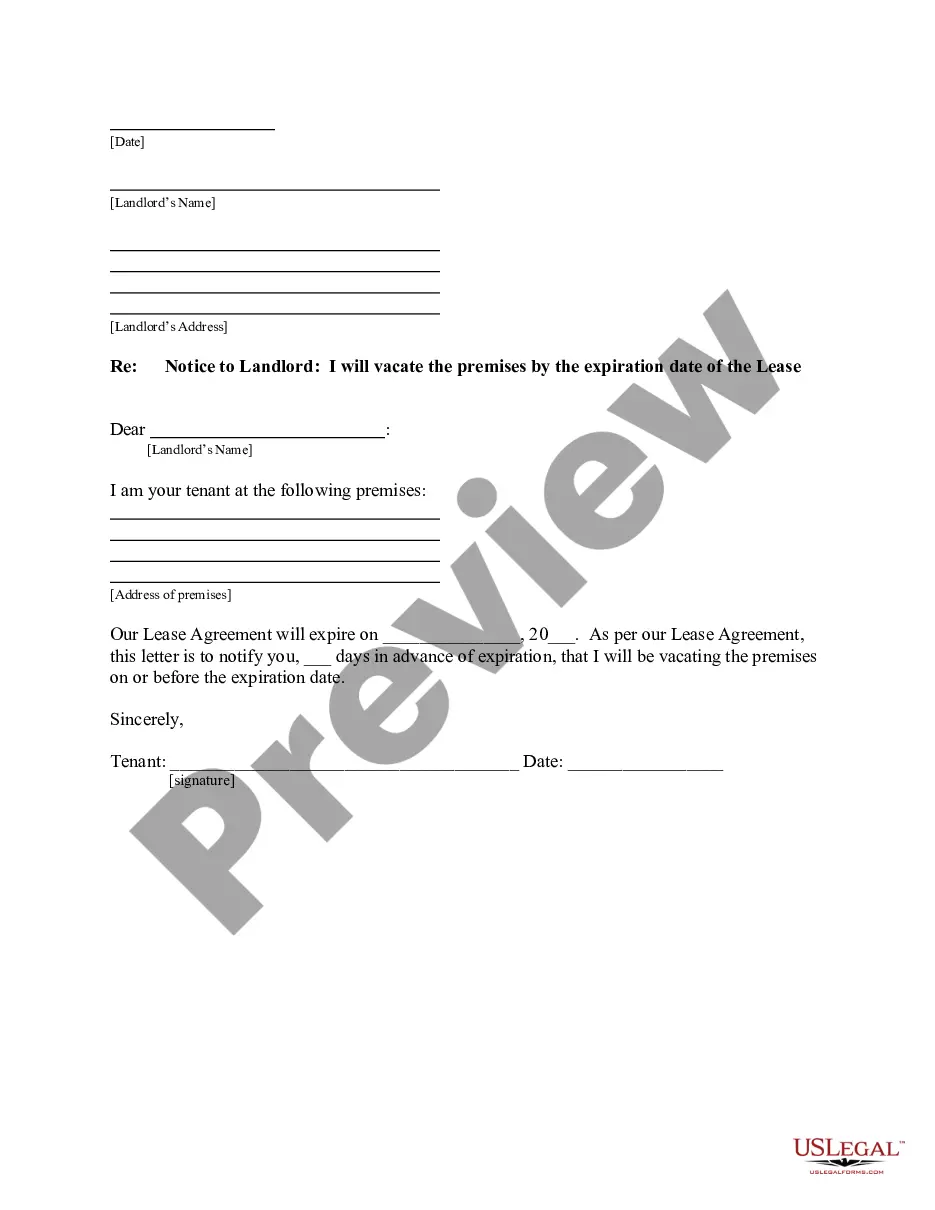

- Go over the document's preview and description (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some records.

- Examine the related forms or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Maricopa Accounts Receivable Write-Off Approval Form.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Accounts Receivable Write-Off Approval Form, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer entirely. If you need to cope with an exceptionally complicated situation, we recommend using the services of an attorney to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific documents with ease!